Bitcoin God arrived last month. Bitcoin Pizza was delivered in January. Bitcoin Private’s issuance date is... still a secret.

They’re just a few of the growing stable of so-called forks -- a type of spinoff in which developers clone Bitcoin’s software, release it with a new name, a new coin and possibly a few new features. Often, the idea is to capitalize on the public’s familiarity with Bitcoin to make some serious money, at least virtually.

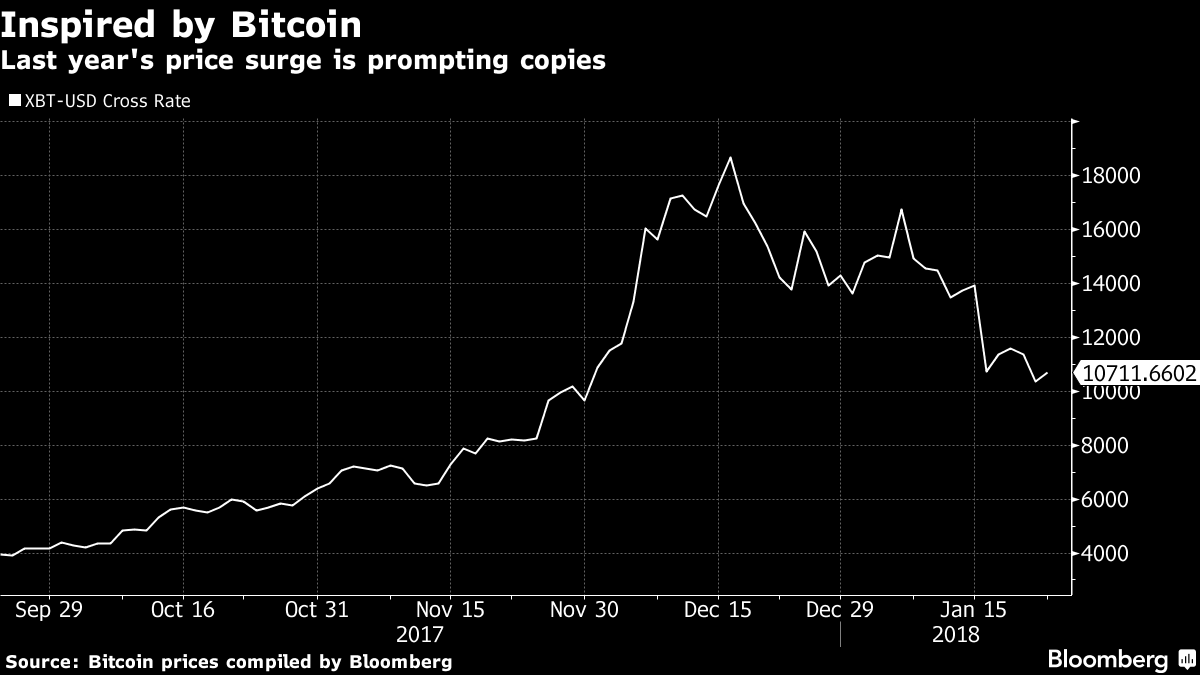

Some 19 Bitcoin forks came out last year -- but up to 50 more could happen this year, according to Lex Sokolin, global director of fintech strategy at Autonomous Research. Ultimately, the number could run even higher now that Forkgen, a site enabling anyone with rudimentary programming skills to launch a clone, is in operation. In a Jan. 14 tweet, hedge fund manager Ari Paul predicted more than 10 percent of the current value of Bitcoin and Bitcoin Cash will reside in new offshoots.

Motives behind the efforts vary. Some backers try to improve on Bitcoin. Others seek a quick profit. Developers typically score a cache of newly minted coins in a process called post-mining. Yet prices don’t necessarily hold up for long.

“Unfortunately, most fork-based projects we see today are more of a sheer money grab,” said George Kimionis, chief executive officer of Coinomi, a wallet that lets Bitcoin owners collect their new forked coins. “Looking back a few years from now we might realize that they were just mutations fostered by investors blinded by numerical price increases -- rather than honest attempts to contribute to the blockchain ecosystem.”

He predicts forking may soon sideline a more popular alternative, initial coin offerings, in which startups raise money by selling entirely new tokens. That market has gotten crowded after raising about $3.7 billion last year, and smaller offerings have struggled.

A fork’s main advantage lies in sprouting from Bitcoin, the world’s most famous cryptocurrency. In a typical fork, all existing Bitcoin owners are eligible for the forked-off coin -- giving the new asset a potentially huge number of users. Most coins arrive with at least some name recognition, because they bake “Bitcoin” into their moniker. Take for example, Bitcoin Diamond, with a price that started off strong. It didn’t last forever.

“Bitcoin forks are kind of the new alt coin,” Rhett Creighton, who’s working on the upcoming Bitcoin Private fork, said in a phone interview. “We are going to see now a bunch of Bitcoin forks. And they are going to start replacing some of the top hundred alt coins.” Bitcoin Private promises to offer more privacy features than the original Bitcoin.

Forks can also help startups raise funds in countries such as China, where ICOs have been banned, said Susan Eustis, CEO of WinterGreen Research.