Call it the running of the bears.

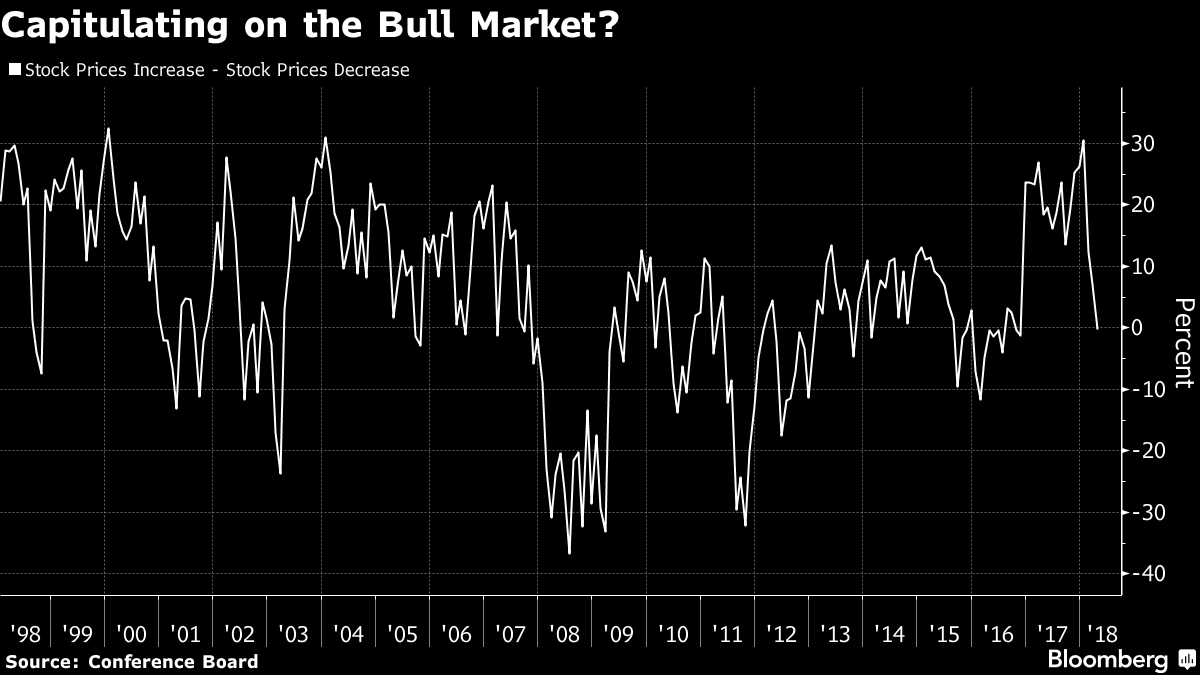

With equities almost three months removed from the last record, Americans have grown less optimistic that the market will bounce back. For the first time since Donald Trump’s shock election in November 2016, a majority of consumers expect stocks to be lower 12 months from now, according to the latest sentiment survey from the Conference Board.

It’s a stark turnaround from January, when a surging stock market pushed sentiment to a record in the University of Michigan’s survey. That release arrived just as volatility spiked and the S&P 500 slumped to its first correction in two years amid angst that rising inflation would force the Federal Reserve to accelerate the pace of rate hikes.

Since then, markets have swung in a wide range as investors assess whether expectations for rising corporate profits will be enough to overcome the threat of trade wars and geopolitical tension. The S&P 500 was little changed Tuesday as traders digested the 10-year Treasury yield’s foray above the psychologically critical mark of 3 percent for the first time in four years.

“Investors have this understanding that equity markets are at lofty levels and we are in a low-return environment, so as the risk-free rate moves higher, even in a gradual manner, that becomes more of a competitive asset class,” said Chad Morganlander, portfolio manager at Stifel Nicolaus, while cautioning that this metric may not be that useful for market timers to set their watches to.

April’s Conference Board survey capped three months of deteriorating sentiment toward the stock market, with the latest reading pushing the slide to the biggest since the period ended August 2011. That was the height of the debt-ceiling drama that sparked a downgrade of the U.S. credit rating.

For Dave Lutz, head of ETFs at Jonestrading Institutional Services, the reasons for the drop in optimism are manifold. He highlighted trade-war angst, and geopolitical tensions surrounding Syria, Russia, and Iran as key factors.

Add to that the flattening of the Treasury curve, typically a harbinger of an economic slowdown that could spark fear among investors. Still others may not have the stomach for an environment of heightened equity volatility amid concerns about a regulatory crackdown on market leaders in the technology sector.

“I think great earnings were expected, so it’s a ‘sell the news’ event,” added Lutz. “Some future regulation fears around advertising for internet names have everyone selling the news around earnings.”

However, Neil Dutta, head of U.S. economics at Renaissance Macro Research, flagged the retreat as a contrarian indicator for investors.