One of the most profitable quant money managers may soon be taking a dive into the hot exchange-traded fund industry.

AQR Capital Management, the $195 billion firm co-founded by Cliff Asness, last week asked the Securities and Exchange Commission for what’s called exemptive relief for index-based and transparent actively managed ETFs -- the first step necessary to start a fund. If the permission is granted, the firm would have the legal go-ahead to offer the ETFs at any point in the future.

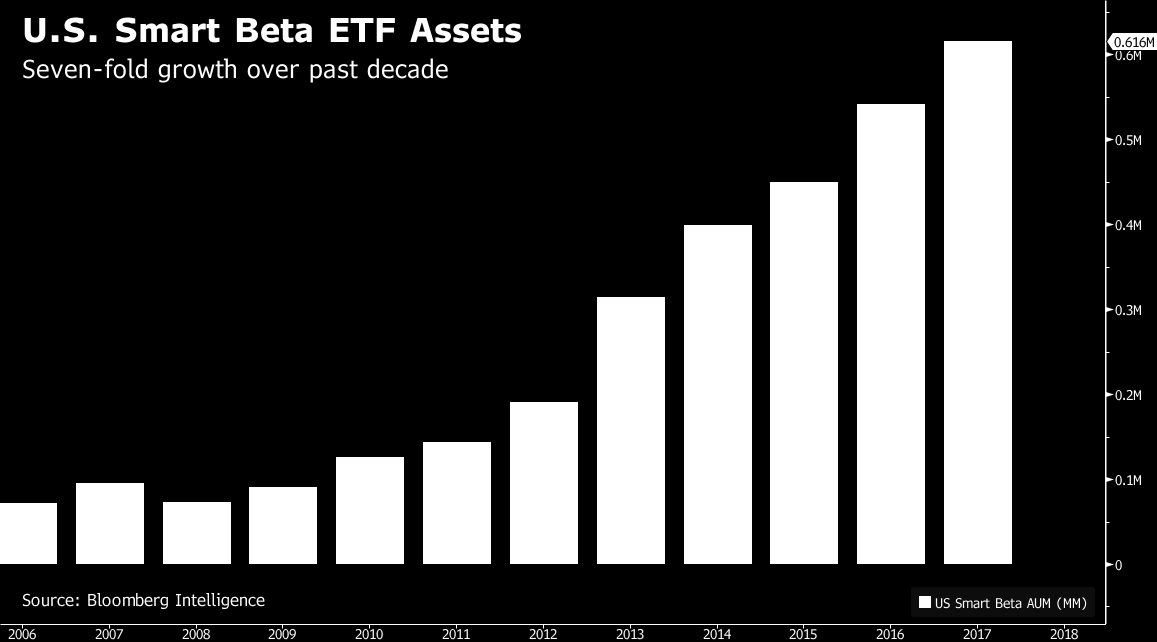

Greenwich, Connecticut-based AQR has been the beneficiary of a surge in popularity around quant factor investing strategies, which sort assets by traits like profitability and momentum. The ETF version of the strategy -- often called smart beta -- has ballooned to $615 billion in assets, according to data compiled by Bloomberg.

Even so, AQR has stuck with the hedge fund and mutual fund packaging. But now it’s leaving the window open for that to change.

“While AQR currently has no immediate plans to launch ETFs, if approved this would provide the option to offer index-based and active-transparent ETFs in the future,” according to a company statement.

Searching for ways to capitalize on increasingly popular passive investments, active managers like Precidian Investments and Eaton Vance Corp. have sought the SEC’s stamp of approval for actively managed ETFs, one of the structures in AQR’s application. But the SEC often takes years before granting approval, which means AQR couldn’t launch anything right away even if it wanted to. For example, passive giant Vanguard Group Inc. is still waiting for a decision on a similar filing submitted a year ago.

“It’s really smart for AQR to file and keep their options open, given the disruption in the asset management space,” said Brendan Clark, chief executive officer at Philadelphia-based Clark Capital Management Group. “There’s a struggle for a lot of active managers to differentiate and command flows, especially when it comes to the passive complex. ”

The AQR filing doesn’t offer specifics on what its funds might look like. Instead, it leaves open the possibility for the firm to offer active strategies packed into ETFs that invest in domestic and global equities, debt or “other instruments (including derivatives),” according to the Thursday filing. AQR’s request also notes that it may hold short positions or invest in mortgage or asset-backed securities. Portfolio compositions would be published every day.

The index-based ETF application seeks the right to offer domestic and foreign equity, fixed income or “hybrid funds,” according to the filing. It also indicates that future products would serve not just institutional investors but retail as well, a historically small sliver of clients for AQR, whose funds require investment minimums as high as $5 million.

This article was provided by Bloomberg News.