Bridgewater Associates’s flagship hedge fund lost 7.6% last year, with all of the drop coming in the last two months of 2023, according to people familiar with its performance.

The losses for the world’s biggest hedge fund corresponded to the biggest two-month gain in global bonds since at least 1990 and a roughly 14% gain in US shares.

The Pure Alpha II fund was up 7.5% through October before dropping about 14% in the following two months.

The firm’s long-only All Weather fund returned 10.6% last year, one of the people said.

A Bridgewater spokesperson declined to comment.

This marked the second-straight instance that Bridgewater’s flagship fund gave up gains at year-end. Pure Alpha II tumbled in October and November 2022 after having been up 22%. It ended that year up 9.4%.

Last year’s market moves produced a wide range of returns for macro managers. Rob Citrone’s Discovery Capital Management made 48%, while Said Haidar’s macro fund fell about 50% through November.

Tekmerion Capital Management, another macro fund, gained 9.8% last year. The firm, run by former Bridgewater employees, won a case against their former employer in 2020, after the hedge fund giant accused them of misappropriating trade secrets, breach of contract and unfair competition.

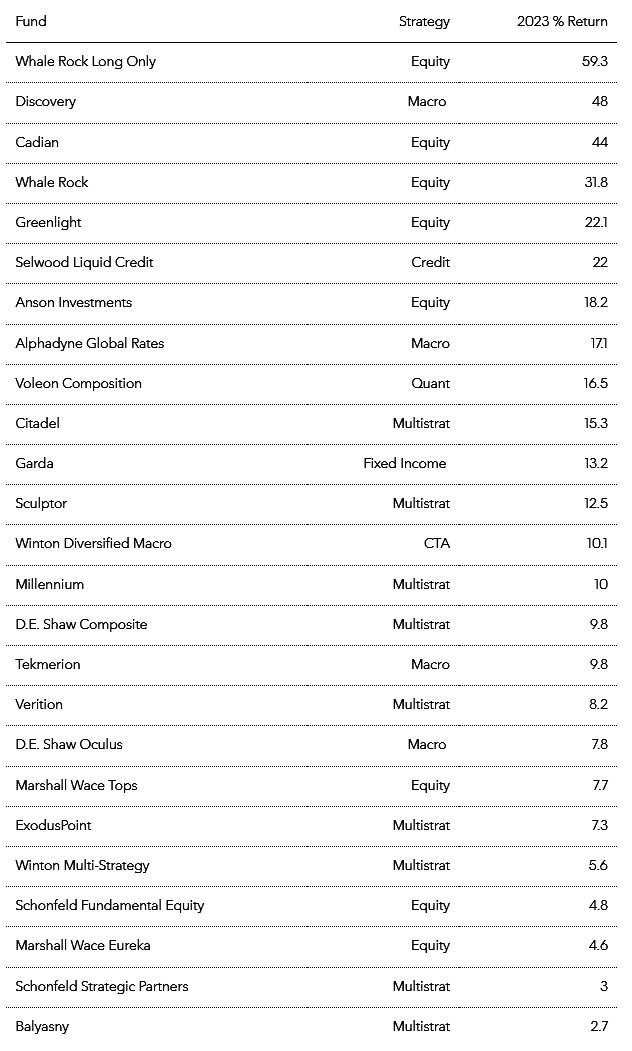

Here’s a look at 2023 returns for other hedge funds: