The corresponding effect on the amount of assets required at the beginning of retirement to sustain a desired withdrawal rate mimicked this result. If markets did well during retirement, less was needed to start the final 30 years and if markets were poor, more was needed.

Of course, a retiree does not know what the markets will do ahead of time. So assuming that the goal was to accumulate enough to use a 4% withdrawal rate, Pfau calculated what savings rate was needed to accumulate that amount. This is very similar to how most people approach retirement planning--isolating an accumulation goal to support an isolated set of parameters during decumulation.

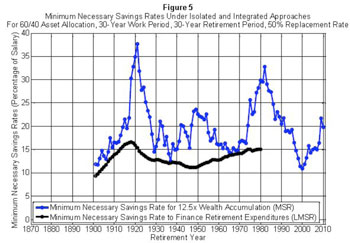

The savings rates required to accumulate enough to employ the 4% rule were every bit as volatile as the differing withdrawal rates. They ranged from 10.89% to 37.7%. When Pfau noticed that the periods of high required savings corresponded to periods where far less was actually needed during the subsequent retirement, he abandoned the 4% number and used actual retirement results to determine the needed savings. The volatility of the needed savings amount dropped significantly.

Figure 5 illustrates the difference between saving to make a targeted amount with a 4% withdrawal rate (blue line) and the savings needed based on actual results. Pfau frames the blue line as an accumulation of 12.5 times salary, which is the needed amount to have 50% of salary equal 4%. He calls the black line the lifecycle-based minimum savings rate (LMSR) needed to finance the desired expenditures and considers the black line the main contribution of his paper.

So what is X under the baseline case that I described earlier? Saving 16.62% of salary would have worked every time. Pfau also provides a matrix that shows results when certain variables change. It lays out 20-, 30- and 40-year savings spans; 20-, 30- and 40-year retirement periods; 40/60, 60/40 and 80/20 allocations; and replacement rates of 50% and 70%. For the typical 30-year retirement time frame, saving for 40 years cuts the safe savings rate to 8.77%, while saving for only 20 years increases the safe rate to over 30%.

One reason for the much higher consistency of the needed savings is that good market environments tend to follow bad ones and visa versa.

I can't help but think of some of the work Michael Kitces, author of The Kitces Report newsletter and the blog Nerd's Eye View at Kitces.com, has done relative to valuations and sustainable withdrawal rates. Low valuations portend better returns and therefore higher sustainable withdrawals. High valuations suggest lower withdrawal rates. Pfau isn't looking at valuations and Kitces is quick to point out that valuations aren't particularly great timing tools, but both shine some light on the effect of the good returns that tend to follow bad returns that tend to follow the good, and so on.

One of Kitces' blog posts pointed out just how much most people depend on the last few years of savings to meet an accumulation goal and some of the implications of relying on the returns leading up to retiring. It was such a good question and post, the NY Times picked up on it for a January 22 column. Pfau's paper suggests that tough years just prior to retirement may not be as problematic as one might fear.

While the "16.62% Rule" doesn't exactly roll off the tongue, I look forward to the additional research I hope this lifespan approach generates. The science of financial planning has always fascinated me.

I'm also quite taken by the "art" elements of the profession. I've read through the paper several times, and each time I come up with a few more interesting twists and turns from a behavioral standpoint. I have so many ideas running through my mind I could write a book on the subject. At the very least I have plenty of material for more columns.

You should be able to see the paper for yourself soon.

Dan Moisand, CFP has been featured as one of the America's top independent financial advisors by most leading financial advisor publications. He has spoken to advisor groups on five continents on topics such as managing investments and navigating tax complexities for retirees, retirement readiness, and most topics relating to the development of the financial planning profession. He practices in Melbourne, FL. You can reach him at 253-5400 or [email protected]