When’s the right time to join the stock market? These days companies taken public by special purpose acquisition companies are raising billions of dollars based on little more than a few prototypes and a business plan.

Never mind profits, many of the businesses targeted by SPACs for mergers don’t even have revenues yet, especially in the electric-vehicle industry. Money from blank-check companies—which raise cash in an initial public offering before finding a promising private firm with which to combine—is helping fund capital-intensive factories and technology development. But Microsoft Corp. founder Bill Gates worries that we’ve flipped from an environment in which companies were waiting too long to go public to one where they’re doing it too soon.

He’s right, and the pitfalls are becoming ever clearer. Companies that have gone public via SPACs have begun ditching financial forecasts made only a few months earlier at the time of their mergers, the Wall Street Journal and FT Alphaville have reported. This is something I’ve also warned about. It stems partly from a regulatory loophole that lets SPACs publish very optimistic financial projections, which isn’t so easy in a traditional IPO.

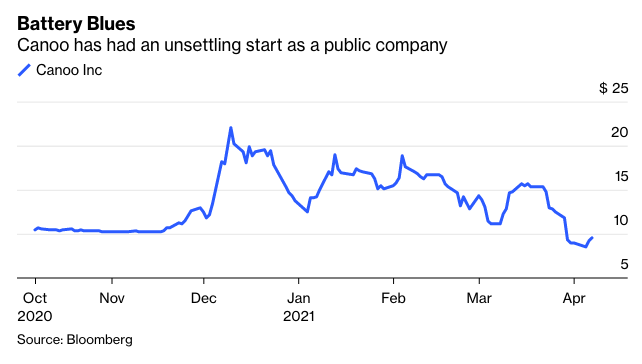

For some, the baptism as a public company has been chaotic and unforgiving. Take Canoo Inc. Having joined the stock market only a few weeks ago, the electric-vehicle start-up has already replaced some of its top management and abandoned key parts of its strategy, while acknowledging its financial controls weren’t robust enough. Wall Street analysts are exasperated and some early investors are pursuing legal action. Canoo is a parable of the perils of premature listing.

Founded toward the end of 2017 and yet to generate significant revenue, Canoo was taken public in December by Hennessy Capital Acquisition Corp. IV, one of five blank-check companies set up by investor Dan Hennessy (a sixth is in the works). Canoo and Hennessy didn’t respond to a request to comment for this piece.

The transaction valued Canoo at $2.5 billion including the $600 million of cash it raised. About half of that cash came via a concurrent so-called PIPE financing anchored by BlackRock Inc. Now the wheels have come off. During a debut earnings call last week—described by one financial blogger as the worst he’d heard from a public company—Canoo’s executive chairman Tony Aquila dropped a series of strategic and financial bombshells.

Canoo’s original business plan, described in this investor slide deck and prospectus and agreed before Aquila was appointed chairman, aimed at providing contract-engineering services to other carmakers and technology companies. This was expected to generate $120 million of revenue this year, tiding the company over until it started manufacturing its first vehicles in 2022.

Engineering services have now been “deemphasized,” Aquila said on the call, while a plan to offer customers vehicles via subscription will be scaled back. He declined to reconfirm previous financial guidance. A vaunted partnership with Hyundai Motor Co. appears to have hit the skids and Canoo’s chief financial officer and head of corporate strategy, who pitched investors on buying its stock, have left. The resignation of CFO Paul Balciunas was “not related to any disagreement regarding financial disclosures, accounting matters or other business issues,” Canoo said. The company is yet to remedy several material weaknesses in its internal controls over financial reporting, according to its annual report.