Planting season, always a critical time for farmers, just became more nerve-wracking for U.S. growers of soybeans and corn.

In a move that caught many in U.S. agriculture by surprise, China on Wednesday announced planned tariffs on American shipments of the two crops. The measures are set to take effect in 60 days. That gives some farmers the opportunity of making a last-gasp switch to another crop. But for others -- perhaps most -- it’s too late to make a change.

"It puts it into flux," said Dave Walton, a farmer in Wilton, Iowa, who intends to watch prices closely in the next few weeks amid expectations that China and the U.S. will negotiate to avoid an outright trade war. "We can switch acres from beans to corn if necessary."

North Americans farmers have until around the end of June to put soybean seeds in the ground, while corn planting typically ends a month earlier. The U.S. Department of Agriculture said last week there will be 88 million acres of corn and 89 million acres of soybeans, covering a combined area larger than California.

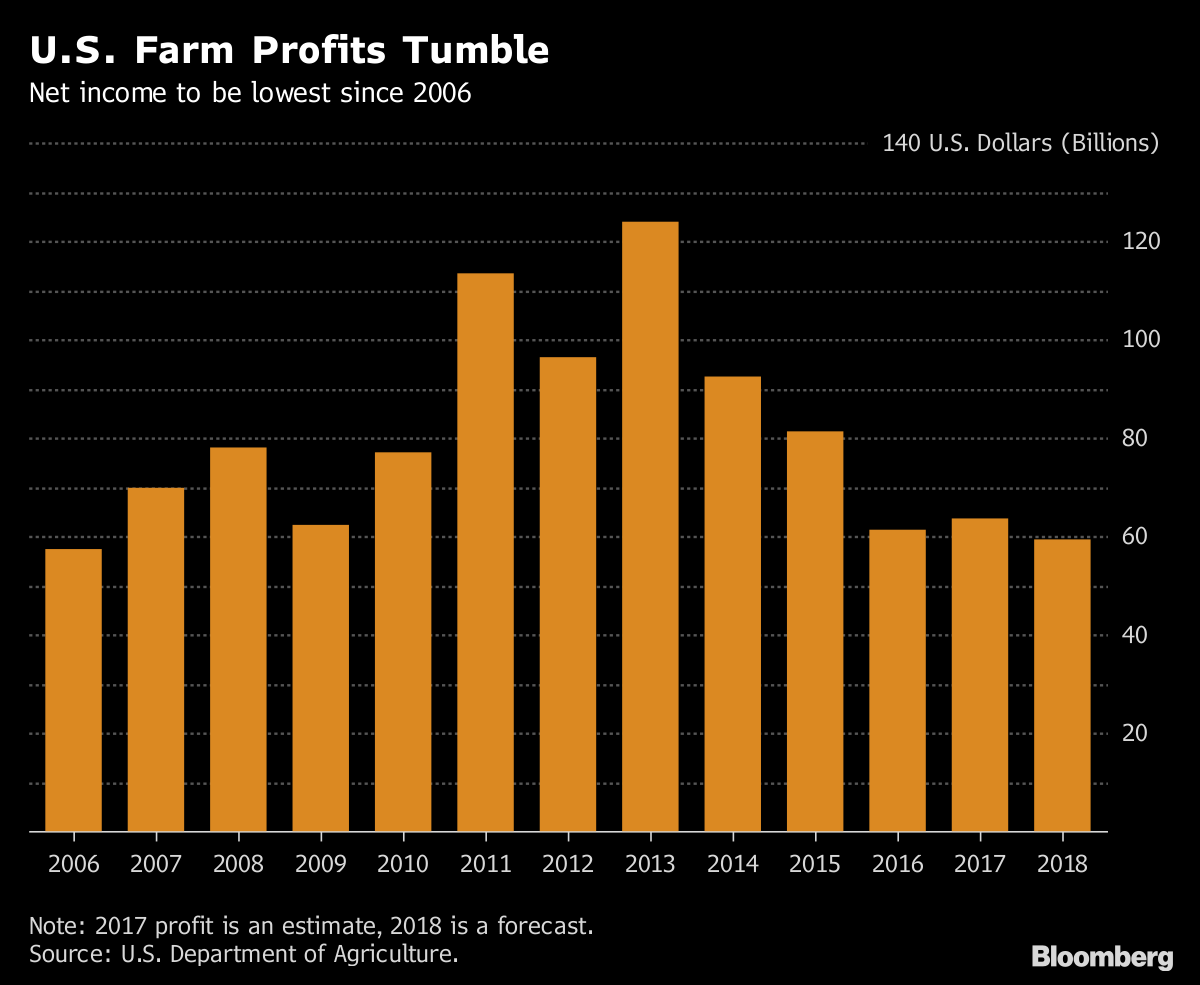

The stakes are especially high this year given the parlous state of the agricultural economy. A succession of bumper harvests has led to gluts and depressed crop prices. The USDA projects net farm income will fall to a 12-year low of $59.5 billion, less than half the record level seen in 2013.

The specter of trade disruption has been hanging over the U.S. farm economy ever since Donald Trump was elected on a platform that included promises to challenge China and renegotiate the North American Free Trade Agreement.

The Chinese tariffs drew warnings from Republicans that a trade war would deliver an economic blow in politically important areas, jeopardizing the party’s prospects in congressional elections in November.

There’s still uncertainty over whether the tariffs will be enacted, how high they will ultimately be, and how long they might last, said Chris Hurt, a professor of agricultural economics at Purdue University in West Lafayette, Indiana.

That was reflected in the market reaction on Wednesday. Amid surging volumes in the futures markets, soybeans and corn futures pared some of their early losses. Soy closed 22.75 cents, or 2.2 percent, lower at $10.1525 a bushel on the Chicago Board of Trade. A 50-cent drop may lead to some acres shifting to corn but a major change would require at least a $1 drop, Hurt said.

Soybeans for May delivery rose 0.1 percent to $10.165 at 8:54 a.m. in Chicago on Thursday.