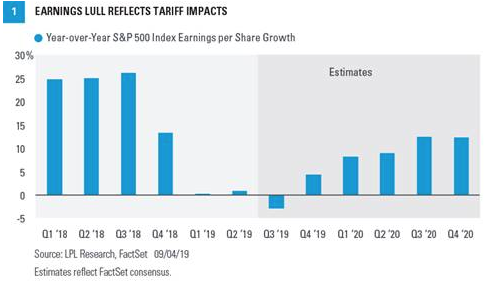

We lowered our 2019 earnings growth forecast for the S&P 500 Index on August 19 due to increased risk to economic growth and corporate profits from the ongoing trade conflict between the United States and China. Until we get clarity on trade, we believe earnings will likely continue to grow but only modestly [Figure 1].

We recently lowered our 2019 S&P 500 Index earnings growth forecast. In our August 19 Weekly Market Commentary, “Tweaking Forecasts,” we lowered our 2019 expectations for growth domestic product (GDP), the 10-year Treasury yield, and S&P 500 earnings per share (EPS). Our revised S&P 500 EPS forecast is now $165 for 2019, and we initiated a 2020 forecast of $175. Importantly, we have maintained our year-end fair value target on the S&P 500 of 3,000, as we expect lower interest rates and inflation to support higher valuations. Here we provide more background on our reduced earnings outlook.

Background

We lowered our 2019 S&P 500 EPS forecast last month, from $170 to $165, due to the impact of tariffs, lower business investment, and trade uncertainty. The revised figure, which is in line with consensus estimates (source: FactSet), represents 2-3% growth compared with 2018. We had been above consensus before tariffs offset much of the benefits of fiscal stimulus. Earnings upside from a surprise trade agreement has become increasingly unlikely after the latest escalation, although we are encouraged by China’s willingness to meet face-to-face in early October.

The trade conflict is weighing on earnings in several ways. Slower economic growth hampers revenue, while paying tariffs and dealing with supply chain disruptions hurt profit margins. In addition, business uncertainty around future trade actions weighs on capital investments, which limits opportunities for companies to grow revenue, particularly industrial and technology companies, and caps gains in productivity (output per hour worked) that could boost profit margins (more output per hour means companies can do more with fewer resources and contain wage increases). On top of that, slower growth in international developed economies has added to near-term pressure on the U.S. economy and therefore on companies’ revenue.

Preliminary 2020 Forecasts

In August we also initiated preliminary S&P 500 EPS forecasts for 2020 of $175. At this point, we expect modest 1.75% GDP growth, 2–2.25% on the 10-year Treasury yield, $175 in S&P 500 EPS, and a range of 3,150–3,200 for S&P 500 fair value at year-end 2020. Our forecasts for GDP and the 10-year yield are near consensus while our EPS projection is currently $8 below the consensus ($183) estimate (source for consensus estimates is FactSet). These forecasts reflect increasing odds of a prolonged trade conflict and of recession in the latter half of 2020.

Takeaways From Second Quarter Earnings Season

We would say the most important takeaway from the now-completed second quarter earnings season is that earnings are still growing and an earnings recession appears to be off the table for now. While FactSet’s math said the S&P 500 Index overall produced flat EPS year over year, other sources such as Refinitiv (former Thomson Reuters) reported operating earnings growth of over 3%. Boeing’s multi-billion charge during the quarter detracted 1.5% from S&P 500 EPS by itself, which appears to be a unique event that shouldn’t recur.