For example, I’ve recently spoken with multiple advisors who’ve expressed the importance of moving to a firm that will allow them to give clients advice on crypto. Why? Because clients are starting to ask.

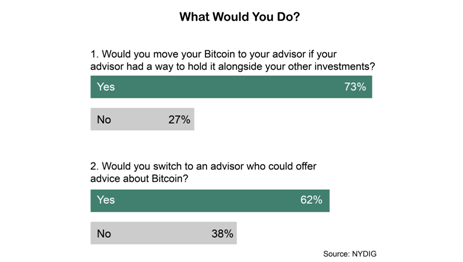

If you don’t believe me, look at the recent study by New York Digital Investment Group:

Investors are overwhelmingly confident that they’d switch to an advisor who could give them advice about crypto. When looking at potential firms, thinking about your long-term success shows your clients that you’re thinking about them long-term.

Avoid (Or Lessen) An Operational Headache

A common misconception is that when you join a larger firm, the operational side of the transition—repapering all of your clients and getting set up on the firm’s new system—will be better executed than at a smaller firm. Nothing could be further from the truth.

Size and brand recognition don’t matter when it comes to how long and how tedious the transition process will be. This is why advisors (77%) who took the Cerulli study listed operational matters as the biggest barrier. It’s a necessary evil, which is why I recommend advisors ask about their potential new firm’s transition technology and support as part of their due diligence.

“Repapering an entire book, all at once, on a short timeline with legal and logistical limitations will put a strain on any ops/tech,” says Grier. “The more prepared you are, the easier the process is. Lost revenue is unavoidable. Transfers of assets take time and you can't bill on assets that aren't there. Plan accordingly.”

Ask the potential firm how long their transitions typically take, what kind of support both you and the clients will have during the process, and which technology systems they use to make the process more streamlined. Transition platforms like Docupace can help tremendously in saving time, streamlining record keeping, and onboarding new clients in nearly half the time it would typically take.

Our industry runs on data. It’s how we help advisors, help their clients. But in some cases, even a tech founder like myself would encourage you to look beyond the data and think about what makes the most sense for you and your clients. Chances are, with the right support and planning, making a transition could be the single best decision you ever made.

Ryan Shanks is founder and CEO of FA Match, a digital recruitment platform that connects experienced advisors with financial services firms equipped to help them thrive. Ryan brings over 20 years of experience as a recruiter and “sports agent” to financial advisors. Learn more at www.famatch.com.