When investors and advisors hear the term "arbitrage" they usually think of risk-free profit. True arbitrage, however, is frequently inaccessible to the average investor. Opportunities created by inefficiencies and temporary mispricing usually do not last long. Sophisticated computer trading models, "real time" information exchange and the ability of institutional investors to deploy millions of dollars almost instantly prevent most arbitrage situations from existing for more than a few seconds. Other trading strategies that have come to be called "arbitrage" (e.g., merger arbitrage) are not arbitrage at all because there is risk embedded in the transaction.

A relatively new entrant in this latter category of quasiarbitrage strategies is gaining popularity with taxable high-net-worth investors. "Municipal arbitrage" (aka "muni arb") trading used to take place only on the proprietary trading desks of large financial institutions. After years of generating annualized tax-exempt returns of between 8% and 10% for their firms, many of the proprietary traders in these strategies saw an opportunity to open their own shops and make these trades available to a wider network of investors. They now offer muni arb strategies to institutions and high-net-worth investors as an "alpha component" to municipal bond portfolios.

Muni arb represents a specific example of what may become a broader trend in alternative investments-an increased focus on tax efficiency. A common complaint about most hedge fund strategies is the inherent tax inefficiency resulting from high portfolio turnover and short-term trading. Further, while most existing dollars invested in hedge funds are from high-net-worth (i.e., taxable) investors, most of the new dollars invested are coming from institutional (i.e., tax-exempt) investors-a disincentive for managers to focus on taxes.

Although many managers generate attractive gross returns, the after-tax returns are less appealing. In a market environment where managers can generate high double-digit gross returns, this tax inefficiency is tolerated. But many investors and economists anticipate return compressions going forward, due to increased competition, increased asset flows chasing the same opportunities and lower volatility. In a return environment of high single digits to low double digits, after tax return becomes increasingly important (following the old market adage that while you cannot control returns, you can control fees and taxes).

This may present an "early adopter" opportunity for advisors who can find and employ tax-advantaged alternatives for their high-net-worth clients. Thus the current interest in municipal arbitrage: Managers have historically been able to deliver consistent absolute returns in a highly tax-effective manner.

Why The Opportunity Exists

Muni

arb seeks to take advantage of two underlying market conditions: the

slope of the municipal yield curve (and the fact that this curve has

never inverted-that is, when long maturities yield less than the short

maturities); and the difference, or spread, between the municipal yield

curve and the taxable yield curve.

Theoretically, the municipal and taxable yield curves should differ by a factor that is a function of investor tax rates. For example, an individual in the 35% tax bracket should be indifferent between investing in a 10% taxable bond and a 6.5% tax-exempt bond, assuming the issues have identical credit risk. However, certain fundamental differences between the municipal and taxable curves result in "arbitrage" opportunities. [Note: this is not arbitrage in the definitional "risk-free" sense, but we will use this terminology throughout the article as shorthand for "exploitable investment opportunity."]

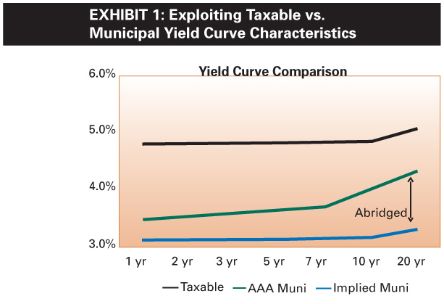

Exhibit 1 illustrates the opportunities arising from the respective taxable and municipal yield curve characteristics. As mentioned earlier, tax paying investors should be indifferent between a taxable bond and a tax-exempt bond that offer the same after-tax yield, assuming constant credit quality. As a result of this relationship, an implied municipal yield curve can be calculated such that the taxable yield * (1-tax rate) equals the municipal yield. However, municipal bonds do not necessarily trade at these implied yields, thus creating the arbitrage. Note that the longer-dated maturities of the municipal yield curve trade more cheaply (i.e. offer a higher yield) than the shorter-dated maturities relative to the taxable yield curve-a bigger difference than can be explained simply by the tax differential.

There are three main reasons for this:

1. Supply and demand imbalance. There is an enormous demand for short-term tax-exempt bonds but the supply is very small because municipalities prefer to issue longer-term bonds to coincide with the life of the funded projects.

2. The uncertainty individuals have about their future tax status. It is fairly easy to predict a personal tax bracket for the next few years, but it is much more challenging to anticipate in which tax bracket the individual will reside in five, ten or 20 years.

3. Political uncertainty. If the government decides to tax income from municipal bonds, the issues should trade more in line with taxable bonds. Investors demand additional compensation for the latter two factors by way of higher yields if they elect to purchase longer-dated bonds.

Capitalizing On The Opportunity

Municipal

arbitrage managers exploit the slope differential by purchasing

long-term bonds, using short-term bond issuance to finance the

purchase. The primary way this is accomplished is through a "Tender

Option Bond" [TOB] program. An investment bank deposits a long-dated,

fixed-rate bond into a trust. The cash flow from the bond is then split

into two pieces. The first piece is a short-term floating rate

security. The rate fluctuates with market conditions based on the

seven-day Bond Market Association (BMA) Index (a commonly used

short-date muni index).

The second piece is an inverse floater known as the residual certificate. As the name suggests, the rate paid on this piece is the difference between the underlying fixed-rate bond and the floating rate. That is, an investor in the residual certificate receives a coupon equal to the fixed rate on the underlying bonds minus the rate paid out on the short-term floating rate security. As short-term rates rise, the residual certificate yield falls (hence the name "inverse" floater).

A muni arb manager thus executes the following transactions:

1. Buys a TOB issuance;

2. Retains the residual certificate to, while essentially capturing the yield of, the longer end of the yield curve;

3. Finances the purchase of the TOB by selling off the stripped-out, short-term floating rate securities;

4. Earns a return by capturing the yield differential or spread between the retained longer-dated residual certificates and short-dated securities. Because the municipal yield curve has never inverted, this "positive carry trade" has historically generated consistently positive returns for the muni arb manager;

5. Because the spread, or positive carry, might be relatively small (in a flat yield curve environment, for example), muni arb managers might lever the trade up five to ten times to generate outsized net returns.

6. Because the underlying securities in this trade are municipal issuances, the return generated should be largely tax-exempt for the investor.

No Free Lunch

While

the managers have the potential to generate attractive tax-exempt

income, the embedded leverage subjects the trade to substantial

duration or interest rate risk and, potentially, corresponding large

fluctuations in Net Asset Value [NAV].

For example, if an underlying bond portfolio has a duration of five years, a 1% increase in interest rates should result in a portfolio value decline of approximately 5%. A manager leveraging this position by a factor of ten can expect the same 1% increase in rates to result in a 50% decline in portfolio value. Since muni arb funds report total return and not just income, the fluctuating NAVs are potentially detrimental to performance. These funds can have an annual standard deviation two times to three times greater than a traditional municipal bond portfolio.

Hedging

To minimize NAV

fluctuations, fund managers attempt to hedge the duration of their

portfolios down toward zero. Most muni arb funds operate with a hedged

duration between zero and two years.

This is accomplished by short-selling instruments found in the long end of the taxable bond market (because of insufficient choices, volume and liquidity in the municipal market). Examples include selling Treasury futures or entering into a LIBOR-based swap.

In each instance, the manager is shorting the long end of the taxable yield curve and investing in the short end. For example, in a LIBOR swap the manager agrees to pay a longer-term fixed rate (set at the inception of the swap contract) and receive the short-term LIBOR rate (which resets periodically-usually every three or six months- throughout the tenure of the swap). This is the opposite of the TOB trade, where the manager is paying a floating rate on the short end of the curve and receiving a fixed rate based on the long end of the municipal curve.

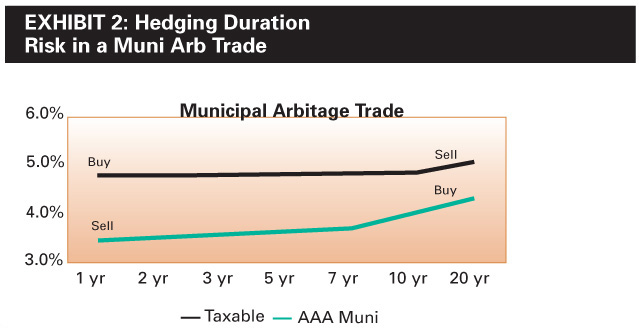

As illustrated in Exhibit 2, as long-term rates increase, the loss to the municipal bond is off-set by the gain in the taxable swap. Similarly, the increased borrowing cost for the muni arb fund created by a rise in the short-term municipal rates is offset by the additional amount received from the floating rate side of the LIBOR (taxable) swap.

Risks

Because

muni arb managers are hedging the duration risk of their

municipal-bond-based trades with taxable LIBOR-based products, basis

risk is introduced. This is the risk that the municipal market and

taxable market will not move up and down in (more or less) tandem.

Although the municipal market tends to move in relative tandem with the taxable market, this is not always the case. In practice, it is possible for municipal yields to rise without any change in the taxable market. That is, the instrument used for the hedge (e.g., LIBOR swap) moves out of synch with the underlying municipal-based security (TOB).

For example, if long-term municipal yields rise (bad for the TOB trade) but long-term taxable yields fall (bad for the hedge), the hedge did not work and the fund will see a loss from both the municipals and the swap.

Similarly, if short-term municipal yields rise (bad for the TOB trade) and short-term taxable yields fall (bad for the hedge), the hedge, again, did not work. The basis risk introduced by hedging a municipal-based trade with a LIBOR-based trade can be expressed mathematically as (1 - p2), where p is the correlation between the underlying asset (the municipal) and the hedge (the swap).

Basis risk is the primary source of volatility for most muni arb funds. Additional risks include, but are not limited to, credit risk of the underlying bonds within the TOBs, counterparty risk from the hedge trades and legislative risk that the federal tax exemption of municipal bonds might be eliminated.

The Marketplace

Currently

there are approximately 20 municipal arbitrage hedge funds open to

outside investors. While the underlying strategy is consistent from

manager to manager, realized returns can vary widely based on each

individual manager's decisions regarding leverage, source of funding,

choice of hedging instrument and the degree to which duration risk is

tolerated and/or managed. These differences in returns are illustrated

by examining the correlation of returns between managers. On a strategy

that is generally consistent across managers, the correlations between

manager returns range from approximately +0.51 to +0.80-positive, but

not as close to +1 as might be expected.

As already discussed, the term "arbitrage" is a misnomer when discussing these trades. They are by no means risk-free, and there is substantial potential for loss.

But good muni arb managers have the potential to generate fairly consistent returns. They do represent an opportunity to add relatively uncorrelated and tax-effective alpha to a diversified portfolio. Investors seeking this potential alpha, however, need to understand the risks involved with the strategy, and have an extensive knowledge of the portfolio managers.

Evan Ratnow, CFA, is a director of fixed income at Fortigent LLC (www.fortigent.com), which provides outsourced wealth management solutions to banks, trust companies and independent advisory firms that target high-net-worth investors