Of all the candidates in the 2020 presidential field, including Donald Trump, the U.S. stock market’s biggest booster might just be Bernie Sanders.

With Sanders’s victory in the New Hampshire Democratic primary on Tuesday, questions about how the market would fare if the Vermont senator were elected president will intensify. The prevailing narrative is that his socialist bent would send the long-running bull market into retreat, but don’t bank on it.

The narrative that Sanders and stocks don’t mix is bolstered by the obvious fact that no one so openly hostile to free-market capitalism has ever occupied the White House. On that, Sanders has been shockingly consistent for decades. When asked whether he was a capitalist in a segment on the Today Show titled “Socialism in New England” in 1981, the newly elected mayor of Burlington, Vermont, shot back, “No, I’m not,” a courageous admission in the heyday of the Reagan Revolution.

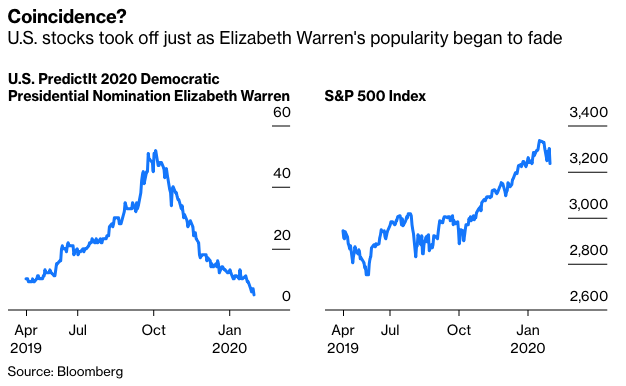

More recently, the narrative was reinforced by the market’s moves around Elizabeth Warren’s surge—and then collapse—in popularity last year. Warren, of course, is the other top Democratic candidate with an ambitious progressive agenda. As her popularity skyrocketed from May to September, so did the stock market’s gyrations, leaving the S&P 500 Index range-bound during those five months. When Warren’s fortunes nose-dived in October, the S&P 500 broke out, rising 8.5% during the fourth quarter.

But those are trivial reasons to fear Sanders. It’s just as likely that the market’s apparent reaction to Warren was purely coincidental. Also, even if elected, Sanders is unlikely to have the legislative muscle and popular support to remake the U.S. into a socialist oasis. That includes nationalizing broad swaths of the U.S. economy, as many fear he might do.

Instead, any serious attempt to anticipate how the market would perform during a Sanders presidency—acknowledging that market predictions are famously dicey—must answer two questions: What has propelled the U.S. stock market in recent years and what impact would Sanders realistically have on those forces?

Popular explanations for the current bull run that are even tangentially related to the president include the Federal Reserve’s cheap money policy, President Trump’s tax cuts and his rollback of federal regulations, but their impact is overstated.

As I pointed out recently, the vast majority of the S&P 500’s 13.6% annual return during the last decade came from freakishly high earnings growth (10.2%, or 6.2% a year higher than the long-term average) and little came from valuation expansion (1%), so the availability of cheap money hasn’t induced investors to pay meaningfully more for stocks.

And while Sanders would seek to reverse Trump’s policies, lower taxes and deregulation haven’t contributed much to the bull market, either. Most of the earnings growth that fueled higher stock prices was already in the books when Trump’s tax cuts took effect in 2018. Also, many of the regulations targeted by the administration focus on the energy sector, which has struggled to grow earnings at all since the 2008 financial crisis.