Scott Davis took that lesson to heart when he became manager of the Columbia Dividend Income Fund in 2013 after his mentor Dahlberg’s retirement. (He’d been co-managing the fund with Dahlberg since 2001.) Davis and his current co-managers, Michael Barclay and Peter Santoro, believe the highest-yielding stocks—or those that have been paying dividends the longest—aren’t necessarily the best ones for investors.

Instead, the three focus their search on companies with the healthiest levels of free cash flow to identify attractively valued securities and forecast a company’s potential dividend actions. The income produced by the dividend-paying stocks of financially strong companies in their portfolio is also meant to provide some downside protection when the market trends lower.

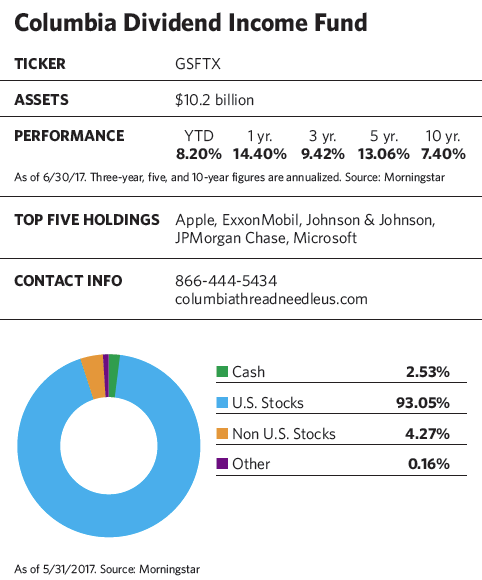

The focus on high-quality companies with above-average dividend yields “has kept the fund out of trouble, especially when less reliable firms cut dividends when their fundamentals weaken,” noted Morningstar analyst Gretchen Rupp in her review of the fund. “Although this fund can trail its index when markets accelerate, it doesn’t usually fall too far behind and has captured about 96% of its bogy’s gains in months when the market has gone up.” Back in March 2008, Dick Dahlberg, who managed the Columbia Dividend Income Fund at the time, told this magazine that the bank stocks investors craved for their high-dividend yields were going to have a hard time maintaining or increasing their dividends as their financial positions weakened. Instead, he favored stocks in health care, consumer staples and other sectors he felt had more reliable free cash flow to keep dividends afloat and to weather a market storm.

Back in March 2008, Dick Dahlberg, who managed the Columbia Dividend Income Fund at the time, told this magazine that the bank stocks investors craved for their high-dividend yields were going to have a hard time maintaining or increasing their dividends as their financial positions weakened. Instead, he favored stocks in health care, consumer staples and other sectors he felt had more reliable free cash flow to keep dividends afloat and to weather a market storm.

When that storm hit later in the year, no corner of the market was spared. But by trimming down bank stocks and sticking with dividend payers that had better cash flow and stronger balance sheets, his fund managed to avoid the S&P 500’s 37% drop (it fell by only 28% during that challenging year).

When that storm hit later in the year, no corner of the market was spared. But by trimming down bank stocks and sticking with dividend payers that had better cash flow and stronger balance sheets, his fund managed to avoid the S&P 500’s 37% drop (it fell by only 28% during that challenging year).

Some stocks in the portfolio, such as Johnson & Johnson, are no strangers to common high-dividend stock lists. It’s a longtime favorite of Davis, who estimates J&J will generate $19 billion in free cash flow this year. Others, such as global semiconductor giant Broadcom, might be relatively new to the dividend game but have strong cash flow and good potential to maintain or increase those payouts.

In addition to having strong cash flow, companies in the Columbia fund must appear committed to maintaining or increasing dividends and using cash judiciously. “Using cash for stock buybacks isn’t necessarily a bad thing,” says Davis. “But it can also be destructive when companies do it at prices that are substantially above accretive value.” A number of energy companies that engaged in aggressive stock buyback programs in 2015 and 2016 made that mistake, he says. So companies pursuing buybacks must have a consistent, clearly articulated policy for doing so and sensible price targets.

Craving Cash Flow

August 1, 2017

« Previous Article

| Next Article »

Login in order to post a comment