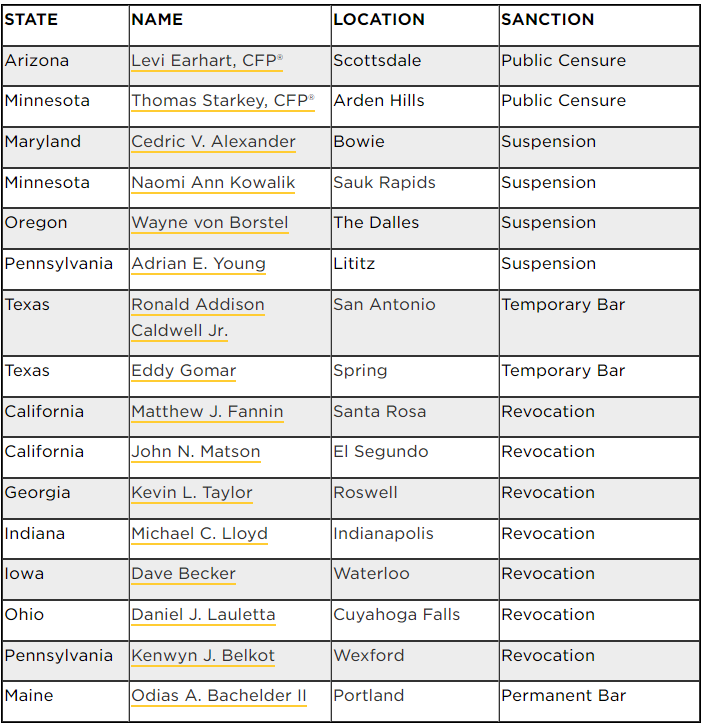

The Certified Financial Planner Board of Standards has sanctioned 16 current or former certified financial planners for various violations, in one case revoking the license of a planner who was charged with engaging in “a pattern of racketeering activity” that resulted in $12 million awarded in damages by the Georgia Superior Court.

The sanctions include public censures, temporary bars, permanent bars and revocations of the right to use the CFP marks, the CFP Board said. Under the board's disciplinary code, permanent bars apply to planners who do not currently hold the CFP mark, while revocations apply to CFP holders.

Among the sanctioned are two planners who were publicly censured, four were suspended, two were temporarily barred, one received a permanent bar, and seven had their rights to use the CFP marks revoked, the board said.

Kevin L. Taylor of Roswell, Ga., had his license revoked by the board, effective June 5, following his failure to respond in a timely manner to the board’s probe into a case that led to him being the “subject of an order of final judgment entered by the Superior Court of Fulton County, Georgia on June 18, 2020.”

According to the court’s complaint, Taylor, who oversaw trusts and companies that were entrusted to him, carried out a scheme to enrich himself. The court said he “manipulated and misrepresented a company’s financial status to manufacture losses and took other steps to obfuscate the company’s financials and profits so that he could siphon money from trusts into the company and ultimately to himself.”

In so doing, the court said Taylor “paid himself a significant salary to which he was not entitled” and used the money he stole for his personal use. A total of $12 million in damages was awarded by the Superior Court, which the Georgia Court of Appeals affirmed, the complaint noted.

“Mr. Taylor engaged in a pattern of racketeering activity, in violation of Georgia’s Racketeer Influenced and Corrupt Organizations Act and engaged in acts consisting of theft by taking by a fiduciary, theft by deception by a fiduciary, theft by conversion by a fiduciary and false statements,” the court said.

The board said Taylor violated Rule 6.5 of the Rules of Conduct, whereby he engaged in conduct that reflected “adversely on his or her integrity or fitness as a CFP professional, upon the CFP marks or upon the profession.”

Taylor could not be reached for comment.

According to the Securities and Exchange Commission’s Investment Adviser Public Disclosure database, from February 2020 to July 2020, he worked for Raymond James & Associates Alpharetta, Ga. He has not been registered since then. Prior to that, he worked with Eastbeck Wealth Management LLC, where he began his career in 2015.

The complete list of sanctioned planners is as follows: