Single-A credits can potentially be riskier, from a valuation perspective, than their BBB or BB counterparts, particularly in a recovering economy.

Watch The Ratings Cycle–Don’t ‘Buy High’ And ‘Sell Low’

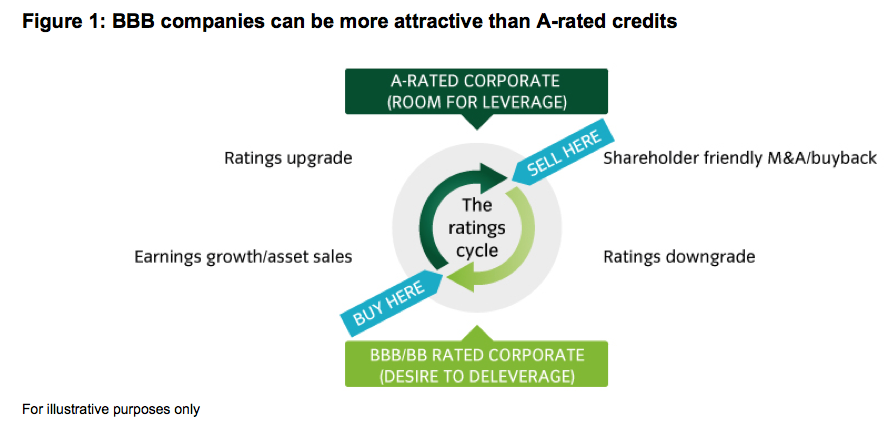

As the U.S. economy recovers, the corporate "ratings cycle" is coming back into play (Figure 1).

A-rated industrial corporates are often at the "top" of the ratings cycle and BBB/BB corporates can often be at the "bottom" of theirs, each potentially gravitating to mid-to-high BBB from opposite directions.

A-Rated Companies Can Be At Greater Downgrade Risk

Equity investors often pressure A-rated companies to increase leverage to increase shareholder returns, often through M&A or share buybacks.

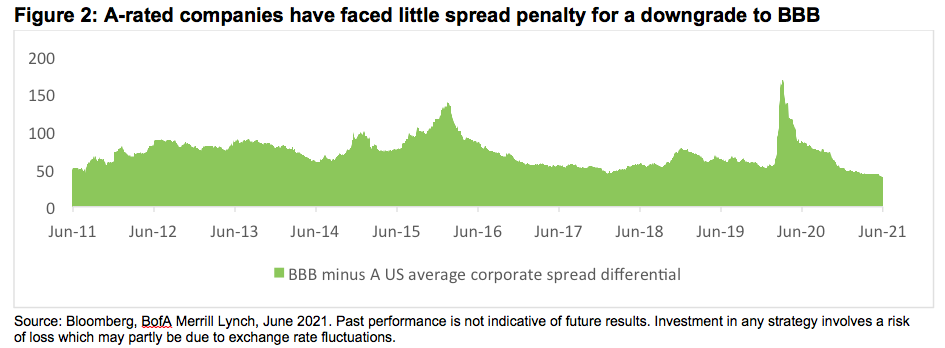

This is often understandable. Increased leverage can optimize a company’s weighted average cost of capital as the average credit spread cost of a downgrade from A to BBB is only ~40bp, the lowest in over a decade (Figure 2).

Notably, average all-in corporate yields are also ~40bp lower since pre-pandemic (as Treasury yields fell), meaning a downgrade on average means comparatively no additional cost from a treasurer’s perspective.

A-Rated Companies Are Already Leveraging Up

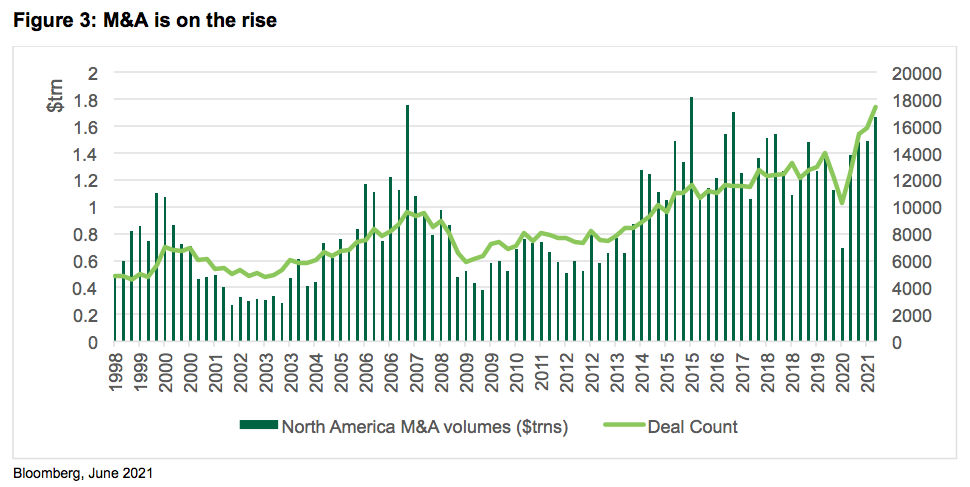

M&A is emerging as one of the remaining major drivers of new issuance in 2021 as many companies look to purchase competitors that fared less well during the pandemic (Figure 3).

Examples of deals this year include Verizon (an A- / high BBB issuer), which sold $25bn of bonds to finance spectrum purchases, in our view all but giving up on near-term aspirations of fully returning to single-A.

Elsewhere, Oracle sold $15bn of bonds in March partly to pay shareholders, receiving a two-notch downgrade from A3 to Baa2 by Moody’s given “aggressive use of debt to finance large shareholder returns.”