A client says: “I need to raise cash. My son, Bobby, invested in some silly scheme to cash in on the EU crisis and lost everything. We are continually bailing him out of big mistakes like this. I wish he were more like his sister, Rose, who can turn anything into a success. We are even making Rose the CEO at our family business and restricting Bobby’s stock so he can’t get any more money for his foolish schemes. He has to earn his own way; I’m not going to help him anymore.”

Now, Bobby is resentful and angry with his parents and his sister, Rose. He continues to speculate in risky schemes and complains that he is not getting his “fair share” of the company earnings; Rose takes a salary as CEO but Bobby only gets enough to pay the taxes on the pass through income. Now the client comes back to you and says that Bobby is joining forces with an investment bank to try to force the sale of the company to a private equity firm to “free up” his capital. Things are getting ugly fast.

Additionally, Rose, who has had exceptional performance for years, is having a hard time because the market for the company’s goods has changed; the company is now playing “catch up” with their competitors.

Why didn’t anyone predict this turn of events? Originally, the solution seemed simple: severely restrict Bobby’s ability to control assets and promote Rose -- a solution designed to “cure” Bobby and reward Rose. But nothing is that simple, especially in a family business.

These “sensible” solutions to the problems are actually enabling the behavioral problems in the family and business and will ultimately lead to disaster. Clients come to you for advice, but what they really need is a setting where they can learn how to fully analyze the family and business situation without falling victim to immediate pressure and leaping to an easy, but inadequate, solution. As the advisor, you can motivate family and business members with confidence in the potential of successful change. And you need tools to define problems, formulate and test solutions, implement solutions, and avoid solutions that spawn more problems in the future.

One such tool is modeling, which deals with internal feedback loops and time delays that affect the behavior of the entire system. What makes modeling different from other approaches to diagnosing and preventing problems in complex family and business systems is the feedback loops, which help describe how even seemingly simple systems can be counter intuitive.

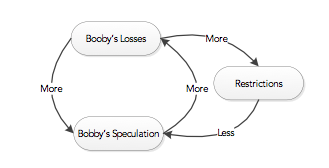

Back to Bobby, who is chronically speculating and losing money. Every time he has a financial crisis, the family leadership intervenes to “bail out” Bobby, and further restricts Bobby’s access to capital. This model looks like:

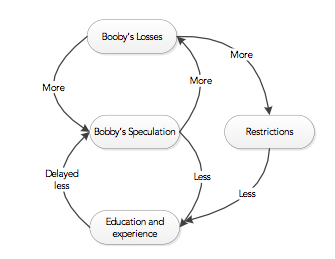

It is now obvious that the restrictions on Bobby never included any instruction or mentoring on how and when to invest capital or judge risk, and Bobby becomes resentful of the capital controls of the client, and then of Rose, as the family leadership. But if the restrictions had been removed, Bobby (over time) could have learned how to manage investments and judge risk. So the reality of the situation actually was:

The client works with Bobby to perform well in the short term while teaching him the insights and long-term sustaining decisions that family leaders seek to have Bobby adopt. A clear picture in the client’s “mind’s eye” and a collective shared vision with Bobby about his role in the family and business system avoids the pressure for the “quick fix” and the resulting cycle of interventions that ultimately creates systemic gridlock.

1. Modeling Action Steps:

2. Drafting Prescriptive Actions:

f

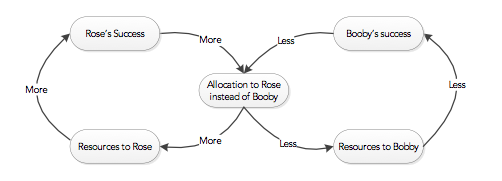

But family resources are finite -- resources given to Rose are not available to Bobby. As Bobby is less and less successful, he gets fewer and fewer resources and Rose, as she is more and more successful, gets more resources.

a. Identify the original symptom.

b. Map all the “quick fixes” that appear to keep the solution under control.

c. Identify the impact the quick fix solutions have on other parts of the system.

d. Identify fundamental solutions from multiple perspectives.

e. Map unintended effects of quick fixes that undermine the fundamental solution.

f. Find the connection between the fundamental relationships, as well as any links between the effects and solution that cause gridlock.

g. Identify high level actions from the perspective of the client and other organization members.

a. Encourage patience - the family leadership should focus on the fundamental solution, but may need to use quick fix solutions to buy time.

b. Elicit multiple viewpoints in the family to differentiate between fundamental and symptomatic solutions, and to gain consensus around an action plan.

c. Explore potential side effects of proposed solution(s) before implementation.

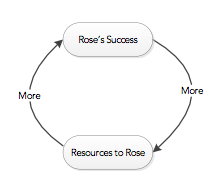

Now, look at the situation where there does not seem to be a problem, such as Rose as CEO of the company. By every measure of performance, Rose excels. At first, the “backing a winner” strategy does not seem to have drawbacks, and looks like: