"The consistent earners protect us in tougher markets, while the emerging franchise and basic value groups contribute more to performance during an upturn," says Browne.

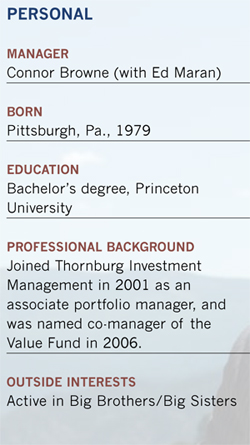

The strategy has worked well over the long term, though it fell short in 2008 when the fund plunged 41%, about 5% more than the S&P 500 index. Morningstar analyst William Samuel Rocco says Browne and Maran have succeeded in honing the strategy they learned from former manager Bill Fries, who gave up his co-manager role in late 2009 but continues to run Thornburg International Value. While Rocco gives kudos to the fund's strong long-term returns, distinctive large-blend portfolio and seasoned management, he also warns that "sector and issue concentration cause short-term pain from time to time."