Equity index futures are among the most liquid and cost-effective ways for investment managers to capture the returns of major stock market indexes such as the S&P 500 and Russell 2000—especially now that financing costs have cheapened.

Futures allow investment managers to use capital more efficiently. They facilitate full exposure to a given market beta (market index return) for a minimal financing cost (roughly Libor) while freeing up the bulk of capital to pursue alpha (returns in excess of the market index).

Financing costs in the equity futures market may remain favorable in the environment described in our latest Cyclical Outlook, “Growing, But Slowing,” which points to higher volatility and lower market returns as the business cycle matures and central banks dial back their post-crisis monetary support.

Supply And Demand

The financing cost of equity futures is primarily determined by supply and demand. In normal market environments, investors can expect to finance equity index exposure at roughly short-term rates, such as Libor (the London Interbank Offered Rate).

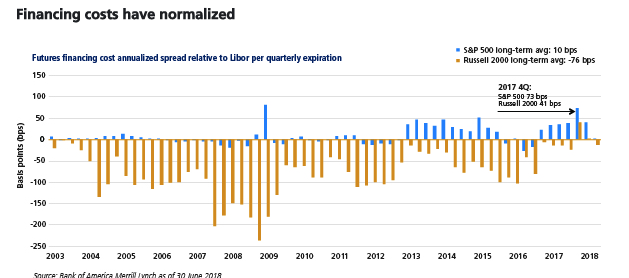

However, in late 2017 and early 2018 financing costs increased sharply as the persistently strong returns of the S&P 500 coupled with low volatility spurred demand for long equity exposure (more buyers) and reduced the demand for hedging (fewer sellers). Meanwhile, post-financial-crisis regulatory changes have reduced the ability of banks to commit capital to the equity futures market (less supply).

As a result, S&P 500 futures saw their richest roll (the implied financing rate) in nearly 10 years at 73 basis points (bps) above Libor, and Russell 2000 futures spiked to 41 bps above Libor—the first time Russell 2000 futures rolled at a premium to Libor in the last 15 years (see chart).

Yet markets can remain one-sided for only so long.

When volatility picked up and markets corrected in February of 2018, speculative long investors trimmed exposure and increased hedges, causing financing costs to decline toward longer-term averages. Consistent with what we have observed historically, the spike in financing costs was transient and conditions have normalized. S&P 500 futures rolled at roughly Libor and Russell 2000 futures rolled at Libor -12 bps, according to Bank of America Merrill Lynch data as of 30 June 2018.