In the research that CEG Insights has collected on the work of top advisors, we’ve found that about one-third of the prospects they meet with become their clients. That, of course, means around two-thirds don’t become clients.

Ask yourself what your business might look like if 80%—or even 100%—of the prospects who you want to work with said yes.

That conversion rate is entirely within your reach. The key is to take one step: Create a “total client profile” for every ideal prospect with whom you meet.

Here’s a look at how a such a profile can turn a prospective client into a raving, loyal fan of you and your practice—and how to create compelling profiles that will drive prospects to work with you instead of your competitors.

Benefits Of A Total Client Profile

A total client profile is the end result of you getting to know a prospective client on a deep, meaningful level. You gain that insight by taking the prospect through a discovery process, during which you ask a series of questions designed to help you understand the person sitting across from you better than any other financial advisor out there.

These questions cover financial information, of course—but they go much, much deeper than simply looking at the numbers. Armed with that information, you can help the prospect recognize and articulate the things in life that are truly important to them. What’s more, you’ll be in an ideal position to recommend financial solutions that truly address their most vital wants and needs.

By crafting a total client profile, you realize several important benefits to your business:

1. You connect emotionally to prospects. When you ask them about themselves on a deep level and make the conversation all about them, they immediately see you as someone who cares about them as people (or as parents, and so on). This emotional connection is crucial in getting them to become clients.

2. You can deliver on clients’ key concerns. Just as a doctor can’t effectively treat patients without knowing all their symptoms, advisors can’t address clients’ key concerns until they understand everything that’s important to those clients—their families, the causes they care about and their values.

Ultimately, taking prospects through a discovery process and creating this profile for them typically lets advisors double their conversion rate.

How It Works

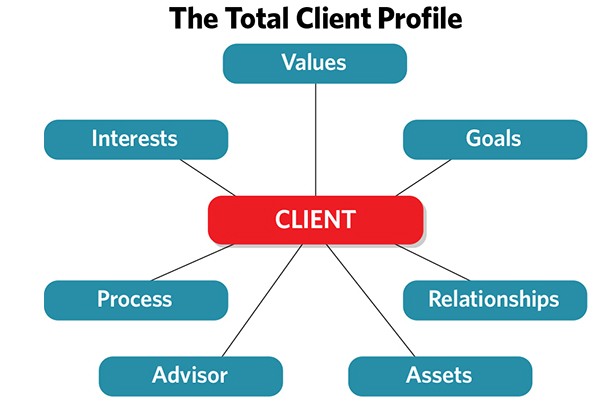

The total client profile results from the discovery phase with a prospect, and it covers seven key areas of importance—only one of which is focused on financials.

1. Values. This is where you ask clients: “What is truly important to you about your money and your desire for success, and what are the key, deep-seated values underlying the decisions you make to attain them? When you think about your money, what concerns, needs or feelings come to mind?”

2. Goals. This is where you ask, “What are you most proud of achieving in the past? And going forward, what do you want to achieve with your money over the long run—personally and professionally, from the most practical to your biggest dreams?”

3. Relationships. This is where you ask, “Who are the most important people in your life—including family, employees, friends and even pets?”

4. Assets. Here you ask, “What do you own and what are your liabilities—from your business to real estate to investment accounts and retirement plans—and where and how are your assets held?”

5. Advisors. Now ask, “Whom do you rely on for advice, and how do you feel about the professional relationships you currently have? Is there a need to find new, trusted professional advisors?”

6. Process. Here you ask, “How actively do you like to be involved in managing your financial life, and how do you prefer to work with your trusted advisors?”

7. Interests. Now ask the clients, “What are your passions in life when you are not working—including your hobbies, sports and leisure activities, charitable and philanthropic involvements, religious and spiritual proclivities, and children’s schools and activities?”

Presenting The Profile

The total client profile isn’t simply for your knowledge. Don’t write down the answers and put them in a folder. Instead, using mind-mapping software and create a formal profile that you can review with your prospects. When they see their specific answers in the seven areas laid out visually, it is truly a moment to wow them—and that’s when they can see how different you are from all the other advisors they’ve met or worked with.

Once a prospect becomes a client, this total client profile should be your first stop at each regular progress meeting you have with the client. Instead of launching into a talk about the markets, pull up the profile and see what may need updating. For example: Did the client’s daughter have her baby yet? Is their plan still to buy a second home in South Carolina, or has anything changed? You want to be updating the profile regularly and getting clients to talk about their lives. When they talk about the things they care about, you are going to be able to make better decisions to help them. You’re going to see what matters to them. And they’re going to feel closer to you.

The upshot: Don’t overlook this all-important tool for turning prospects into clients. It truly has the potential to fundamentally reshape your practice.

John J. Bowen Jr. is CEO of CEG Worldwide and CEG Insights. Join the “Play to Win” consultation; it’s your guide to wealth management success.