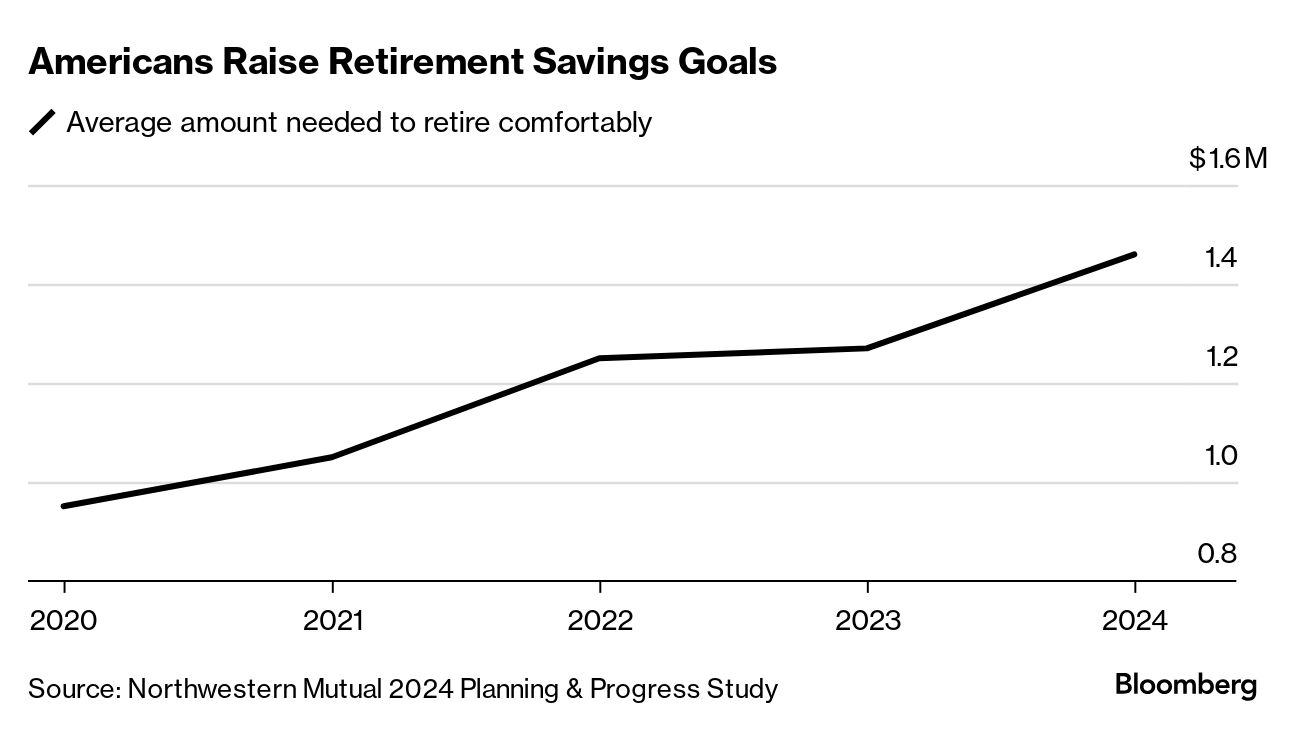

Retirement is becoming an even more distant goal as higher costs cut into American budgets.

A typical person now believes they need $1.5 million to retire comfortably, which is nearly 17 times more than the $88,400 savers have set aside on average, a Northwestern Mutual study shows.

The gap, up 16% from last year, highlights the challenges coming into focus as the over-65 population in the US increases and Americans face the prospect of financing longer life spans and potential cuts to Social Security benefits.

“People’s ‘magic number’ is now 50% higher than it was during the pandemic,” said Aditi Javeri Gokhale, chief strategy officer at Northwestern Mutual. “Soaring costs are putting more pressure on consumers to plan and be disciplined savers, and everyone knows they will need more money as they live longer.”

Gen Z and millennials set the bar for a comfortable retirement the highest, at more than $1.6 million. Gen X was close behind. And the generation closest to retirement, the baby boomers, set the bar lowest, at $990,000. “Boomers have a better feel for their numbers and they don’t believe they will live as long as Gen Z, which expects to retire at 60 and live to 100,” said Javeri Gokhale.

Breaking out the size of current retirement accounts by generation reveals the daunting obstacles for savers of all ages. The average amounts saved were $22,800 for Gen Z, $62,600 for millennials, $108,600 for Gen X and $120,300 for boomers.

One way to help bridge that gap is through advanced tax planning to spread assets among accounts that are taxed differently.

“Many people put money in 401(k)s but don’t realize that in retirement that income will likely be taxed at about 20% or 30%,” said Javeri Gokhale. Withdrawals from traditional 401(k)s in retirement count as ordinary income so that can push retirees into a higher tax bracket.

Of the 30% of Americans surveyed who did have a plan to minimize taxes on retirement income, about a third said they would make strategic withdrawals from traditional tax-deferred and after-tax Roth retirement accounts in order to stay in a lower tax bracket.

Northwestern Mutual’s 2024 Planning & Progress Study was conducted online by the Harris Poll between Jan. 3-17, among 4,588 US adults.

This article was provided by Bloomberg News.