It is almost impossible to keep track of all the misleading economic statistics that get bandied about for political purposes. My personal favorite, by which I mean the most disingenuous, is that most Americans don’t have enough cash to pay for a $400 emergency expense. Vice President Kamala Harris used a version of this statistic just last week, saying that “the average American is a $400 unexpected expense away from bankruptcy.”

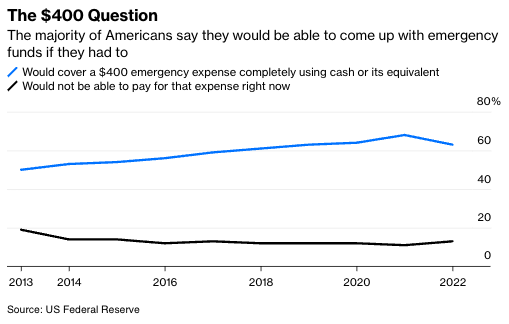

The data say nothing of the sort. The figure is derived from the U.S. Federal Reserve’s Survey on Household Well-Being , which asks households if they would cover a $400 emergency expense using cash or the available equivalent. In 2022, 63% of households said yes, down from 68% in 2021. The results reflect a draw-down of pandemic savings, fewer government benefits and high inflation.

Still, households are better off than they were in years past. In 2013, only 50% said they would use cash, though it is worth noting the $400 question has not been adjusted for inflation and emergencies have become more expensive.

None of this means that 37% of U.S. households cannot handle a $400 emergency expense—or that it would cause them to file for bankruptcy. The survey asks the cash-poor 37% what they would do if they needed the money. Only 13% of all households said they could not come up with $400 at all.

That’s not great, but it is far from the average American falling into bankruptcy over a car repair. The bottom line is that, if faced with a $400 expense, 87% of all U.S. households could still pay their other bills.

But back to that 37% who did not say they would pay for that $400 emergency expense with cash or the available equivalent. How would they cover the expense? Sixteen percent of all households would put the expense on a credit card. Another 9% would borrow the money from friends or family. Some 6% would sell something, while 4% would borrow from either a payday lender or a bank.

Going into debt is not ideal. But the survey also shows that households do have other options and access to credit, even if some of the options come with high interest rates.

The Fed survey points out that some of the 37% actually do have the cash, but they would take out debt in an emergency in order to preserve a cash buffer for other emergencies. So last year the poll included a new question, asking people what is the largest emergency expense they could handle right now using only savings. 68% of households said they could handle an expense of $500 or more.

In a perfect world, this percentage would be higher. Too many households are vulnerable to a big health expense, a divorce, even a car repair. But there was never a golden era when all households had enough savings. In fact, U.S. households are actually better off now than they were a decade ago.

The idea that the average U.S. household can’t come up with $400, let alone declare bankruptcy over it, is not only false. It is also misleading, and it feeds the perception that the economy is much riskier than it really is.

Allison Schrager is a Bloomberg Opinion columnist covering economics. A senior fellow at the Manhattan Institute, she is author of An Economist Walks Into a Brothel: And Other Unexpected Places to Understand Risk.