No recovery was ever driven by visits to parks (up 53% since January, not surprising given the improved weather in most places). Grocery and pharmacy visits weren’t much impacted the pandemic, as they were essential. The big story is retail and recreation: down 49% nationwide at the trough (April 5), but now down just 16%.

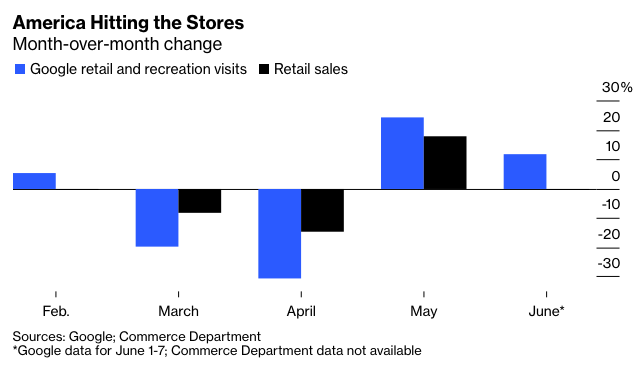

Mobility data predicted the recent positive statistics on retail sales. In May, the monthly jump in sales reported by the Commerce Department was 17.7%; the monthly jump in Google’s data for retail and recreation visits was 24.4%.

New and old data alike are voraciously devoured by Wall Street analysts. Combined with the Federal Reserve’s multiple liquidity and credit facilities, which are designed to shore up the prices of pretty much all financial assets, they explain why U.S. stocks are back where they were in early March, before the pandemic panic. Mr. Market is acting as if Covid-19 is over. The trend you can infer from the Google data points to July 10 as the date when consumption will be back to normal.

The problem is that Covid-19 isn’t over. As some of us have been warning for some time, the failure to contain the spread of the virus in the U.S. has made a second wave inevitable in many of those places where case numbers had fallen significantly, and a continuation of the first wave inevitable in those places where they had not. The national data for new cases and deaths don’t show this, as they are dominated by improvements in the Northeast (New York and its neighbors).

Eyeballing the latest data on confirmed cases, I see second waves in Arizona, Florida, Idaho, Nevada, Oklahoma, Oregon, Washington and Wyoming, as well as second ripples in Hawaii, Kansas and Montana. First waves continue in California, Mississippi, South Carolina, Tennessee, Texas and Utah. Trends in case numbers, positive tests and hospitalizations look especially worrisome in Arizona, Florida and Texas.

As Americans hit the road in increasing numbers, including longer-range trips to vacation destinations, we can also expect rising numbers of cases in states with hitherto low numbers of Covid-19 infections, such as Montana.

So what’s going to happen next? One possibility is that Americans will recoil from reopening when they see worse data on cases, hospitalizations and mortality in their states — or, more likely, if they see worse cable news reports or Internet clickbait about those things. (Watch for breaking news on Arizona’s intensive care unit capacity.) Any actions by state or municipal authorities to slow down the rush back to normality (mandatory masks in Raleigh, North Carolina, for example) may add to public anxiety.

Polling by Civiqs shows that many Americans — Democrats much more than Republicans — are still “extremely concerned” or “moderately concerned” about Covid-19. Eminent economists — notably Michael Spence, who has sought to match mobility and infection data — look at the dumb reopening and conclude that it will end badly. Spence and his co-author Chen Long warn that “the U.S. is heading for a situation comparable to the Great Depression.” They are in good company: Hardly any leading academic economist believes in the V-shaped recovery story, where output snaps back as far and as fast as it has fallen.

The alternative, and I suspect more likely, scenario is that Americans carry on getting back to normal and tacitly accept further excess mortality as just a cost of doing business until a vaccine is available. That would be bad news for the significant number of Americans who, because of their age and/or pre-existing health problems such as obesity, hypertension or kidney disease, are potentially at serious risk from Covid-19. But it would not be without precedent.