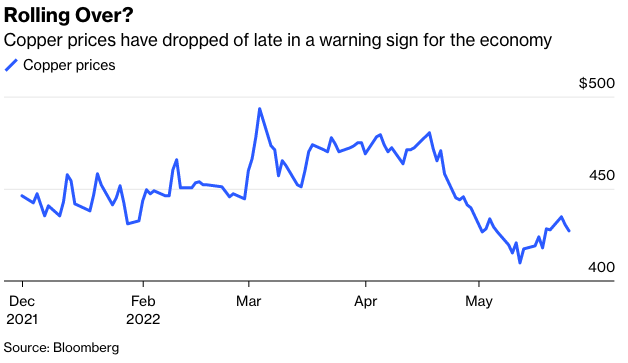

In aggressive portfolios we manage, we’re short copper futures, which are already down 14% from their early March peak. Copper is used in almost every manufactured good from autos to machinery to appliances to computers, so it’s a great proxy for the global recession I’ve been forecasting. Also, copper has no cartel on either the demand or supply side that can disrupt fundamental economic forces. After suffering some dark years, higher copper prices and robust demand forecasts have, as usual, spurred new mines and refining capacity. The International Copper Study Group expects the refined copper market to have a huge 328,000-metric ton surplus this year after a 475,000-metric ton deficit in 2021.

Copper bulls forecast exuberant demand in future years from electric-vehicle batteries and other electrical uses. But I remember when serious forecasters thought that the growth in electricity distribution was limited because there wasn’t enough copper in the earth’s surface to make all the necessary wires. Then came fiber optics made from silicone, the world’s second most abundant mineral. Bet on human ingenuity, not shortage-driven chronic price rises.

Gary Shilling is president of A. Gary Shilling & Co., a consultancy. He is author, most recently, of The Age of Deleveraging: Investment Strategies for a Decade of Slow Growth and Deflation, and he may have a stake in the areas he writes about.