“To emit a Yogiberrism, in academia there is no difference between academia and the real world. In the real world there is.” – Skin in the Game by Nassim Taleb

In preparation for a talk, I began to review Sir John Templeton’s track record with the Templeton Growth Fund (TEPLX), which he managed from 1954 to 1991. At the age of 34, with a father that broke into the investment business in 1980, I was very aware of Templeton’s success in his career, but unaware of how the results came to his clients. What you walk away with after reviewing his track record is the knowledge that very few people in our industry (particularly academics) are conscious of what it took to produce that success. After Templeton, we also reviewed Sequoia Fund (SEQUX) from inception to date. We walked away thinking that the ride that the investors had with these vehicles wasn’t the most important part of the experience, it was the results. Academia says otherwise. We will unpack this.

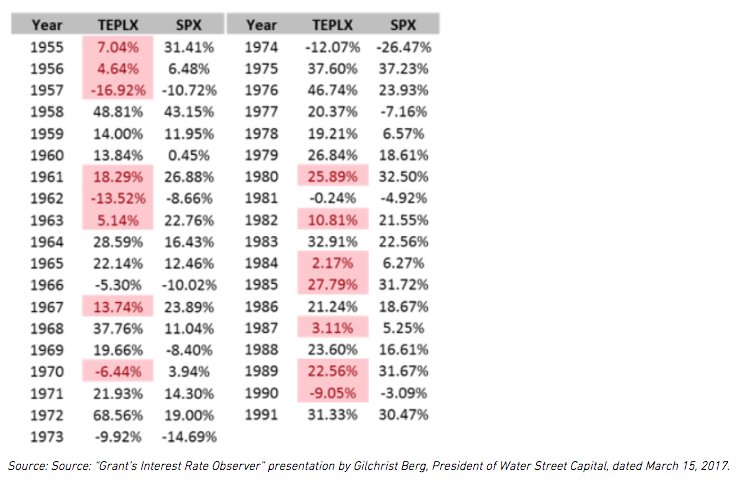

Sir John Templeton began managing the Templeton Growth Fund in 1954. He produced a prodigious amount of success during his tenure at the helm of the Fund. What was important was the results he produced. It became evident as we reviewed his results that the tracking error, or volatility of the results relative to the benchmark, were not an important factor to focus on. Below is the entire annual return series of the Templeton Growth Fund from 1955 to 1991.

The investors of the Templeton Growth Fund underperformed right out of the gate during 1955-1957. He rebounded to beat the market from 1958-1960, but underperformance continued on and off during the 1960’s. After calculating the returns, Sir John Templeton didn’t outperform the market from the Fund’s inception until 1969 arrived.

One of the greatest contrarian investors of the last 100 years took 14 years to break even! Let it be said that the S&P 500 Index wasn’t a widely used index in the 1950’s or 1960’s. However, the Dow Jones Industrial Average was, and everyone was aware of the peers. People would have been watching Jerry Tsai at Fidelity Capital Fund (a hot-shot manager) at the time, as an example.

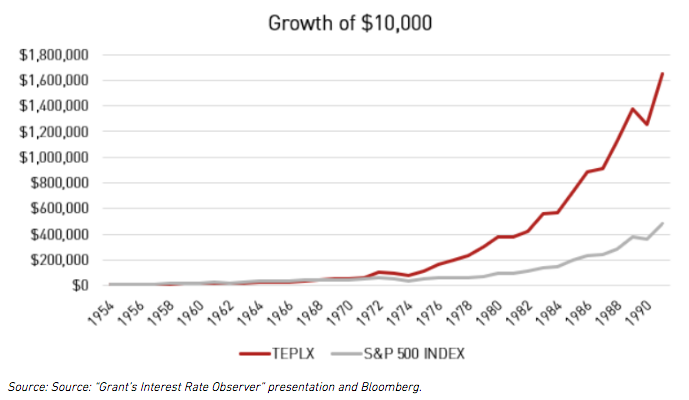

Below is growth of $10,000 for the Templeton Growth Fund using the data we provided above.

“We next consider the rule that the investor does [or should] consider expected return a desirable thing and variance of return an undesirable thing.“ – Portfolio Selection by Harry Markowitz

Thanks to a book recommendation from our friend, Vitaliy Katsenelson, I read Nassim Taleb’s newest book, Skin in the Game. Taleb lays out the doers of society as the source of all great invention and creativity, while academia remains anchored in a protectionist fashion of their own intelligence. Taleb argues that academics focus their attention on winning an argument rather than winning.