This week marks the start of the NCAA’s 68-team, single-elimination tournament to select the men's basketball team champion. There is a women's version as well, but the men attract most of the betting interest. Workplaces across the country are creating “bracket pools” with entry fees from $1 to $10,000 where bettors try to predict the results.

I'm going to demonstrate a powerful quant technique -- factor investing -- to pick a winning NCAA bracket. Skip lower for the picks, but if you have patience, I'll show interesting things along the way.

In the 1950s and 1960s, finance professors discovered asset returns were something akin to random walks in that professional investors could not beat random market selections. Conventional investment wisdom was wrong. Led by the University of Chicago’s Eugene Fama, known as the “the father of efficient markets,” academics assembled overwhelming evidence in support of the efficient market hypothesis, or EMH.

But there were persistent anomalies. Small capitalization stocks did better than they should and high price-earnings ratio stocks did worse. Academic opinion gradually shifted toward multiple factors to explain returns, such as value, momentum or quality. The tipping point was a seminal 1992 paper by Fama and Ken French establishing multiple factors with the same rigor that supported EMH.

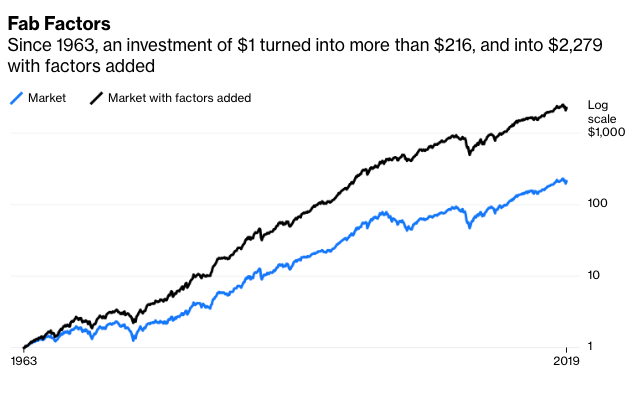

Factors are not complicated. The “value” factor, for example, consists of buying the 30 percent of stocks with the lowest price-to-book ratios and shorting the 30 percent of stocks with the highest, rebalancing once a year. The factors were not meant to be held as stand-alone investments, but overlaid on the market. The chart below shows the results since 1963 of this simple investment rule. The scale is logarithmic. The market turned $1 into more than $216, but $2,279 when factors are added. Moreover, volatility was slightly lower than the broader market. Over the years the factor literature expanded, notably with a 2013 paper that found “value and momentum everywhere.” This demonstrated the same factors drove results in a many domains.

How do factors apply to NCAA brackets? The key insight is not that factors are good. Lots of people liked small capitalization stocks and stocks with low price-to-book ratios before Fama and French were born. But those people believed in combining those traits with lots of other considerations in order to pick good stocks. Factor investing is not about picking good stocks. It's about applying simple criteria systematically to build good portfolios. And factor investing is not about weighing dozens of considerations in complex ways, it's picking a handful of simple factors that work across markets and eras, then adding them up (people who forget this end up with the dreaded “factor zoo”).

Here's the quick version of NCAA bracket pool factors. I use a five-star system.

Quality. One star for teams that have the highest or second highest Basketball Power Index (ESPN’s BPI power rating) within their seed.

Size. Add a star for teams that have the highest or second-highest success in prior NCAA tournaments within their seed.