U.S. states have negotiated to the bitter end to keep health insurers selling Obamacare plans in every county next year, in some cases taking a hard-line to prevent exits that leave residents without access to health coverage.

But states cannot rule out a last-minute pullout by an insurance company.

Insurers must sign government contracts detailing where they will offer 2018 coverage by midnight on Wednesday. In recent months, dozens of U.S. counties risked having no insurer offering subsidized individual insurance next year after national players including Anthem Inc, Aetna Inc and Humana Inc announced plans to pull out.

Many insurers have lost money on their Obamacare business. Others fear exposure to a program targeted by President Donald Trump and the Republican-controlled Congress for repeal. Trump has also threatened to cut billions in subsidy payments to insurers to undermine predecessor Barack Obama's healthcare law.

Still, insurance commissioners in Republican-leaning states such as Tennessee, Missouri, and Virginia spent months negotiating with insurers to see who might pull out of their markets and either convince them to stay, or find a replacement.

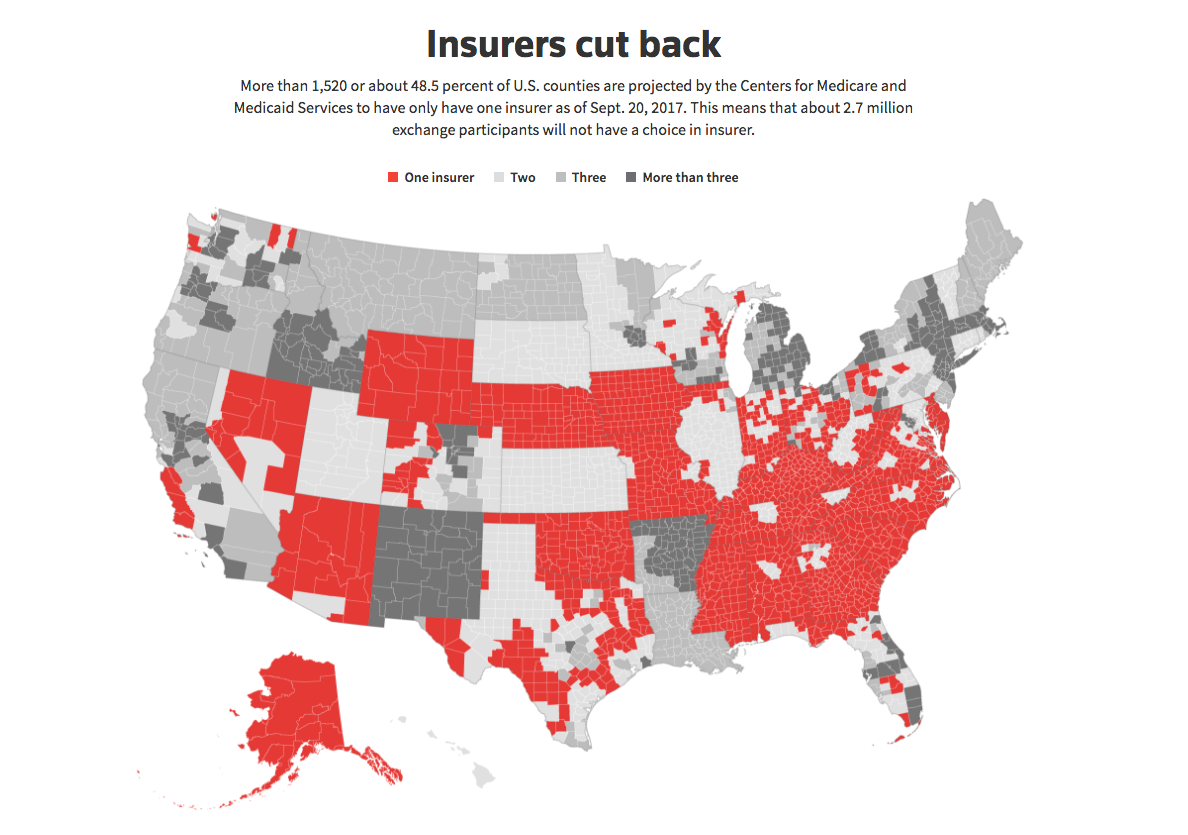

By Tuesday, it appeared they had succeeded in keeping every county covered in all states. But individuals will still face challenges. Nearly half of U.S. counties have no choice, with only one insurer offering individual plans. And many insurers filed price hikes of 20 percent or more to offset the political uncertainty.

Some states still fear a last-minute surprise.

"My colleagues and I are still very concerned that today insurers are making a decision about whether or not to participate," Tennessee insurance commissioner Julie McPeak said. "That makes us nervous."

After Humana said it would exit the Obamacare business entirely, leaving the Knoxville area with no insurer, Blue Cross Blue Shield of Tennessee said it would step into the region.

Georgia regulators warned Anthem that it could not sell in the state for five years if it left any bare counties, Deputy Insurance Commissioner Jay Florence said. As a result, after first proposing to stay in just one county next year, Anthem only left markets in Georgia where it could be sure at least one other insurer is offering coverage.