We had a panel at SIC with Patrick Cox and leaders of three of the biotechnology companies he follows. What they’re working on, from different angles, is almost unbelievable. It is entirely possible that we will see cancer wiped out in the next five years. Scientists are making huge strides with heart disease, dementia, spinal cord injuries, and the other great enemies of life and health. One by one, the dominoes are falling. Other companies we know about are working on the “Fountain of Middle Age,” whereby they intend to either delay or semi-reverse the aging process. It won’t take you back to your youth, but for many of us 50 years old sounds pretty good.

And there are groups like Mike West’s at BioTime, Inc., that are working on technologies like induced tissue regeneration (ITR), which will literally turn back your cellular clock. This was science fiction and a pipette dream 10 years ago. Today it is simply science, and it’s coming out of the theoretical stage and the petri dish and moving further up the experimental lab chain.

Some of you will object, “What will we do if everybody lives so long? Frankly, that’s a first-world problem. I see very few people who ask that question offering to die. If we live in a world that can figure out how to turn us young again, give us automated cars, and all sorts of abundant resources, you think we’ll have trouble figuring out how to feed everyone and keep them occupied? Malthus was so wrong in so many ways.

The $400 Trillion Gap

While this is wonderful news for humanity, it will bring some challenges, too. The world is not financially prepared to support as many retirement-age people as it will have to sustain in coming decades. We have some huge adjustments in store.

Specifically, we already have a huge retirement savings shortfall, both public and private. I discussed that problem at length recently in Part 4 and Part 5 of my “Angst in America” series. Adding millions more person-years to the equation will make the problem much worse.

The World Economic Forum’s white paper tries to quantify how much worse the personal retirement shortfall will be if current practices continue. The amounts presently earmarked for retirement income via government-provided pension systems (i.e., Social Security), employer plans, and individual savings fall far short of the mark.

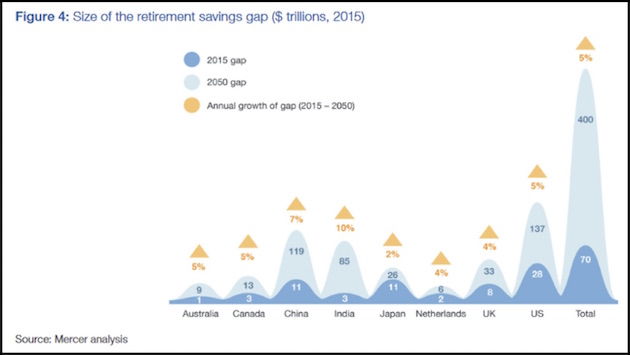

Here is the bad news in graphic form.

The bumps you see there are the difference between what is necessary to fulfill obligations (defined as 70% of pre-retirement income) and what has actually been saved or set aside to do so. The darker blue is the 2015 gap, and light blue is a 2050 estimate.

WEF shows these eight countries, which are obviously not the whole world, simply because the data was available. They also excluded assets held by the wealthiest 10% of the population, in order to show the situation of non-wealthy citizens. (Their full methodology is described on page 22 of this PDF file, for those of you who want to take a deeper dive.)

By 2050, the total shortfall in these eight countries alone will be $400 trillion. That number is so absurd that I feel very confident we will never have to face it. One way and another, some promises will be broken. The only questions are, whose and to what degree.

Remember, this is just the personal savings shortfall. This is not the government and unfunded liability shortfall. Globally, that runs into the multiple hundreds of trillions on top of the $400 trillion savings shortfall.