The recent action in the stock market seems to be governed by crowd psychology and reminds us of a theory we created in college called the “coat theory.” Back in the 1970s, the fraternities and sororities at my alma mater hosted several mixers so the students could get to know each other better. The ladies hung their coats on a large coat rack just inside the door to our fraternity house. We sang and shared our dessert with our sorority guests.

It didn’t take us very long to figure out the behavior of these sorority girls. When the main part of exchange was over, one of the ladies would go to the coat rack, put her coat on and prepare to leave. Within five to ten minutes, virtually every one of their sorority sisters had gone to the coat rack and headed back to their dormitory or home near campus. We called this behavior “coat theory.” The theory was that one coat would quickly lead to all the coats.

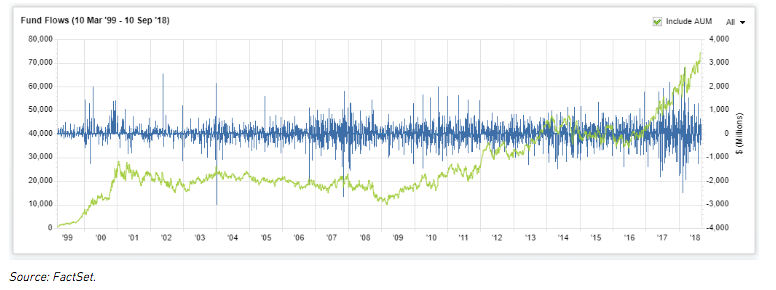

From a historical perspective, tech shares are as large a part of the S&P 500 Index as they were at their all-time peak in popularity at the end of 1999. If you count Amazon and Netflix as tech companies, the tech stock coat rack looks just as crowded today. Here is a chart which shows that the most popular tech ETF, the QQQ, has seen its assets grow to $75 billion recently, dwarfing the peak of $27 billion in 2000:

When you put thirty or more coats on the coat rack inside the entrance of our fraternity, the rack got crowded. In the stock market, when everyone piles into the same stocks, it also gets very crowded. Unless you have been hiding under a rock, you know that we have had an unusually long stretch of popularity in the largest-cap tech-stock darlings, and those highly-priced shares have gained a disproportionately large part of market gains in recent years.

With the recent vaping of Facebook and Twitter, and the temperature-reducing decline of Tesla shares, numerous questions must be asked. Is there a change in the crowd psychology surrounding the tech shares? Were Facebook and Twitter the first people in the sorority to get their coats and will this lead to a pendulum swing in crowd psychology in the stock market? How twisted up is the ownership of tech in the S&P 500 Index and does this make it a crowded coat rack? Where will the money go if investors pull their coats off the glam-tech rack?

After getting vaped, Facebook and Twitter have not rallied like tech shares did in prior head fake corrections. Also, Tesla quickly joined the negative swing in the psychology by pretending to go private and attempting to squeeze short sellers. Now, all the biggest internet-based businesses are having their power in the marketplace examined by political leaders and anti-trust legal minds. In a recent The New York Times article, journalists are now sharing the debate about monopoly status and the anti-competitive nature of Amazon, Alphabet and Facebook. (Source: The New York Times). This wasn’t true in prior corrections.

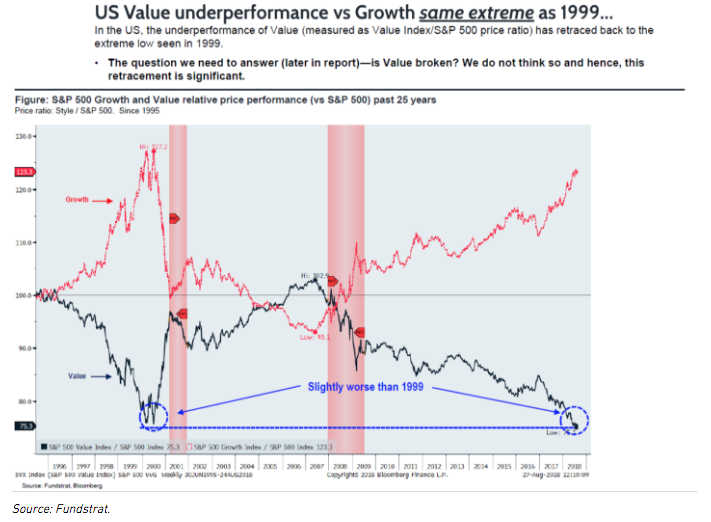

We have had many head fakes on prior pullbacks in glam tech shares. However, this current run in momentum growth stock investing looks long in the tooth over twenty years of history. Fundstrat has provided some great research and the chart below:

The S&P 500 Index has become dramatically more popular as a percentage of total assets invested in the U.S. stock market, which means that a negative feedback loop could be triggered by the combination of a coat theory event in glam tech shares and a crowd exit from the S&P 500 Index itself: