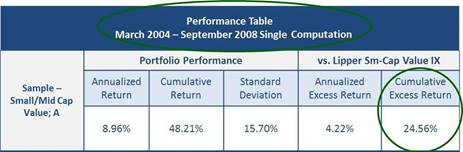

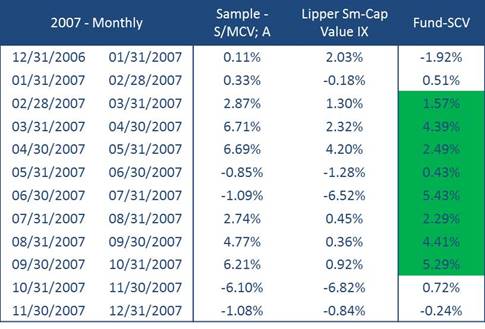

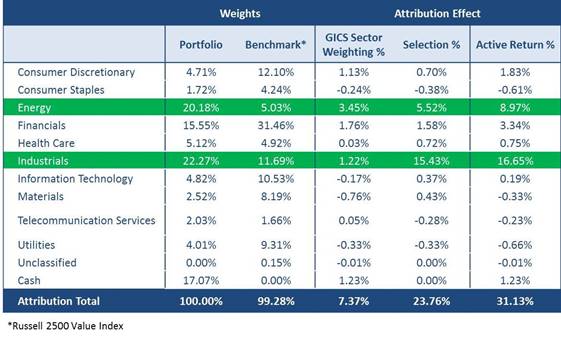

Now that we had the specific periods of out performance, we were able to dive deeper into those specific periods to determine what drove returns. Was it good stock selection across most sectors of the market? Or, was it a heavy emphasis in a few sectors of the market that significantly outpaced the broad market? This is where our next “tool” comes into play – attribution analysis. Attribution analysis isolates specific sectors, weights among those sectors and performance of individual stocks so we can determine what was responsible for a strategy’s under-, or out performance relative to a market index. What can be seen in the attribution table below is the strong results over the eight-month period noted above were primarily a function of concentrated sector bets along with good stock selection in two sectors of the market; energy and industrials.

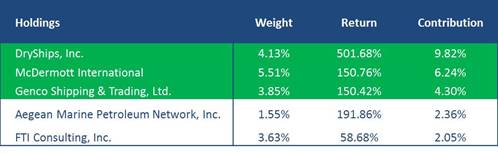

Once we had the data above, we were able to further isolate what was responsible for the strong performance in the energy and industrial sectors. What can be seen below is that three stocks contributed approximately 20% of the fund’s total performance over eight months. Furthermore, it can be seen that the performance of only five stocks over eight months explains the entire out performance relative to peers over a period of nearly five years!

The main takeaways from the performance and attribution analysis were:

· The strategy’s out performance was a function of only a handful of stocks in the portfolio.

· There was no history available to determine how the manager performs in down markets since the manager left their prior firm before the fourth quarter of 2008.

· Without having the down market history noted in the bullet point above, we do not know what the manager would have done with the “winning” stocks on the way down. Would they have sold the “big winners” before the market went down? Would they have sold them during the way down? Or, would they have held them the entire way down? Unfortunately, there is no way to get an answer to these questions outside of hearsay and speculation.