Differentiation is one of financial advisors’ biggest goals—and biggest challenges. There are so many advisors today that most would-be clients find it virtually impossible to tell what makes one of you different from all the others.

That’s true even among the affluent, despite the fact that they’re often more knowledgeable about money and savvier about the professionals they work with than are the non-affluent.

And yet, being different from the pack and being able to highlight those unique features to potential clients is what empowers financial advisors to become, essentially, wealth magnets—attracting a steady stream of pre-qualified, pre-endorsed prospects to their doors.

In order to show ideal prospects and clients (as well as referral sources like centers of influence) how you stand out and stand apart from your peers, you first need to understand the current market landscape yourself. By seeing where you currently fit in the marketplace and knowing the other levels of success that exist, you can both get clear on where you are today and create a vision of where you want to be in the years ahead.

Armed with those insights, you can start to highlight—to clients, prospects and others—exactly what type of advisor you are and what makes you different from the rest.

The Hierarchy Of Advisor Success

Broadly speaking, there are three key outcomes that advisors today want to realize:

1. Capture assets under management.

2. Work with ideal, profitable clients.

3. Enjoy a life of significance—a meaningful existence.

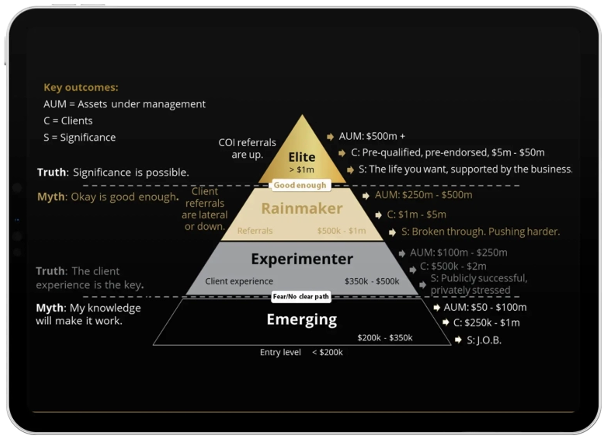

Essentially there’s a pyramid of success upon which all advisors exist at any given time, shown in the chart below. By understanding what the advisors at each level are doing—their best practices—you can begin to formulate a plan for moving to the next level, or even several levels higher.

We don’t study entry-level advisors making less than $200,000 annually, simply because they haven’t yet demonstrated the best practices of significant success that can help guide most advisors today.

Therefore, the base of the hierarchy is what we call Emerging Advisors. They net about $200,000 to $350,000 with assets under management of around $50 million to $100 million, and their client base is typically clients who are considered to be mass affluent. It’s not a bad place to be, but it tends to feel more like a job than a meaningful profession or calling.

Indeed, most advisors want to break past this stage, but they get stuck. The big reason: They believe that their knowledge will take them higher. The problem is it's the investment knowledge they tend to focus on. Investment management has largely been commoditized—it’s “table stakes” for advisors to offer this service, so doing so does very little to differentiate them from the pack. They bump up against a ceiling of fear with no clear path for pushing through it.

The next level in the hierarchy of advisor success is Experimenter Advisors. This level consists of advisors who have begun to understand that their success will not come from focusing on investments, but rather on the whole client experience they deliver. In particular, they recognize the need to address the key financial concerns of their clients—the biggest ones of which include:

• Making smart decisions about wealth.

• Mitigating taxes

• Taking care of their heirs

• Protecting assets from being unjustly taken (litigation, divorce, etc.)

• Magnifying their charitable intent and impact

Often, advisors at this level have assets under management of around $100 million to $250 million and are making around $350,000 to $500,000. That’s a great income in almost every market. But behind that public success that everyone can see, these advisors are too often privately stressed out and frustrated. They know they’re starting to make a real difference in their clients’ lives, but they also see they’re capable of a lot more. And they start to see other advisors who aren't as talented or as smart, and who don't work as hard, who are having more success.

The good news is that frustration drives many Experimenters to push through to the next level on the hierarchy—the Rainmaker Advisors, which include advisors with around $250 million to $500 million in AUM and net incomes of $500,000 to $1 million or so. A key trait of rainmakers is they have to do very little active marketing because their existing, satisfied clients become the main source of referrals. That said, these referrals tend to lead to prospects with the same or less wealth as those existing clients. It’s rare for clients to introduce advisors to significantly wealthier people. Rainmakers are in a position to have great lives. But the temptation for Rainmakers is to sit back and say “good enough” and become stagnant over time—resulting in a feeling of “is this really it?”

The most driven advisors will want to go beyond and reach the highest level of the hierarchy—the Elite Advisors. These are the advisors consistently making more than $1 million a year in net income, with AUM of $500 million or more. These are the advisors using best practices in everything or nearly everything they do. They are delivering an extraordinary client experience that addresses the full range of their clients’ concerns. They focus on working with only the right clients for them. And they build the types of relationships that empower them to find those ideal clients easily.

Their clients tend to be pre-qualified, pre-endorsed affluent investors with $5 million to $50 million, or even more. That means they almost never get introduced to a prospect who isn’t an ideal fit for their business model.

The key at the elite level is, once again, referrals. However, the source of the referrals for elite advisors makes all the difference. Elite advisors’ clients come largely from centers of influence—other professionals who also work with the affluent (such as CPAs, estate planning attorneys and the like).

The Choice Is Yours

The point here is not that every advisor has to aim for elite-level status. Instead, think about how you can better differentiate yourself given this landscape.

• Where are you today on this hierarchy?

• How important is it to you to move up a level (or two, or three)? What could doing so mean to your business and your life?

Think about the power of choice. You are at a crossroad today and you get to choose what you're going to do to elevate your practice to the level of differentiation and success you want to achieve. Making the choice to move up this hierarchy is a decision that shows you’re ready to play to win—and build a life of significance for your clients, your team and yourself.

John J. Bowen Jr. is the CEO and founder of CEG Worldwide and CEG Insights. Give yourself the tools you and your team need to capture AUM, work with ideal clients and live a life of significance! Schedule your Play to Win consultation today to see how CEG Worldwide can help you race up the hierarchy of advisor success.