But didn’t Nassim Taleb teach us that crises are ‘Black Swans’, events that cannot be modeled or anticipated by definition? That there are an infinite number of possible crises out there and our finite minds cannot possible make sense of all of them and prepare. Of course, if you subscribe to this theory then the only logical action you can take to be successful is to buy lottery tickets and wait until your ship comes in. Dr. Taleb calls it exposing yourself to positive right tail events. Or you can become a best-selling author, but the chances there are sadly even smaller than winning a lottery. In reality, financial crises are quite similar. They can easily be categorized into crash impacts, just like car crash impacts such as frontal, rear, side, rollover etc. There are certain types of fundamental building blocks of the financial system that can be used for this purpose: equity prices, interest rates, spreads, commodity prices, other real assets etc. Take those and break them up by region and you can have a list of possible events that will cover just about everything, except natural disasters (which along with sudden geopolitical hostilities are the true black swans). The Lehman Collapse of 2008 and the LTCM crises of 1998 had great many similarities in the mechanism of the market dislocation. Southern Europe sovereign debt problems of 2010 are not dissimilar from the past sovereign debt problems regularly observed in the financial history (check out This Time is Different by Reinhart and Rogoff).

Once the list of plausible events is identified, you do not want to be overly focusing on any single one to the exclusion of others. You certainly do not want to be timing them, as nobody can do that consistently.

Sample Stress Test

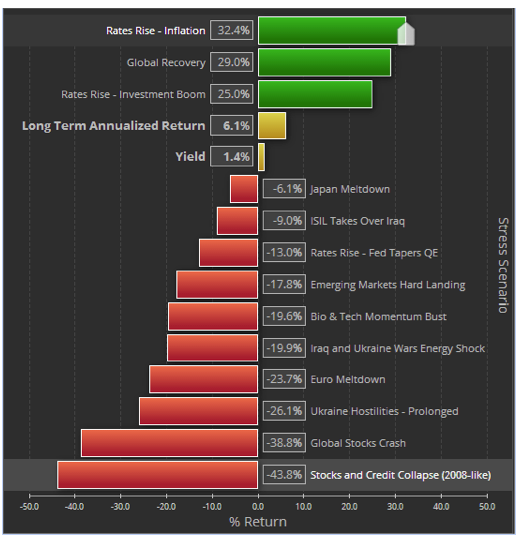

Here is a picture of a sample stress test. Though your stress test summary can look different, the key is that it should include a variety of plausible events that can be explained to the client in plain English. Remember, our main goal is to create a suitable portfolio. To do that we need to get buy-in to reduce the chances of the client selling at the bottom and (as a consequence) getting back in at the top. The stress test report should also include events with some upside as well as some indication of the long term performance and current yield of the portfolio.

Exhibit 1 – Sample Crash Test

Risk Adjustments

At this point a reasonable question might be asked. What if we clearly see that valuations are stretched, leverage is off the charts, complacency at all-time highs? Should we not react to that just because we cannot time the crash? The answer is that we should absolutely monitor such systemic risk trends. But we should be humble and remember that timing is quite difficult. Instead we can either de-risk or buy portfolio insurance.

De-Risking