Financial markets have priced in an assumption that the threat of broader conflict in the Middle East, potentially affecting oil shipped through the Strait of Hormuz, is low and that disruption from Huthi missile attacks on vessels traversing the Red Sea is manageable.

That calculation may have to be reworked once the U.S. response to the drone attack by Iranian-backed militia that killed three U.S. soldiers in Jordan is fully known.

The Biden administration reportedly plans to strike Iranian targets in Syria and Iraq. Iran is a critical threat to trade through the Strait, through which it passes some 20 million b/d of crude oil and oil products—almost three times as much as passes through the Suez Canal. Unlike the Red Sea, there is no alternative maritime route.

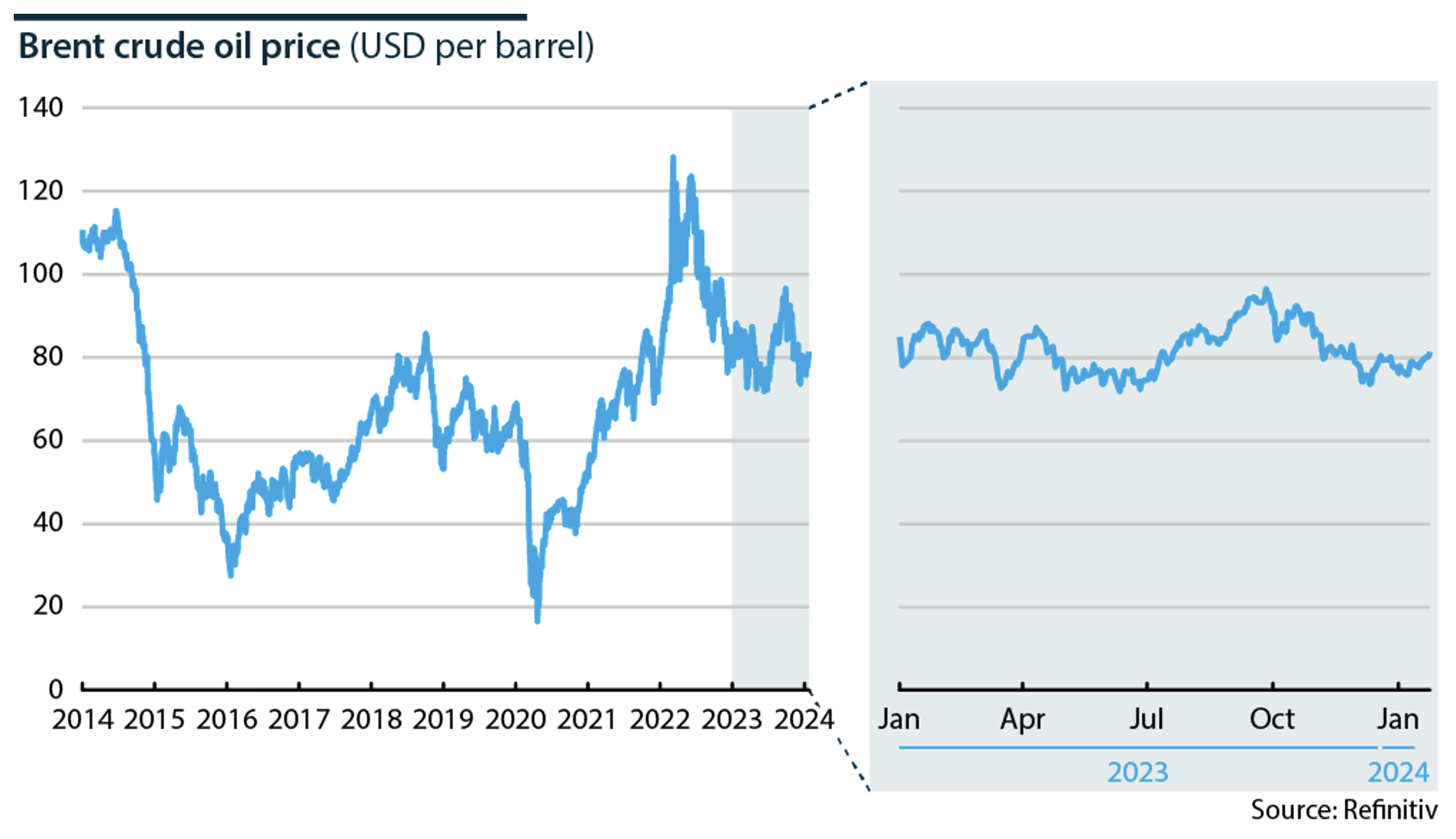

Prices have ticked up. Although below a peak of over USD90 per barrel following Hamas' assault on Israel in October, Brent crude had risen back to over USD80 per barrel by January 25, though eased a tad since.

Cuts by OPEC have built up the amount of crude production capacity held back from the market. At over 5 million b/d, according to the IEA, this capacity is held predominantly by Saudi Arabia (3.2 million b/d) and the United Arab Emirates (UAE; 1.0 million b/d), with an additional 0.7 million b/d held by Kuwait and Iraq combined.

Riyadh remains firm in its commitment to play swing producer and is likely to continue leading Middle Eastern efforts to limit the oil supply in defense of prices above USD70 per barrel.

Oil supply growth from non-OPEC producers looks strong. The U.S. Energy Information Administration (EIA) forecasts that U.S. oil output will rise from 12.92 million b/d in 2023 to record levels of 13.21 million b/d and 13.44 million b/d in 2024 and 2025, respectively.

According to the IEA, after a rise of 2.6 million b/d year-on-year in the fourth quarter of 2023, 2024 will see an increase of 1.5 million b/d in non-OPEC oil production, 91% of which will be accounted for by the United States, Canada, Brazil and Guyana.

Although Brazil has joined the OPEC+ group, it is not expected to participate in output cuts.

The key factor governing the supply outlook in 2024 will be Saudi Arabia's willingness to maintain or increase, if necessary, its current output restrictions, backed by other Gulf oil producers.

Demand Narratives Diverge

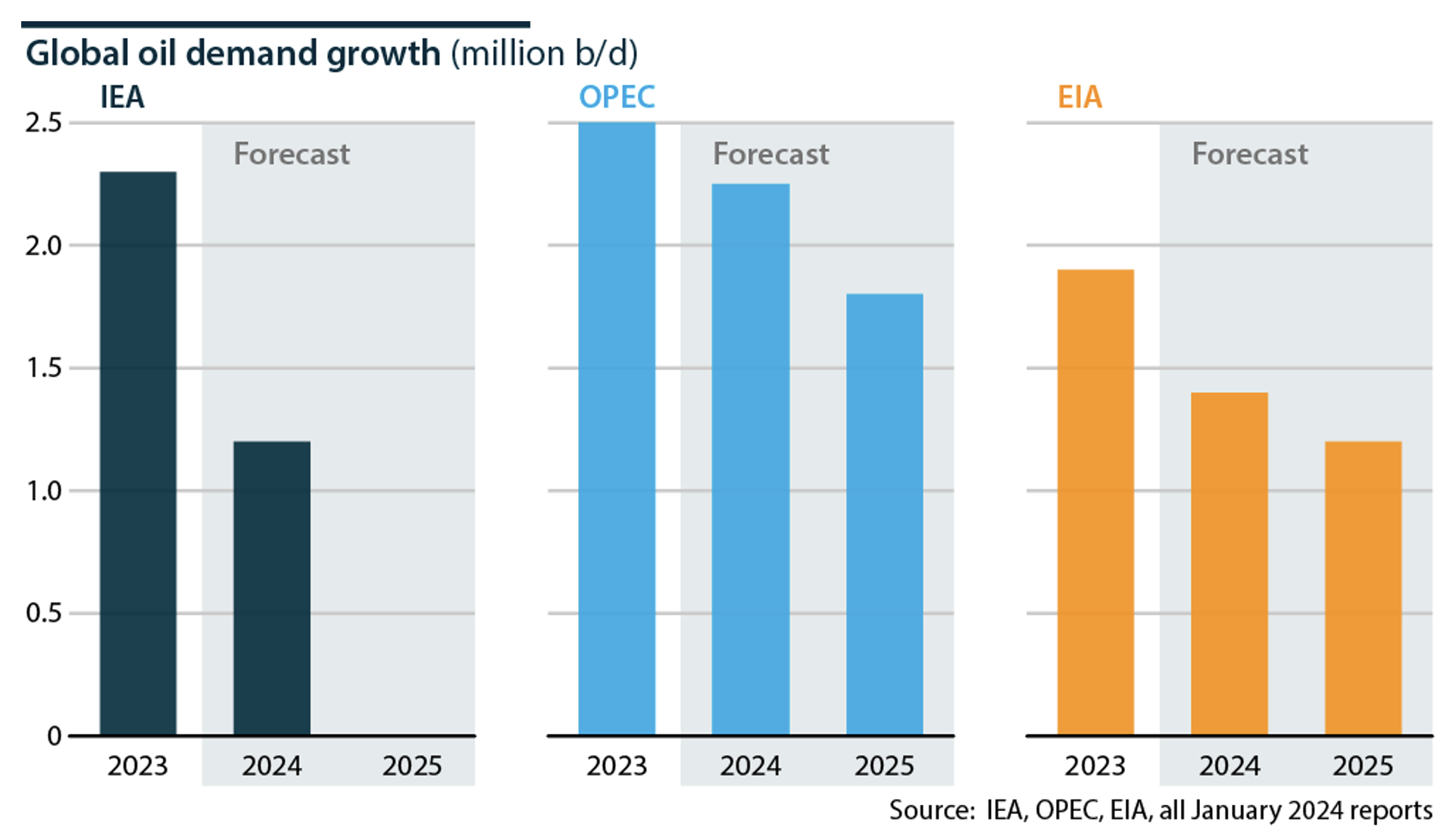

Geopolitical disruptions aside, views on the demand side of the market continue to diverge:

• The IEA forecasts that oil demand growth will fall significantly this year to 1.2 million b/d, lower than the expected increase in non-OPEC supply. It says demand grew by 2.3 million b/d in 2023.

• The EIA puts 2024 oil demand growth at 1.4 million b/d, falling to 1.2 million b/d in 2025. It says demand grew by 1.9 million b/d in 2023.

• OPEC sees oil demand growth at 2.2 million b/d in 2024 and 1.8 million b/d in 2025.

Behind these projections, the IEA, in its World Energy Outlook 2023, predicts that global oil demand will peak by 2030 if governments meet their current commitments on climate change. This was the first time it had made such a prediction, but the caveat on pledge realization is important.

By contrast, OPEC expects oil demand to continue rising for at least a decade.

The drivers of reduced demand growth and then decline, according to the IEA, are:

• slower GDP growth in China, which continues to account for most demand growth;

• reduced consumption as a result of the increase in electric vehicle (EV) use;

• more efficient use of energy; and

• an unwinding of the post-pandemic rebound in transport.

The EIA agrees with this analysis but forecasts higher demand growth for 2024. Its forecasts for 2024-25 are consistent with the 1.2% average annual growth in liquid fuels consumption over the 20 years since 2004.

OPEC, IEA and EIA forecasts all see demand growth almost entirely concentrated in China and the non-OECD, with India playing an increasingly important role.

Energy Transition Impact

The energy transition is far less advanced in non-OECD economies, bar China, than in OECD economies. This unevenness supports OPEC's demand growth view more than the IEA's.

Growth in heavy transportation and petrochemical demand continues to outweigh gains in energy efficiency and demand reductions from adopting EVs.

China, which has more solar and wind capacity and more EVs than any other country, nevertheless posted record crude oil imports in 2023, up 11% year-on-year. India also saw record oil consumption last year.

Demand growth is expected to slow in 2024, even in China, but the drivers of demand still appear more potent than the drivers of demand destruction.

Growing energy transition momentum is expected to reverse the situation, but at what point and by how much remain uncertain.