Chile's state copper producer Codelco and the country's leading private lithium producer, New York-listed Sociedad Quimica y Minera de Chile (SQM), are thrashing out the details of a memorandum of understanding against an end-of-first quarter deadline to establish a joint venture to produce lithium in northern Chile's Atacama Salt Flat.

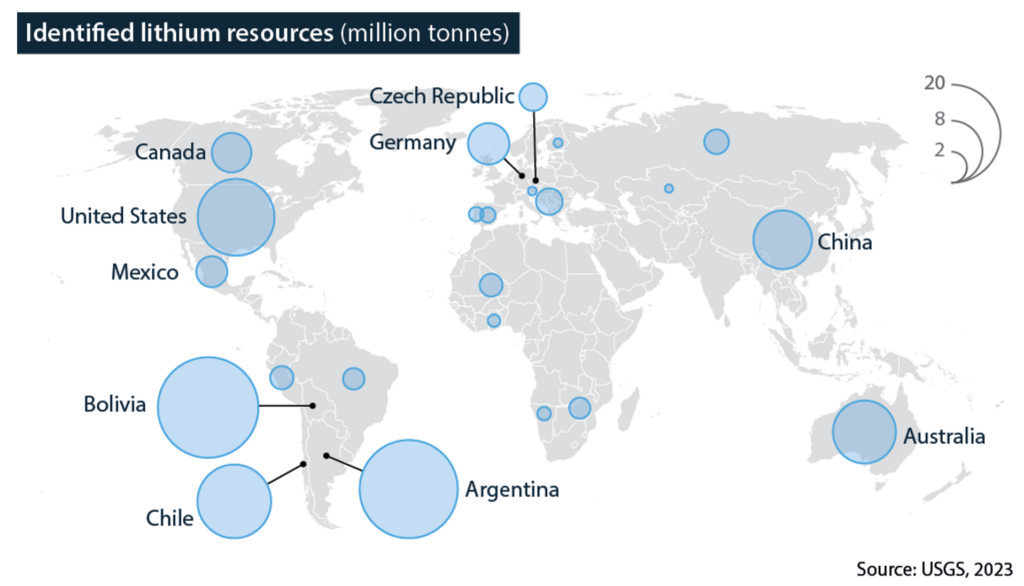

Chile has among the world's largest lithium reserves. Moreover, they are contained in brine rather than rock, making for low production costs.

Yet, the country has been slow to exploit these resources, due mainly to legal requirements for state-controlled production dating from the 1973-90 Pinochet dictatorship.

This restriction has been skirted through government-awarded rental contracts to exploit reserves. Yet only two companies currently produce lithium in Chile: SQM and Charlotte, N.C.-based Albemarle Corp.

Two-Stage Joint Venture

The memorandum of understanding agreed in late December envisages two phases:

- As of January 2025, Coldeco will take over SQM's assets in the Atacama Salt Flat, including its current rental contract, which expires at the end of 2030, and its production facilities. In this first stage, different share series will give SQM control of the operation despite Codelco's stake of 50% plus one share. Codelco will receive earnings corresponding to approximately 20% of the operation's production in this period.

- As of January 2031, the joint venture will hold a 30-year rental contract on the reserves currently exploited by SQM. This new contract was awarded to Codelco by the government, controversially without a tender. In this stage, the venture will have a single series of shares, and Codelco's stake of 50% plus one share will give it control, with the operation's earnings distributed according to each partner's stake.

Pragmatic Move

For a left-wing government, an alliance with SQM was a surprising decision. SQM has long been tainted by its questioned privatization under the dictatorship when, as a nitrates and iodine producer, it was headed by Julio Ponce, then Pinochet's son-in-law and still a significant shareholder. In the mid-2010s, involvement in a major political financing scandal further damaged the company's reputation.

However, the joint venture fulfills several government objectives:

First, as part of the deal, the government would increase the current production cap on SQM's rental contract by approximately one-third, boosting Chile's lithium output in the short term.

Second, the government's controversial decision to award the rental contract from 2031 directly to Codelco, rather than calling a tender, was to strengthen its negotiating position with SQM. The government justified the decision as ensuring production continuity.

Third, although Codelco will not control the joint venture until 2031, the deal allows President Gabriel Boric to claim fulfillment of an election promise to create a state lithium company to ensure a fairer distribution of the benefits of the country's natural resources.

Life-Line For Codelco?

Beleaguered by delays on new projects, falling production, and high leverage, Codelco has experienced successive credit ratings downgrades: by Moody's in October, Fitch in November, and S&P in December.

In this context, the joint venture promises much-needed fresh income. During the first stage, Codelco will not be expected to contribute investment financing.

However, the impact on its financial situation will depend on whether it can retain these earnings, for which, as a state company, it requires specific government authorization. The Boric administration has authorized it to reinvest an average of 30% of profits in 2021-24, but historically, governments have tended to appropriate all or most of Codelco's earnings for fiscal spending.

Impact On SQM

From nitrates and iodine, SQM has gradually shifted into lithium, which accounted for 76% of its sales in 2022, up from 21% in 2020.

The company, in which China's Tianqi Lithium Corp., the dominant global producer, holds some 22%, estimates that in 2022, it accounted for 20% of global lithium chemicals sales volume.

Although SQM will lose control of this crucial part of its business from 2031 to Codelco, rendering the operation more exposed to political—rather than technical and economic—decisions, it also stands to gain from the deal:

- The agreement removes uncertainty about SQM's future in the key Atacama Salt Flat, where it had no guarantee of remaining after its rental contract expired in 2030.

- In 2025-30, the likely increase in SQM's production cap would more than compensate it for Codelco's share in the operation's earnings, and, as of 2031, the operation promises a steady long-term source of income.

Fiscal Revenues

Government revenue from lithium currently takes two forms: rent paid by SQM and Albemarle and corporate and mining taxes. In 2022, a year of record lithium prices, they amounted to $3.1 billion and $1.9 billion, respectively, according to the Autonomous Fiscal Council, an independent government advisory body.

Together, they represented 1.6% of GDP and 6.4% of total fiscal revenue, exceeding the $4.5 billion in taxes paid by the country's largest copper mining companies.

Preliminary figures suggest that rental payments reached nearly $4 billion in 2023, although tax revenue may have dropped in line with lower lithium prices. From 2025, fiscal revenue would, depending on prices and the peso-US dollar exchange rate, be boosted by the increase in production and Codelco's share of the joint venture's earnings.

This would be particularly welcome to the government, given its failure so far to obtain approval from Congress for a tax reform to increase revenues.