Hortz: What types of client and advisor needs did you see that drove you to create this institute and how did you build FEI to address those problems?

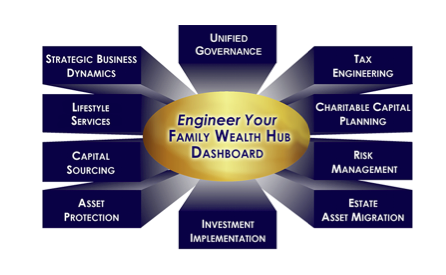

Gregory: From the HNW client perspective, we took a much more holistic view on what surrounds successful families and their businesses. As the diagram below depicts, we determined 10 key areas of support needed: family governance, tax engineering, planned giving, risk management, estate planning, investment planning, asset protection, private banking, strategic business planning and life style services.

The more complex the family wealth and asset assortment is, the more dynamic and disjointed it all becomes. Professional advise from law firms, accounting firms, real estate firms, financial advisors, insurance investment professionals is usually quite fragmented and comes from a very focused, closed minded point of view—not examining all of the connective tissue of the entire financial ecosystems of their clients. So how can HNW families deal and coordinate with all the different disparate issues and advice and product providers they tolerate and how do they figure out what they are missing as they evolve?

So over the past 42 years we've spent a lot of time simplifying the complexities of those 10 areas that surround the entire wealth ecosystem of these families and building a network of what we call “expert sourcing” firms that have the expertise and specialize in theses various areas to assist us building out resources and solutions for HNW advisors. Therefore, we engineered an exclusive concierge services platform with their issues in mind.

From the advisor perspective, we asked ourselves: What if an advisory firm could easily fortify their client value proposition by fusing key HNW services and products into their firm offering? This could create fresh revenue while enhancing client acquisition and retention. Further providing these as turnkey solutions in a private label manner could assist in branding, positioning and differentiating the advisory firm against their competition, really providing them with an unfair advantage in the marketplace.

So, we built out FEI and The Family Wealth Hub, with our comprehensive and harmonized online dashboard of turnkey HNW solutions, to position the advisor to be able to sit with their HNW clients and uniquely position themselves in the middle of those 10 HNW need areas that are strewn with important opportunities and pitfalls. The diagram depicts the synchronized Family Wealth Hub Dashboard we engineered.

Hortz: Tell us more about one of those HNW need areas of planned giving and your “converting taxable capital into charitable capital” program. How does your Charitable Capital Design Center tie into that process?

Gregory: Because of all the misperceptions surrounding “planned giving”, we decided to redefine the term as a specific form a “capital”— “charitable capital planning”—and we spunoff The Charitable Capital Design Center from FEI. It is dedicated to support financial advisors, wealth management firms, non-profit organizations, law firms and accounting firms to get the tax knowledge, marketing materials, specialized tools and best practices coupled with mentoring, training and case design to help clients/donors “convert taxable capital into charitable capital.”

Using the heart of tax law dating back to 1969, clients/donors can divert substantial amounts of “taxable capital” (income, capital gains and estate tax incentives) and use that “capital” to pin-point exactly what causes they wish to contribute to in satisfying their giving desires. The charitable capital planning program is embedded within our wealth engineering platform and includes a set of tools for advisor/donor use: donor advised funds and gift annuities, as well as, lead remainder and private income trusts. The program helps advisors and their clients better understand, better plan and give more!