Brevan Howard Asset Management LLP’s flagship hedge fund lost 0.7 percent in May, its third straight monthly decline, according to an investor letter seen by Bloomberg News.

The loss deepened the $8.7 billion hedge fund’s slump this year to 3.8 percent. Peers betting on macro economic trends gained 1 percent on average during the first five months of 2017, according to estimates from Eurekahedge. A spokesman for the investment firm run by billionaire Alan Howard declined to comment.

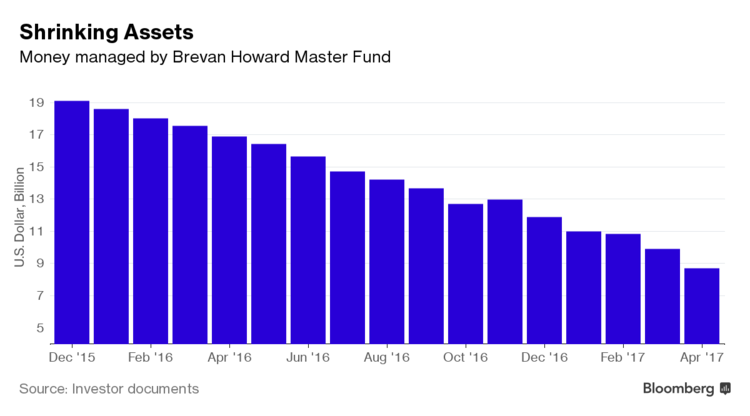

Brevan Howard’s Master Fund is battling an investor exodus following years of poor performance, even as demand increases for other macro hedge funds. The prospect of further policy normalization from the Federal Reserve has increased money-making opportunities in the industry, with macro funds raising $11.6 billion in the first four months of this year, the most of any trading strategy, according to eVestment.

Howard, 53, has seen the fortunes of his once-$40 billion hedge-fund firm decline as investors ask for their money back. The Master Fund’s assets roughly halved in the 12 months through April, while firm-wide assets dropped to $13.3 billion a month earlier.

This year’s loss erases the main fund’s 3 percent return from 2016, which was its first annual gain in three years.

This article was provided by Bloomberg News.