Seasonality could be on the bull’s side, especially after U.S. stocks’ best first quarter in 20 years.

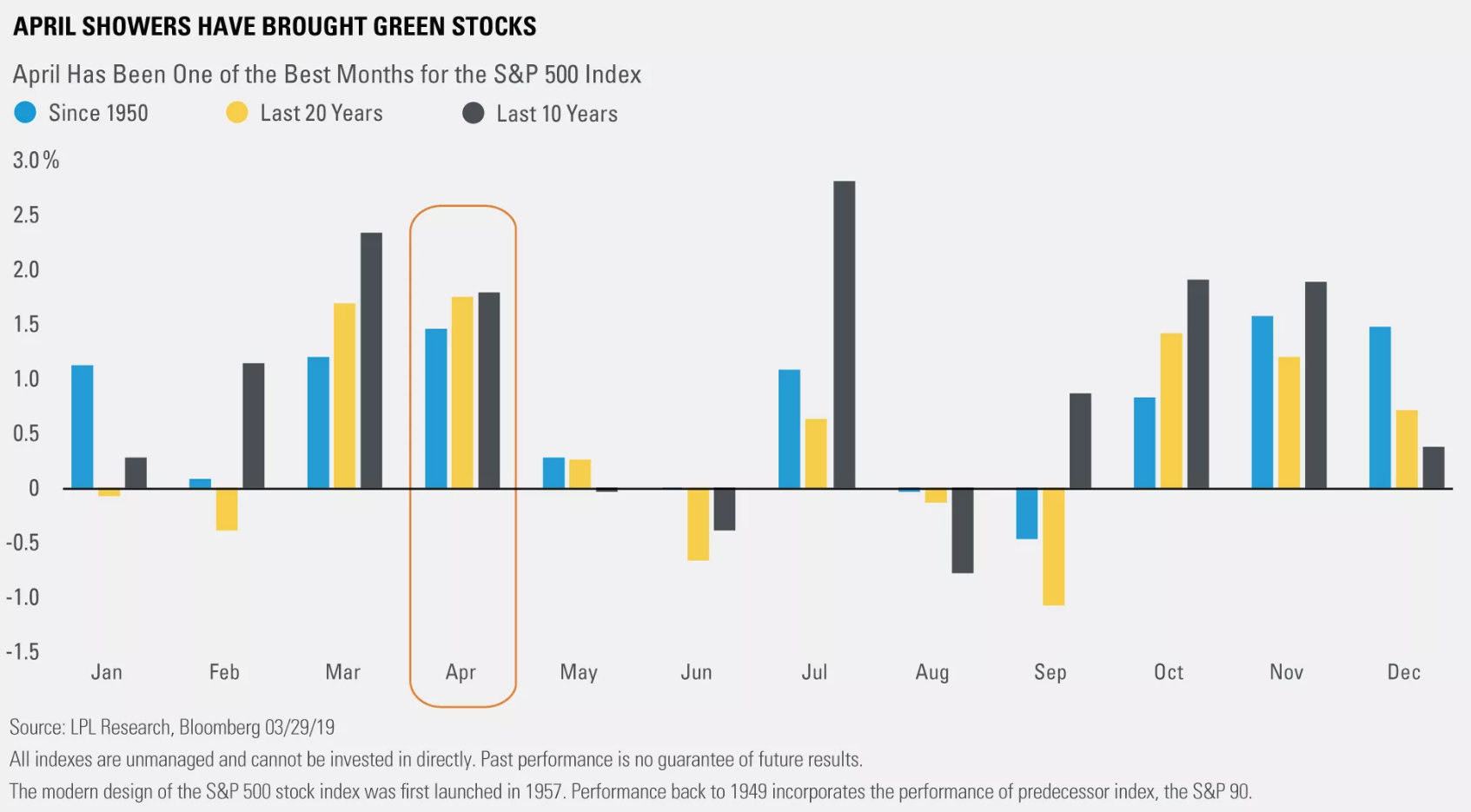

As shown in the LPL Chart of the Day, April has consistently been one of the strongest months for U.S. stocks. Over the past 20 years, April has actually been the best month of the year for the S&P 500 Index, rising 1.7 percent on average.

U.S. stocks’ strength in April has been especially apparent in the current bull market. The Dow Jones Industrial Average (Dow) has closed up in April for the last 13 years, while the S&P 500 has closed up in April for 12 out of the past 13 years. Positive momentum at the start of the year has helped April’s returns: Since 1950, April has closed up 15 of 19 years when January, February, and March were all positive as well, and the average gain in April for those 15 years was 2.6 percent.

It’s hard to say what has caused positive seasonality at this point in the year. Investors could be heaving a sigh of relief after a typically volatile first quarter, managers could be squaring up portfolios at the start of a new quarter, or the advent of spring and warmer weather could just lighten up everybody’s moods.

However, higher stock prices may be tougher to achieve this April. U.S. stocks just capped a strong rally after a near bear market to end 2018, and a weaker corporate outlook, recession worries, and global headwinds could inhibit markets in the short term.

“April may bring showers, but lately it has brought a lot of green as well,” explained LPL Senior Market Strategist Ryan Detrick. “With the Dow up 13 of the past 13 years in April, this month sure has been kind to the bulls, but 2019 is a new year, and there are always new worries.”

We believe the S&P 500 will eventually push higher through 2019, as we maintain our 3,000 fair value target.

Ryan Detrick is senior market strategist for LPL Financial.