Closed-end funds can offer investors high yield at a discount, but they’re complex vehicles that need a fair amount of research and babysitting.

Seeing opportunity, a number of exchange-traded funds have emerged over the past few years designed particularly to identify and purchase these closed-end funds and find profit in their discounts. These ETFs offer to do the homework for investors and deliver yield.

But what they do comes at a hefty price.

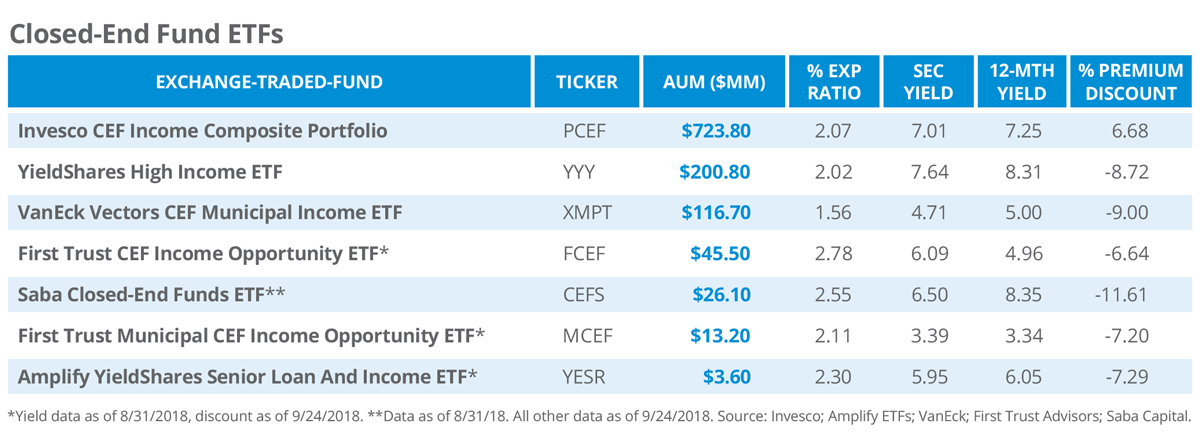

The two largest closed-end fund ETFs by assets under management are the Invesco CEF Income Composite Portfolio (PCEF), a $723 million fund that recently offered a yield of 7.25%, and the YieldShares High Income ETF (YYY), a $200 million fund that offered an 8.31% yield.

High yields notwithstanding, those funds carry eye-popping price tags: The PCEF fund has an all-in expense ratio of 2.07% while the YYY fund carries a 2.02% ratio. While those figures might give pause to financial advisors and their clients, people familiar with those ETFs say that if they are used carefully they can be worth it for some advisors whose clients need income.

Unlike standard ETFs that employ a creation-and-redemption process to keep the share price near the net asset value of their securities, closed-end funds have a fixed number of shares, and their price depends on supply and demand in the open market, says Leah Jordan, vice president at Saba Capital, which created and manages the year-old Saba Closed-End Funds ETF (CEFS), an actively managed fund with $26 million in AUM. Saba Capital is an alternative investment shop in the closed-end and hedge fund space.

Tom Roseen, head of research services at Lipper, says he’s a fan of closed-end funds in general. Unlike open-end funds, closed-end funds don’t have a cash drag: The portfolio managers don’t have to hold cash in reserves because they don’t have to worry about redemptions. They also have more flexibility to invest in less liquid vehicles that investors would otherwise have limited access to.

A big selling point for closed-end funds is that many of them trade at a discount to net asset value, so investors who buy them can get both the potential for capital appreciation and income.

“If I can buy something that has a distribution that is similar to my open-ended fund brethren, but I can buy it for 92 cents or 93 cents on the dollar, I’m actually increasing my yield,” Roseen says. “So that’s the benefit of buying at a discount.”

Roseen says that as of August 31 (the latest data available) only 87 funds were trading at a premium and 407 were trading at a discount, with the median equity closed-end funds discount at 6.2% and the median bond fund discount at 8.4%. Fixed-income closed-end funds are trading at a bigger markdown because investors are concerned about the Federal Reserve’s possible interest rate hikes, which would harm bonds—a fear, says Roseen, that explains the widening bond discounts since August 31, 2017, when bond fund closed-end fund discounts averaged only 4.17%.

Christian Magoon, the founder and chief executive officer of Amplify ETFs, which sponsors the YieldShares High Income ETF and the Amplify YieldShares Senior Loan and Income ETF (YESR), a fixed-income closed-end fund ETF, says studies over the past 15 years show that the average closed-end fund trades at a discount of about 4.5% to net asset value.

Most funds try to keep some sort of a discount to encourage buyers, Roseen says. But premiums and discounts fluctuate, giving owners a chance to sell when prices come closer to NAV or go premium. He adds that most closed-end funds don’t have huge premiums, and some have it written in their prospectus that the premiums must be capped at 7%.

When closed-end funds have their initial public offering, they may trade at NAV or a premium, but they almost always fall into a discount afterward, Roseen says. Over a complete market cycle, a closed-end fund may trade at discounts, par value or premium, but there’s no guarantee that it will ever trade at a premium..

Investors seeking capital appreciation may hope their closed-end funds trade at premiums, but Roseen says most people who buy these vehicles usually do so to enhance their yield.

What he sees as important is a fund’s “total return, including income distributions, capital gains and price appreciation,” he says.

Jordan from Saba Capital says the reasons closed-end funds can trade at premiums or discounts can be more idiosyncratic than structural—for example, when big-name fund managers make comments about a fund or if an investment house changes a portfolio structure to include or exclude a fund. She adds that her firm’s fund acts as an activist that will buy funds at a discount and try to work with the managers to narrow that discrepancy in order to capture the value of the assets.

Factors To Consider

Roseen says that while he likes closed-end funds in general, buyers should watch how a fund manages its income distribution—and that’s a concern whether or not the closed-end fund is in an ETF. If there is not enough interest income, some of it can come from the return of capital, he says. Jordan says some closed-end funds that move from a discount to a premium do so by returning capital. But if the income distributed comes by a return of capital, it can lower the fund’s cost basis, causing a taxable event.

David Dziekanski is a portfolio manager with Toroso Investments, which builds portfolios made up of ETFs for financial advisors and uses closed-end funds in those portfolios. He says advisors need to make sure they know when a distribution from these ETFs is for an investment held for the short or long term or whether it’s a return of capital.

Investors should also know that many closed-end funds use leverage to boost returns, Roseen says. While the seven big closed-end fund ETFs themselves may not use leverage (their prospectuses say), the funds they hold may use it. The ETFs may try to limit total leverage to about 30%, weeding out smaller closed-end funds with less than $500 million in assets or those that see little trading volume.

All these closed-end fund ETFs have all-in expense ratios above 2%, except for the VanEck Vectors CEF Municipal Income ETF (XMPT), which comes with a net expense ratio of 1.56%. ETFs made up of closed-end funds have high fees in part because they are funds of funds: They carry ETF management costs, plus the fees the underlying funds charge. They list both an SEC yield and a 12-month distribution yield. Amplify’s Magoon looks at the SEC yield to compare ETFs, while Jordan says she looks at the 12-month distribution yield when thinking about portfolio income.

Parsing The Funds

Of the seven closed-end fund ETFs, two are focused on the muni market, two use a mix of equity and fixed income, one is fixed income only, and two are multi-asset class funds.

The two muni bond-focused closed-end fund ETFs are XMPT from VanEck, a passively managed ETF, and the actively managed First Trust Municipal CEF Income Opportunity ETF (MCEF).

XMPT follows the S-Network Municipal Bond Closed-End Fund Index. The index invests in four sectors of municipal closed-end funds: leveraged municipal fixed-income closed-end funds, unleveraged municipal fixed-income closed-end funds, leveraged high-yield municipal fixed-income closed-end funds and unleveraged high-yield municipal fixed-income closed-end funds. The index is rebalanced quarterly. Its share price for the year was down 4.5% (all performance numbers are dated as of September 24, 2018) but it had a three-year annualized return of 3.7% and a five-year average gain of 5.8%.

As an active fund, MCEF employs a proprietary model to select anything from the municipal bond closed-end fund universe (regardless of its strategy, sector, credit quality or leverage exposure) to generate current income. It may also use tactical trading to get in and out of positions. The fund was down nearly 4% this year.

PCEF from Invesco and CEFS from Saba Capital mix equity and fixed income to generate yield. PCEF is passively managed and follows the S-Network Composite Closed-End Fund Index, rebalancing quarterly. It includes investment-grade, high-yield and option-writing closed-end funds. It seeks a balance of about 70% fixed income and 30% option income. The fund’s share price had been essentially flat in 2018, but it sported category-best three-year average returns of about 10.3% and five-year annualized returns of 7%.