Even as U.S. businesses lobby President Joe Biden to reduce or eliminate the tariffs his predecessor imposed on Chinese imports, Donald Trump is doubling down—quintupling down, in fact. Trump is considering a 60% tariff on all Chinese imports if he is reelected, according to reports, which would be five times the current average rate of 12%.

Even that understates the harm a higher tariff would do. Back-of-the-envelope calculations suggest that the new tariff would be 25 times more costly than existing trade restrictions. That would not only wreck the U.S. economy and wreak havoc with global supply chains, but it would also devastate the federal budget.

The Tax Foundation estimates that existing tariffs on Chinese goods cost the economy roughly $60 billion a year. Yet the damage from a tariff goes up with the square of the rate. Doubling a tariff, for example, produces four times the damage. So quintupling the U.S. tariff on China, as Trump proposes to do, would cost the U.S. economy approximately $1.5 trillion a year.

A tariff of that size would also create a global supply chain shock as producers scurried to find alternative sources for Chinese imports.

In response to the Trump-era tariffs, importers shifted their sourcing to third-party countries such as Vietnam and Mexico. Much of the content of those imports, however, still comes from China. A tariff of 60% is so large that it would discourage any attempts to get around it. Producers would be aware that a slight shift in the rules—declaring products with Chinese components to be Chinese imports, for example—would devastate their competitiveness.

The likelihood of Chinese retaliation, and further escalations on both sides, would induce many companies to eliminate Chinese goods from their supply chains completely. The resulting disruption would be greater than what occurred after the pandemic, and could bring about a painful recession.

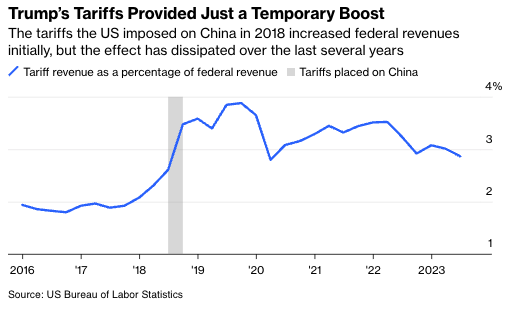

And then there are the consequences for the federal budget, which would be even more disastrous. Trump likes to brag about how much revenue his tariffs took in, but the total haul is miniscule: At current rates, they will raise about $74 billion over the 10 years to 2027, according to the Tax Foundation.

Quintupling the tariff won’t increase federal revenue by a factor of five because a tariff, by design, reduces imports. Still, let’s imagine that Trump’s tariffs do manage to increase revenue five times. These new higher rates would still raise only about $370 billion over 10 years.

The economic contraction caused by the tariffs, however, would push down both GDP and federal revenues. In 2001, a relatively mild recession resulted in a revenue decline of more than 10%, from $2.03 trillion in 2001 to $1.78 trillion in 2003. Translated into today’s numbers, a mild recession could cause revenues to decline more than $500 billion per year, dwarfing what any tariff could generate.