The entirety of a recession—particularly a mild one—hasn’t historically been all that bad for stocks from start to finish. As shown in Figure 3, the median S&P 500 performance during recessions has actually been positive at 5.4%. The average of 0.8% is dragged down by 2008-2009 when the index tumbled 37%.

How can this be? It’s because stocks anticipate both the start and end of recessions several months ahead of time. In particular, the trough of a recession tends to be followed by powerful rallies before the recession officially ends. By the time the recession is deemed over, the stock market’s recovery is typically well underway.

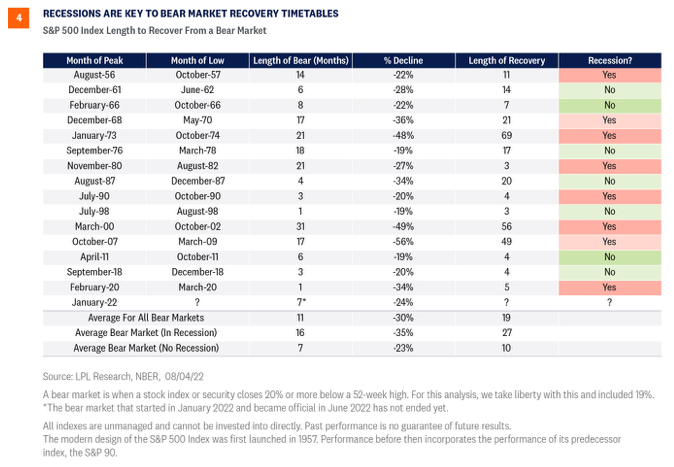

Looking at a different angle, the path of bear markets is greatly influenced by the recession question. As shown in Figure 4, the S&P 500 Index has averaged a 30% peak-to-trough decline during all bear markets since 1956 (We count declines of 19-20% for the purposes of this analysis.). When these bear markets are parsed by recession, we can see the severity of the declines tends to vary widely.

Without a recession, bear markets tend to trough in seven months. In that scenario, the market’s trough came on June 16, and this bear market is almost surely already over. But we won’t know for sure until stocks rally more than 20% to mark the start of the next bull.

Bear markets without recessions typically fall between 20% and 28%, or 23% on average. So far during the current bear market, the maximum peak-to-trough decline was 23.5%. If the U.S. economy does go into recession, we would not expect it to start for another six to 12 months, giving stocks some time to advance as inflation pressures presumably cool. We won’t predict a soft landing, but there is a plausible scenario where a mild recession comes in 2023, the S&P 500 does not retest its June 2022 lows, and stocks are nicely higher in a year. We’ll see.

Conclusion

We maintain our preference for equities over fixed income and cash in our recommended tactical asset allocation. However, after a 13% bounce in the S&P 500 off the June 16 low, there is no doubt the risk-reward has become less favorable. Stock valuations are higher but bond yields are still low enough to support valuations with the 10-year Treasury yield well under 3% despite the big jobs number. Although Friday’s very strong jobs report reduces recession risk for 2022, it also likely slows the inflation cooling process and increases the chances that the Fed gets more aggressive.

Markets can take some comfort in the strong job market, healthy consumer balance sheets, and generally solid earnings results for the second quarter. Inflation is eroding consumer purchasing power, but signs of cooling continue to emanate from the commodity markets, fixed income markets, and consumer and business surveys. Earnings estimates will likely have to come down, but probably not as much as the market anticipates, and S&P 500 revenue has risen double-digits for the seventh straight quarter.

And while most students of technical analysis see near-term downside based on the lack of capitulation or panic-selling in recent weeks, we do believe the latest rally has increased the chances that the June lows hold, and rallies off of mid-term election year lows have been extremely strong historically.

Our year-end 2022 fair value S&P 500 target of 4,300-4,400 is 5% above the August 5 closing price at the midpoint. Bottom line, we still expect a growing economy, expanding earnings, and still-low and stable interest rates to fuel higher stock prices despite another likely full percentage point of Fed rate hikes this year, a sluggish economic growth outlook, and heightened geopolitical tensions.

Jeffrey Buchbinder, CFA, is chief equity strategist at LPL Financial.