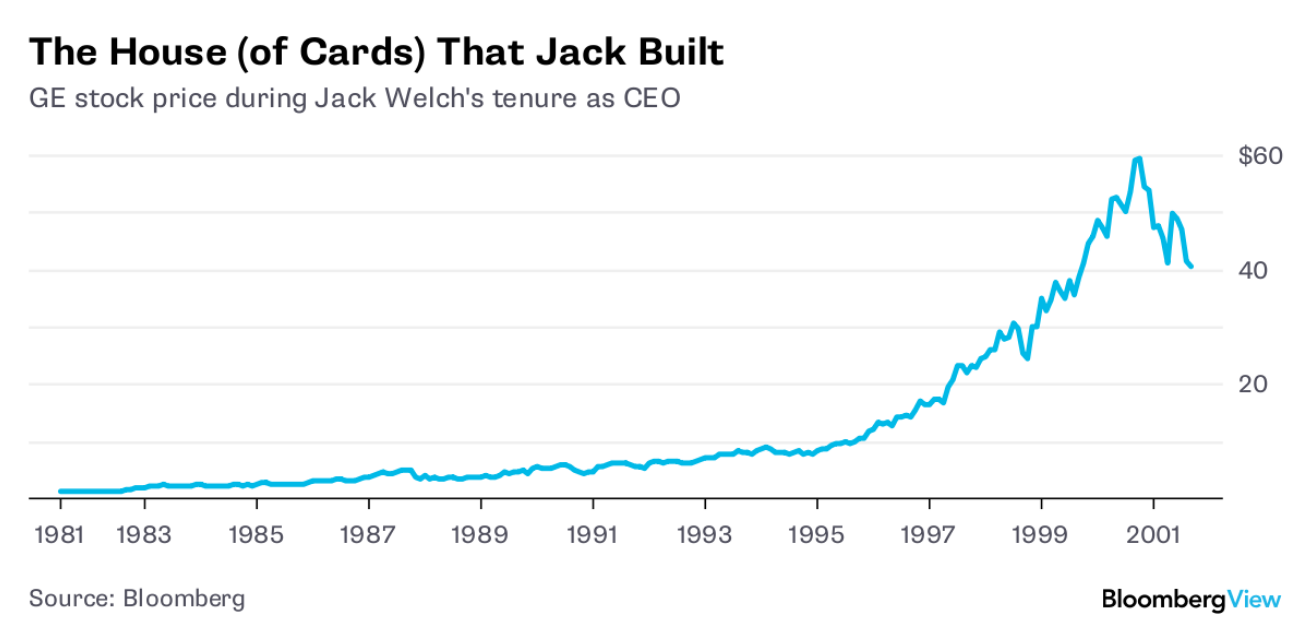

Here's a chart tracking GE's stock performance during Welch's 20 years as chief executive:

It's mind-boggling, isn't it? The stock was up 2,790 percent, while GE's valuation rose something like 4,000 percent. No wonder Fortune magazine named Welch the "Manager of the Century" in 1999! He had that knack — if that's what you can call it — of always seeming to beat quarterly earnings estimates by a penny. Early on, he fired so many people he gained the nickname "Neutron Jack." He bought RCA, which yielded NBC, and built GE Capital into a monster division, growing it twice as fast as the rest of the company. When Welch started, GE's earnings were $1.65 billion; when he left they were $12.74 billion.

But take another look. See where the stock really begins to climb? It's during the summer and fall of 1995 — which is to say that it was right around the time Netscape went public, triggering a raging bull market in tech stocks that lasted for the next five years. And do you see where it peaks? August of 2000, just months after the Internet bubble burst.

I'm not saying that the market viewed GE under Welch as a tech stock. But during those giddy five years, certain iconic U.S. companies with superstar CEOs who knew how to stoke earnings — the Coca-Cola Co. under Roberto Goizueta also springs to mind — were treated like go-go growth companies rather than the dividend stocks they had been for decades. With each quarter's earnings report, the market rewarded them with multiples that became increasingly ridiculous. For most of Welch's tenure, GE's stock had a price-to-earnings ratio in the low teens. But in 2000, it reached 59. That number was unsustainable no matter who sat in the chief executive's chair.

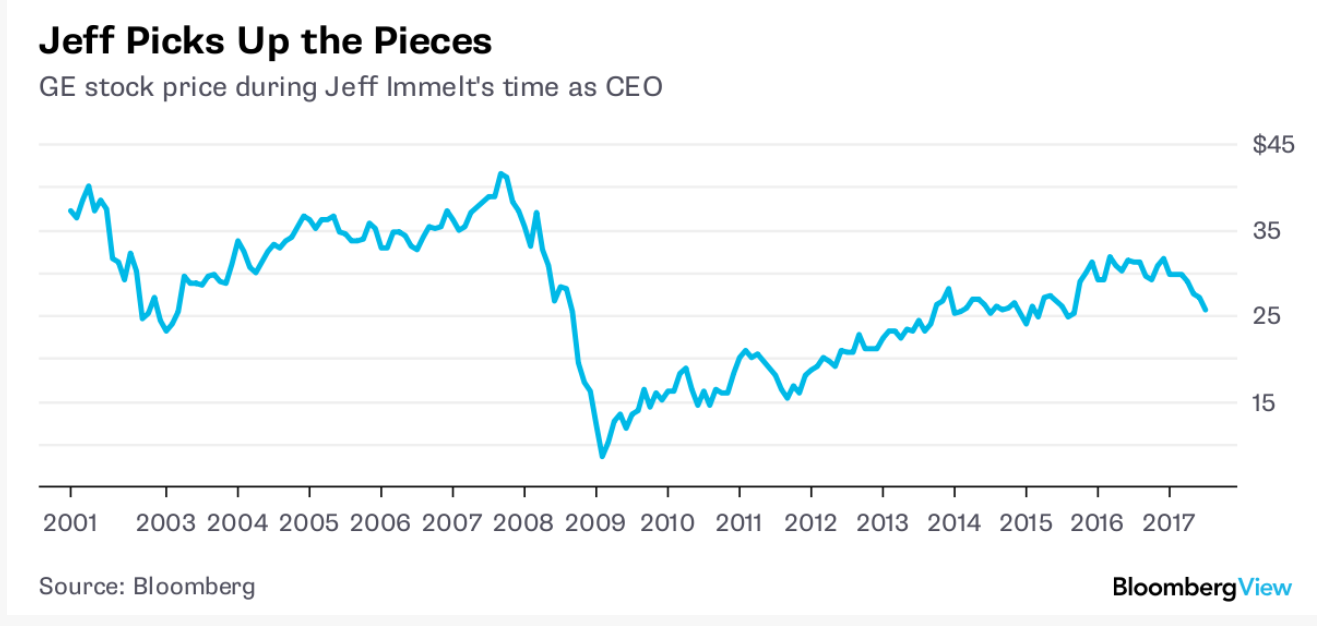

Sure enough, the stock began dropping precipitously even before Welch stepped down. And, as you can see in this second chart, which tracks GE's stock performance during Immelt's tenure, it kept dropping for next year and a half, falling nearly 50 percent.

Was the new CEO the reason the stock plunged? Hardly. Partly, it fell because it had been insanely overpriced. But it also fell because the 9/11 attacks, which took place shortly after Immelt took over, deepened a recession that was already taking hold. The aftermath of the terrorist attacks saw sectors important to GE, such as transportation, get hit hard.

Immelt appeared to right the ship starting in early 2003, and the stock nearly doubled over the next four years. During that stretch, Immelt was generally regarded as a worthy successor to the legendary Welch.

He then ran smack into the financial crisis, an event that crushed GE's stock. (It bottomed out at around $7.) Why? The primary reason was the crisis exposed the problem with depending so heavily on GE Capital for earnings growth. Because it was a non-bank financial institution, it had only the tiniest sliver of capital backing up its loans. And it relied too heavily on short-term corporate paper to fund itself. During the crisis, GE Capital came so close to collapse, imperiling the entire company, that it required $50 billion in bailout loans from the government.