Canada’s exchange-traded fund market has reached a saturation point and any firms with less than C$1 billion ($767 million) in assets should be “very concerned” about the future, according to the sales chief at one of the country’s top providers.

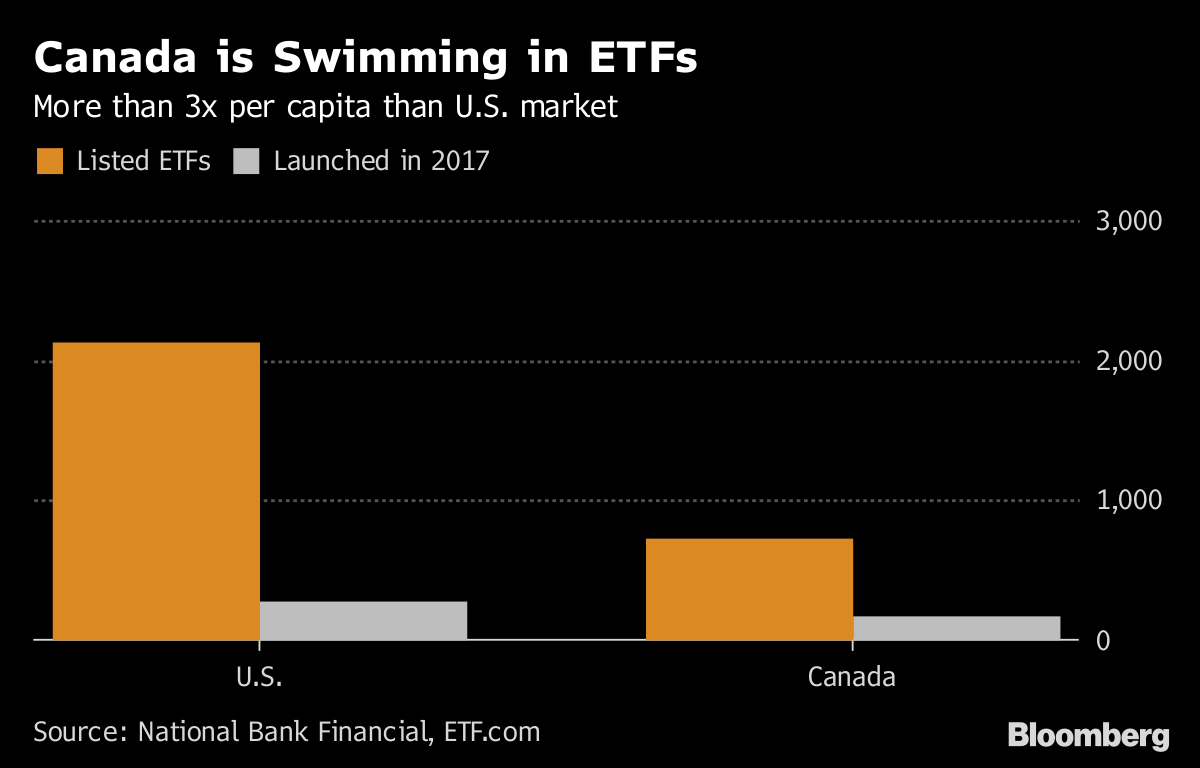

Canada is swimming in ETFs, with 725 listed funds versus 2,130 in the U.S., according to data from National Bank of Canada. That means Canada, with 1/10 the population of the U.S., has more than three times the number of ETFs per capita. Last year Canada added 169 new products compared with 270 in the U.S.

Add to this a slowdown in asset growth and it’s creating a difficult environment for new entrants, said Mark Noble, head of sales strategy at Horizons ETFs Management Canada Inc., the country’s fourth-largest ETF provider.

“The opportunity set is really drying up for new ETF providers,” said Noble, whose firm manages C$10.3 billion. “I think for a lot of them the horse has left the barn in terms of trying to capture growth.”

ETF inflows are still strong, with the industry attracting C$11 billion in assets over the first seven months of 2018, but they’ve slowed from last year’s inflows, which reached C$15.8 billion over the same period, according to National Bank.

Value Differentiator

Those flows are mostly going to the largest established providers, making it increasingly difficult for new entrants to capture assets, Noble said. The top three providers in Canada are BlackRock Inc.’s iShares, BMO Asset Management Inc. and Vanguard Investments Canada Inc.

Many new entrants are existing mutual-fund companies that decided to diversify into ETFs to offset redemptions in their traditional funds. Even though these firms have well-known brand names, they’re taking a risk if they offer ETFs that stray outside their traditional areas of expertise, Noble said.

Analysts and executives in the ETF industry dispute that there’s trouble ahead for those just getting in.

Canada ETF Market Near Saturation Point?

August 28, 2018

« Previous Article

| Next Article »

Login in order to post a comment