A “validation” of holdings and investment ideas at the price trend level is a sound, rational, pragmatic option that can contribute to maximizing returns and controlling risks. Stocks offering quality and good fundamentals but displaying a negative price action signal that the buy-in from the investors is not there and has a high probability to underperform.

By respecting price action, you can make trends work for you.

Hortz: What kind of opportunities does trend validation analytics open up?

Pellegrinelli: The impact of navigating price trends for active portfolios can be figured out by simply observing the performance dispersion of stocks. Performance dispersion is measurable in any investment universe, however selected and applies to any strategy (size, value, growth, ESG, etc.)

This dispersion is a repetitive phenomenon producing remarkable opportunities as well as risks. It provides a great opportunity for investors that have the right tools to capture a reasonable part of the winners and avoid most of the big losers. It can also fine tune any “buy” or “sell” decisions the active manager is considering.

Hortz: Are there any other use cases you have seen from your clients using price trend analytics?

Pellegrinelli: There are many other use cases or ways of extracting value from price trend analytics for different tasks that we have seen from over 200+ institutions that use our advanced analytics and technology, including: ranking and validation of investment ideas; identification of new opportunities; spotting new risks across holdings; portfolio optimization; tactical allocation; smart beta strategies; validation and reporting; and designing, testing and optimization of investment strategies that combine solid fundamentals and trend selection.

Hortz: What evidence can you provide of the value of price trend analytics?

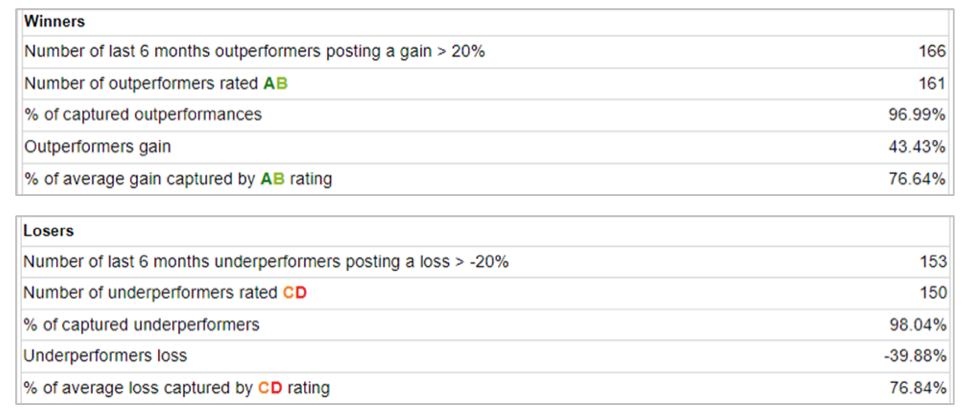

Pellegrinelli: Our unique price trend system designates positive and negative trending stocks — with A and B rated outperforming trending stocks and C and D price underperforming trending securities — enable managers to maximize the performance and control risks are documented by our monthly research briefs which we publish on the NASDAQ Financial Advisor Center.

Let us also offer two charts we developed that provide statistical evidence of the Trendrating price trend model accuracy in identifying the big movers, in this case U.S. large and mid-cap stocks with data as of Jan 19, 2022. This represents analysis of the percentage of securities recording a trend up or down (as measured with +20% and -20% minimum) that have been identified by the model and the average percentage of the whole move captured by A or B stocks on the upside and C or D stocks on the downside.

We welcome beginning a dialogue with active managers to share our research and we offer the ability to directly track the accuracy of our price trend model in real time in any investment universe of choice via a free test.

The Institute for Innovation Development is an educational and business development catalyst for growth-oriented financial advisors and financial services firms determined to lead their businesses in an operating environment of accelerating business and cultural change. We position our members with the necessary ongoing innovation resources and best practices to drive and facilitate their next-generation growth, differentiation and unique community engagement strategies. The institute was launched with the support and foresight of our founding sponsors—Ultimus Fund Solutions, NASDAQ, Pershing, Fidelity, Voya Financial, Advisorpedia and Charter Financial Publishing (publisher of Financial Advisor magazine).