The potential benefits of diversification across asset classes to achieve an investment objective are well known. Constructing a portfolio diversified by market capitalization, geography and style can mitigate overall portfolio risk. But does the adage "Don't put all your eggs in one basket" also apply within a style category? In other words, does it make sense to combine multiple managers within, say, a portfolio's large cap value allocation? The answer, in a word, is "yes." Let's explore why, and how to put the concepts to practical use.

Some Types Of Portfolio Risk

There are many different types of risk associated with investment portfolios, including shortfall risk (the risk that a portfolio won't achieve a desired objective); systematic risk (or market risk that is not diversifiable); unsystematic risk (risk which is diversifiable, for example through increasing the number of portfolio holdings); standard deviation (which measures the variability of a portfolio's returns); and benchmark risk (often expressed through tracking error, which measures how closely a portfolio tracks its benchmark). For purposes of this article, we'll focus on benchmark risk, and ways to enhance the risk/return profile of a style category in relation to its benchmark.

Active Value And Sources Of Benchmark Risk

Active investment managers are continuously taking calculated risks in an effort to provide value over and above their portfolio's benchmark. Over time, good active managers must be able to demonstrate that they can in fact outperform the benchmarks while incorporating risk-control processes. If they can't, investors will choose another manager or a passive investment strategy.

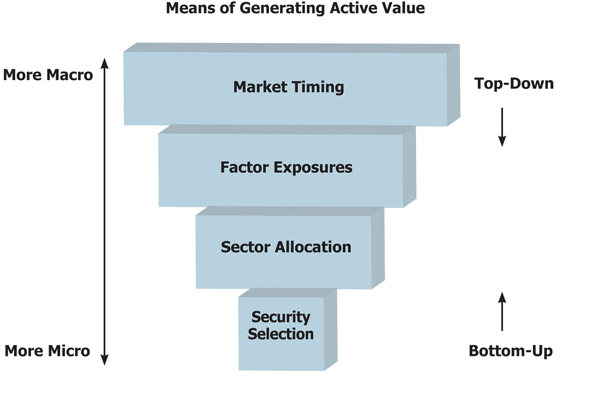

There are of course several ways to deliver benchmark-beating returns, or active value, including (1) increasing the portfolio's allocation to cash when the market appears overvalued (market timing); (2) tilting the portfolio's allocations toward some factor (e.g., momentum) or style (e.g., growth/value, large cap/small cap) that is exhibiting strong performance characteristics; (3) overweighting sectors that are expected to perform best, and conversely, underweighting those with less positive outlooks (sector timing); and (4) selecting the individual securities with the best prospects (security selection).

Market Timing

Of these active bets a manager makes, market timing has proven to be the most difficult to consistently generate excess returns. A market timing decision is actually comprised of two decisions that both need to be correct in order to generate active value: the decision as to when to become conservative and allocate to cash, and a second decision about when to become aggressive again and put the assets back to work. Market timing is a macro-level tactical decision that many managers find difficult because they are so focused on the fundamentals of finding good securities, and less on overall market dynamics. It is for this reason that many financial advisors and pension consultants will give a manager little or no credit for any market timing ability the manager has previously demonstrated.

The other three means by which a manager can generate active value are closely related to the manager's investment strategy and process for identifying the best securities.

Factor Exposures

Maintaining risk factor exposures that are significantly out of line from the benchmark can likewise hurt performance. Risk factors are characteristics that have been statistically determined to drive performance of stocks, such as style (e.g., growth and value), market capitalization (e.g., large cap and small cap), relative strength and volatility. Every stock has a "risk factor fingerprint," meaning that each one has some exposure to each of the risk factors. Widely used risk models such as those developed by Barra (now owned by MSCI Inc.) and Northfield Information Services typically list 11-13 common risk factors. As the risk factors for each of a portfolio's holdings are combined, the portfolio itself will exhibit certain risk characteristics. Generally, any variations between a portfolio's risk characteristics and those of the benchmark will result from the manager's security selection process, but sometimes a manager will try to overweight factors that are poised for a "run." For instance, as the economy begins to accelerate after a period of slow growth, cyclical companies tend to be strong relative performers, and a manager might overweight the stocks of those companies, increasing the portfolio's exposure to the value factor.

Sector Allocation

In terms of sector allocation, managers employing strong benchmark risk control processes will generally maintain sector weights that are relatively close to the benchmark's sector weights. There will usually be slight variances, but veering too far from the benchmark weights is a bet that can result in underperformance, even if the manager was able to select the right securities. For example, the sector with the largest representation in the Russell 1000 Value Index, which measures the performance of a group of large cap value stocks, is Financial Services, which recently accounted for more than 27% of the index's weight. A manager who is unconvinced that the sector has seen its worst days may hold only a 17% allocation, meaning the portfolio is 10% underweight. However, if the Financial Services sector performs well on a relative basis, the portfolio's performance suffers. Even if the manager picks some of the underweighted sector's strong performers, the sector bet may be a drag on performance.

Security Selection

Security selection is perhaps the most important way active value can be generated: managers who can consistently demonstrate an ability to add value through picking the best relative performers at the individual security level are extremely valuable in constructing a multi-manager portfolio. The process for selecting individual securities is the essence of a manager's investment strategy; it ultimately defines the manager's long-term success. Many investment consultants, including PMC, assign the greatest weight to the active value resulting from a manager's security selection abilities, because through combining managers we can neutralize the other risk factors and isolate active value from security selection. We'll discuss the perceived benefits of isolating security selection through combining managers below.

Neutralizing Risk Exposures, Isolating Security Selection

As far as investment consultants are concerned, in an ideal world investment managers would not try to time the market, they would maintain factor and sector exposures that are very close to the underlying benchmark, and they would generate 300 basis points of active value year in and year out solely through their security selection process. But unfortunately, that's not a realistic scenario. Managers with excellent security selection abilities but managing a more concentrated portfolio with, say, 40-50 holdings, may necessarily have factor and sector exposures that are at least somewhat different than the benchmark. Still other managers are good stock pickers, but have lax benchmark risk controls.