When you run an equity portfolio that is concentrated in 25-30 common stock selections, there are usually three stocks that stick out as particularly attractive at any given time. It is tempting to cherry pick and buy those outside of our strategy. As of the end of October 2020, there are more than 10 of our stocks that appear to be worthy of extra attention and affection.

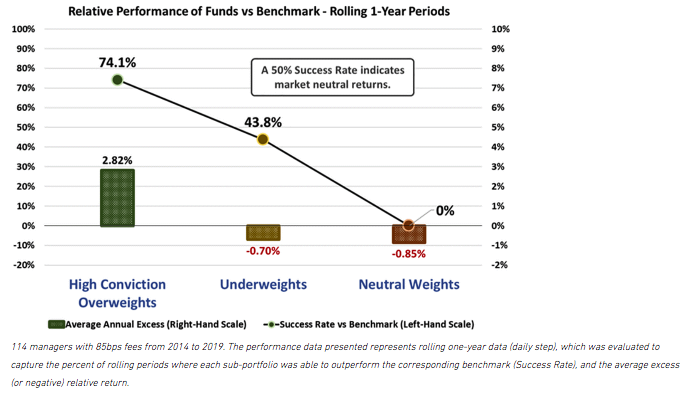

Before we go further, there are a few things to know about us at Smead Capital Management, which block any attempt to guess which of our holdings will be the best to own over the coming years. First, we believe in holding our winners to a fault, because all the stocks that go up five-to-ten times the original purchase price had to double and triple in price to make the mark. Therefore, our leading alpha producers are held for a long time. The beauty of the stock market is that if you pay cash, your limit is losing the original investment and the upside of being correct is unlimited. Here is the academic evidence for holding winners:

Second, studies have shown that you get over 90% of the benefit of diversification in the first 20 stocks owned. Thanks to our concentration, winning long-term performers add alpha. Third, our eight criteria for stock selection normally reduces the choices substantially. Lastly, we personally own our stocks side-by-side with our clients via our strategy and don’t do any cherry picking. This brings us to today.

We have rarely seen so many of our 28 holdings look as mouth watering as they do today. The concentration of capital in today’s vast combinations (Amazon, Google, Facebook, Microsoft, Apple, Netflix, etc.) and over-the-top popularity of finding the next great tech companies, has pigged up all the money. On top of it all has been the voracious appetite to own Covid-19 quarantine beneficiaries. Simultaneously, it has starved value investors of capital, who are trying to buy the most future success for the least amount of money.

Now that we are past the preface, let’s look at some wonderful companies that are deeply out of favor and appear tempting.

Pharma/Biotech

Amgen (AMGN), Merck (MRK) and Pfizer (PFE) look very cheap to us regardless of who wins the White House. The pandemic has reduced doctor visits and prescriptions, but these companies are making very good money until then. Value Line estimates 2021 earnings for AMGN of $17.25 per share, for MRK $6.30 and for PFE $2.90. This means that AMGN trades at 12.50 times forward earnings, MRK 11.89 times and PFE at 12.18 times. This is in a market trading at 19.24 times 2021 earnings. These are superior companies trading at 30-40% discounts to the average S&P 500 Index stock. Did we mention their copious dividend yields?

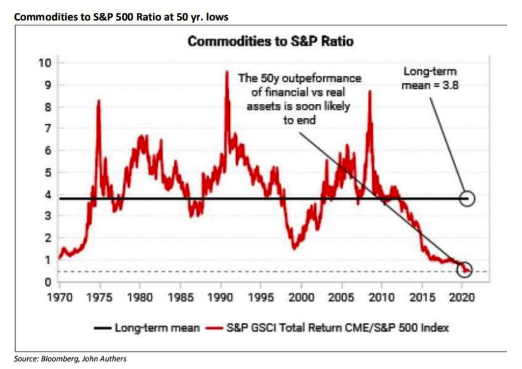

Oil and gas companies are the furthest out of favor they have been since 1999 when oil traded for $11 per barrel. You can buy proven reserves cheaper right now than at any time in my career on the New York Stock Exchange. We like Chevron (CVX) and Continental Resources (CLR). Chevron offers generous dividends while we wait. We are on the lookout for other oil and gas companies that meet our eight criteria.

Real Estate

Physical assets and labor are very undervalued. We like the mall REITs for their very attractive physical property in many of the most popular towns in America. Simon Properties (SPG) and Macerich (MAC) look like they are worth more dead than alive. Did we mention that they pay copious dividends?