Niche lending of this sort has long been the preserve of banks, but there are few credible alternative operators with the ability to underwrite credit risk in compliance with national regulations and, if necessary, work out the local underlying asset. Other examples include land banking, real estate development lending and certain types of consumer lending; the Irish economy is recovering but a single bank dominates the market, creating opportunities for others to win market share. Once again, regulations are a primary force: Under Basel III, for example, High Volatility Commercial Real Estate (HVCRE) rules increase capital charges on construction loans from 100% to 150%.

Identifying investment opportunities is one thing. Seizing them is another. We believe exploiting these opportunities requires a flexible approach to structuring investments, such that potential returns compensate for the degree of risk and economic value created. For example, returns may be generated by lending directly, financing others’ loan assets or taking an equity stake in a specialty lending business. Where the provision of capital makes a lending enterprise more valuable, those supplying the capital should share in that value creation.

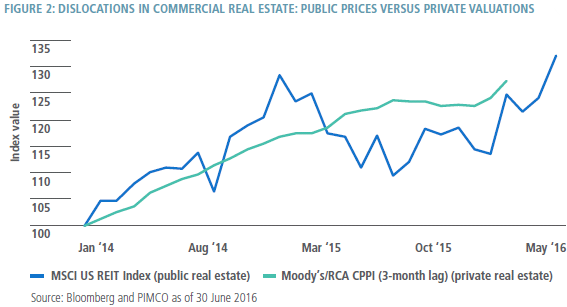

2. Public-Private Market Dislocations

In contrast to public securities markets, where many investors and all dealing desks have been affected by regulatory reform, many assets in private markets are enjoying historically attractive liquidity conditions. Record sums of private equity and private debt capital are facilitating transactions and supporting valuations, particularly of vanilla corporate and real estate assets. The role of banks as intermediaries in public markets versus the lower velocity transactional nature of private markets can result in dislocations, with pricing of securities versus non-securities implying different valuations for similar underlying assets.

For instance, it was notable during both the first and second quarters of 2016 that volatility in public commercial real estate securities, commercial mortgage-backed securities (CMBS) and real estate investment trusts (REITs) was elevated compared to transaction volumes and prices for the underlying physical real estate assets (see Figure 2). The combination of forced selling by certain funds and banks facing prohibitively high capital charges to hold such securities in their trading books meant that the securities implied deep discounts to private transactions.