Bitcoin bulls beware: Wall Street expects the cryptocurrency’s crash to get a whole lot worse.

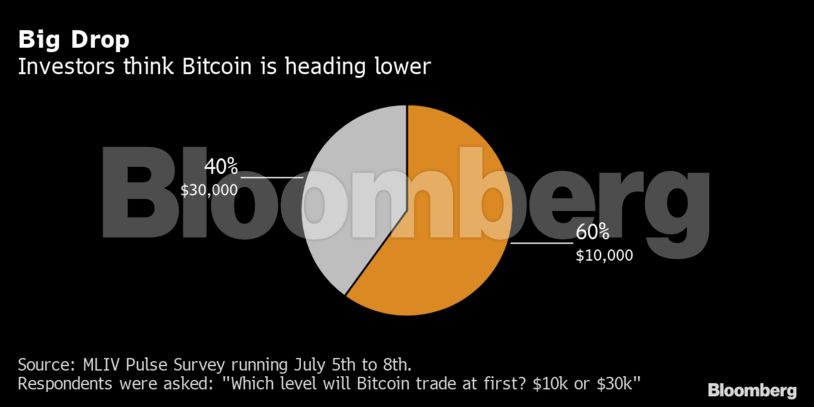

The token is more likely to tumble to $10,000, cutting its value roughly in half, than it is to rally back to $30,000, according to 60% of the 950 investors who responded to the latest MLIV Pulse survey. Forty percent saw it going the other way. Bitcoin fell 2.4% to $20,474 on Monday morning in New York.

The lopsided prediction underscores how bearish investors have become. The crypto industry has been rocked by troubled lenders, collapsed currencies, and an end to the easy money policies of the pandemic that fueled a speculative frenzy in financial markets.

Some $2 trillion has vanished from the market value of cryptocurrencies since late last year, according to data compiled by CoinGecko.

Retail investors were more apprehensive about cryptocurrencies than their institutional counterparts, with almost a quarter declaring the asset class to be garbage. Professional investors were more open-minded toward digital assets.

But overall, this sector remains a polarizing one: while some 28% of the overall respondents expressed strong confidence that cryptocurrencies are the future of finance, 20% said they’re worthless.

Bitcoin has already lost more than two-thirds of its value since hitting nearly $69,000 in November and hasn’t traded as low as $10,000 since September 2020.

“It’s very easy to be fearful right now, not only in crypto, but generally in the world,” said Jared Madfes, partner at Tribe Capital, a venture capital firm. He said the expectations for a further drop in Bitcoin reflect “people’s inherent fear in the market.”

The crypto crash is likely to put further pressures on governments to step up regulations of the industry. Such supervision is seen as positive by majority of respondents, since it could improve confidence and lead to broader acceptance among institutional and retail investors.