Constant Variable - By Russ Alan Prince , Hannah Shaw Grove - 10/1/2007

This is the third article in a four-part series based on proprietary research conducted by Prince & Associates Inc.

We designed our survey with 269 established private banks, brokerages and multifamily offices to help us understand the state of the private wealth business, and in the process had an opportunity to probe more deeply on a variety of relevant issues. Our first article based on the research (see Private Wealth, June/July 2007, "A View From The Top") discussed how these firms define their ideal client, the methods they rely on to find qualified prospects, and the formal business development programs they use to target specific types of affluent clients. The second article (see Private Wealth, August/September 2007, "Blurring The Lines") examined the newer additions to the overall product and service platforms at these organizations, with an emphasis on alternative investments and non-investment services such as tax administration, luxury acquisitions and family and personal security.

In this article, the third, we will take a closer look at the strategic issues facing these firms and their plans and expectations for the future of the business. Interestingly, the findings brought to light the pivotal and influential role a wealthy client has in the world of private wealth management.

Barriers To Success

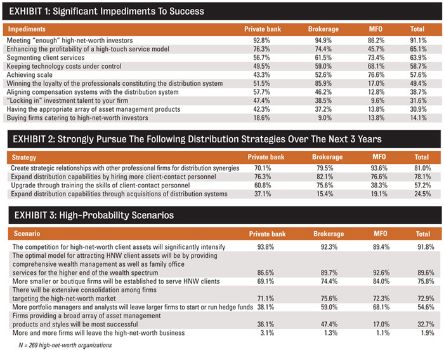

Financial

firms have identified a number of issues as impediments to greater

success (Exhibit 1). The most critical reason, cited by nearly all

firms in the survey, is the inability to access enough wealthy

prospects to meet their business goals. Without the right clients, a

well-constructed and competitive platform of capabilities is useless.

Given the rate at which private wealth has increased and the number of

affluent individuals and families in the world, the issue is not the

existence of qualified prospects but the effectiveness of individual

practitioners in sourcing and converting wealthy clients.

Another impediment, according to about two-thirds of senior managers, is the cost associated with a high-touch service model and its impact on profitability. Without question, the ultra-affluent expect a hands-on approach from the professionals they work with, and the complex goals and solutions associated with greater wealth mean the interface with clients must be more customized than systematized. Interestingly, more private banks and brokerages felt this was an issue than their counterparts at multifamily offices; this is a function of the heritage and evolution of the business models. Historically, banks and brokerages have worked with a broader cross-section of clients with varying service requirements while family offices have always focused on a few, exceptionally wealthy clients. The way firms will be able to offset the costs of individualized attention is by maximizing their relationships with each wealthy client, delivering more comprehensive solutions and generating more revenues.

Segmenting client services to ensure each client gets the most appropriate service and pricing is a concern for about three-quarters of multifamily offices, about two-thirds of brokerages and just half of private banks. Given the variable nature of clients needs and the difficulty determining the actual costs of some non-investment services, many firms don't fully understand client profitability. The answer to this conundrum is a value-pricing model derived from an analysis of each offering's relative profitability.

Keeping technology state of the art can be a high-priced commitment and, like the previous obstacle, is a greater concern for multifamily offices than other types of private wealth providers. Multifamily offices have a much smaller client base over which to spread costs, and the sophisticated needs of their ultra-wealthy families may require upgrades and enhancements at a more rapid pace than many organizations are prepared for. Conversely, most banks and brokerages have an established operational infrastructure with a dedicated support staff and budget.

Scale is a goal for about two-thirds of the firms surveyed, but multifamily offices express greater concern about their ability to get there. Their plans to target even wealthier families means the pool of prospects is smaller and the number of other businesses competing for their business is larger-figures that can have a serious impact on the odds of achieving scale.

Given the very different structures of private banks, brokerage firms and multifamily offices, there was a marked disparity in the level of concern each had for cementing the loyalty of the distribution system. In the brokerage environment, the relationship (and ultimately the loyalty) is between an advisor and a client. This means that clients are as portable as the advisors they work with and a firm must retain its practitioners in order to keep business. Private banks have more of a team approach, meaning wealthy clients have regular contact with multiple professionals. This structure reinforces the capabilities of the whole organization rather than a single individual and builds client loyalty accordingly. Given the flat operational structure of multi-family offices, less than 1 in 5 felt it was an issue.

It's no secret that compensation can be an emotionally charged topic, but private banks see it as a potentially bigger obstacle to growth than the other types of firms we studied. Almost two-thirds of private banks feel more effort is needed to better align the compensation model to reward the professionals that bring in business. Less than half of brokerage firms saw it as a concern, not surprising given their experience with commission-driven business, and less than 15% of multifamily offices perceive compensation as a threat to their future success.

The other issues-retaining investment talent, platform development and growth through acquisition-were of far less importance to any of our respondents.

Growth Through Distribution

It

stands to reason that some of the key strategies for private wealth

firms are related to client acquisition. We asked what efforts would be

implemented over the coming three years to source new, affluent clients

and learned that most firms will pursue two chief initiatives

simultaneously (Exhibit 2). The first approach is to build strategic

partnerships with other institutions, such as accounting firms, to

realize distribution synergies that will benefit both parties. Nearly

all, or 94% of, multifamily offices have prioritized this, as have 80

percent of brokerages and 70 percent of private banks. The other

strategy is more internally focused and includes expanding the number

of client-facing personnel, as cited by three-quarters of private banks

and multifamily offices and 82 percent of brokerages. Three-quarters of

brokerage firms plan to upgrade the skills of their client contact

personnel, as do 61 percent of private banks. By helping their

professionals acquire new skills and address their weaknesses, these

distribution-intensive organizations feel they can do a better job

finding, servicing and retaining their wealthy clientele. Just 39

percent of multifamily offices see professional development as an

avenue to growth.

Far fewer firms plan to grow through acquisition, with private banks being the most likely to buy distribution capabilities that will make them larger and more powerful.

Looking Forward

We

also asked the senior managers of these firms what they anticipate in

the future regarding competition, expansion of services, industry

consolidation and employee turnover. More than 90 percent felt that the

competition for wealthy clients would intensify significantly, with no

statistically significant difference between the three types of firms

represented in the study (Exhibit 3).

A similarly large percentage feel that offering a comprehensive solution to wealthy clients will emerge as the optimal private wealth experience and the best way to attract new business. This is consistent with the trend toward adding a broader range of products and non-investment services that was discussed in the last article (Blurring the Lines, Aug/Sept issue).

There is high recognition that the private wealth business carries attractive margins and is a natural extension for many diversified financial services firms. As a result, about three-quarters of respondents feel more firms would enter the business (especially boutiques that can be established quickly and hold a certain appeal for the wealthy) and predict greater consolidation among providers in an effort to gain a foothold. In the same vein, just 2 percent believe that the appeal of the high-net-worth market will diminish causing some providers to leave the business.

Focused on Clients

Wealthy

clients are the heart and soul of the private wealth business, so it's

natural that they factor prominently in the concerns, objectives, plans

and foresight of leading high-net-worth providers. Most firms believe

it will be harder to access the types of clients that they want and

manage the costs of a personalized service model moving forward. To

help reach their goals, both external and internal initiatives are

being deployed to help support the acquisition of new wealthy clients.

There is a pervasive expectation that competition will continue to

increase and more providers will enter the realm of private wealth with

unique value propositions. These dynamics may cause some firms to adopt

more aggressive marketing tactics to achieve their goals, while others

may turn to more prudent client profiling and pricing methodologies. No

matter what course of action is chosen by private wealth firms, there

is no question that the biggest beneficiary will be the affluent.