Speaking to the recently stronger dollar, while longer term we think the U.S. Dollar Index has traced out a giant top in the charts, near term the dollar could trade higher given the higher environment of short-term higher interest rates. Historically, periods of dollar strength tend to see stocks with the majority of their revenues coming from the U.S. to outperform. Therefore, for your potential “buy lists,” we have screened stocks from the Russell 1000 that have large domestic revenues, are favorably rated by our fundamental analysts, have attractive long-term chart patterns, and have positive metrics on our proprietary algorithms: Sun Trust (STI/$45.69/Outperform), Incyte (INCY/$97.83/Outperform), Laboratory Corp of America (LH/$138.87/Outperform), Union Pacific (UNP/$98.07/Strong Buy), Booz Allen (BAH/$30.19/Outperform), and Vantiv (VNTV/$56.48/Outperform).

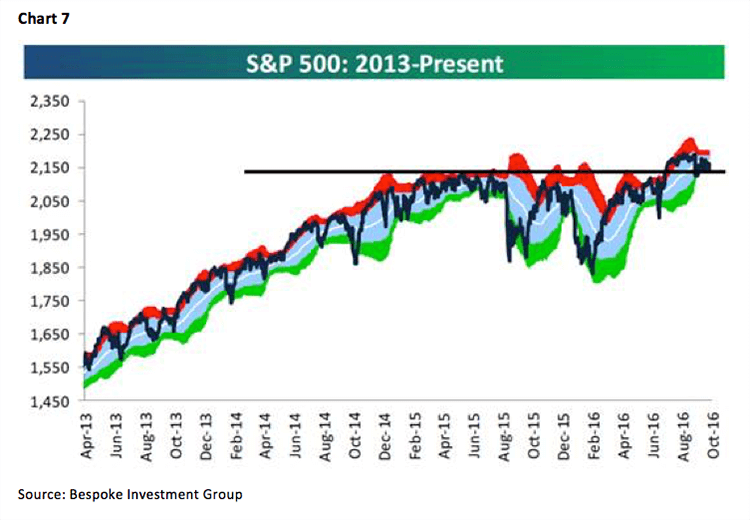

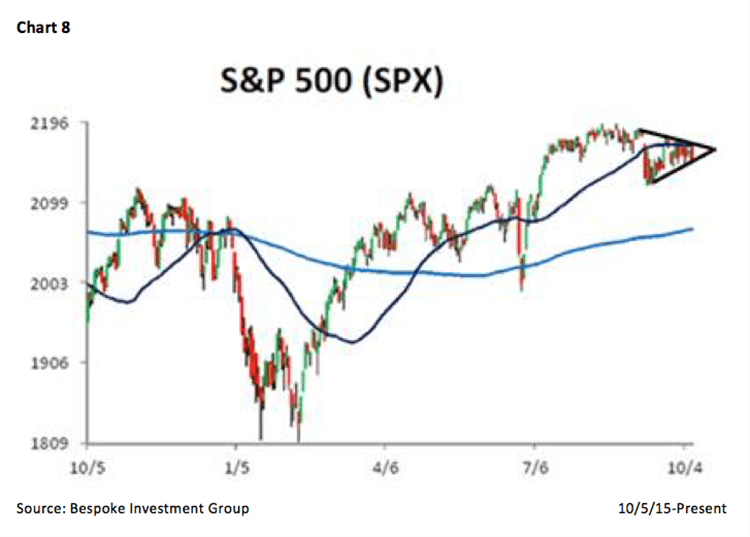

The call for this week: Despite the bravado, the reality is seen in the chart of the S&P 500 (SPX/2153.74), which in early July, broke out to the upside of nearly a two-year trading range with bullish implications (chart 7 on page 6). More recently, we have targeted the triangle chart formation the SPX has worked itself into since early September (chart 8 on page 6). The SPX is now at the apex of that triangle and should be resolved with either a break to the upside or the downside. A break up would obviously have positive ramifications, while a break down would suggest further consolidation. As stated, there is a decent chance our models’ prediction of downside vulnerability in the mid/late September timeframe may be over, but it will take a close above 2187 by the SPX to turn our models positive. If that happens, it would suggest the equity markets will grind higher into 1Q17, which would surprise the greatest number of participants. However, until our models “flip” positive, we continue to exercise patience.

Jeffrey D. Saut is chief investment strategist at Raymond James.