There is, we believe, plenty of value to be found in bonds, and bond-picking is increasingly looking like the best way to extract it.

In fact, according to a new survey from BNY Mellon Investment Management, 50% of adult Americans agree, believing that the best way to maximize value in portfolios is to own individual bonds.

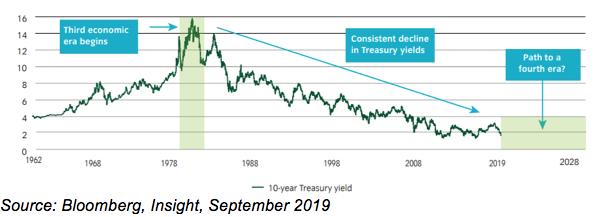

Beta fixed income strategies have had a great run – for an entire 40-years, supported by decades of falling Treasury yields (Figure 1).

Figure 1: Could The Decades-Long Treasury Bull Run Finally Be Running Out Of Steam?

But this run is becoming exhausted as we reach a tipping point that will likely take us into a new economic era in which we believe bond-picking will emerge as the superior fixed income strategy.

End Of An Era For Beta Fixed Income?

Since Adam Smith’s Wealth of Nations was published in 1776, there have been three industrial economic eras.

The most recent began around 1980 and since then, rates have continually fallen. Can this trend keep going? To evaluate, let us consider two crucial drivers.

The first is globalization and technological change, which essentially lowered the cost of labor—perpetuating disinflationary forces. However, today these trends are facing somewhat of a backlash from the rise of populist political movements across the developed world.