The panic of the day is the news about interest rates. The headlines state (correctly) that rates have moved up sharply in recent days. They state (correctly) that stocks have pulled back, noting this fact is due to that increase (which is possibly but not necessarily true). And they state (incorrectly, I believe) that higher rates are going to derail the economy and the markets, in that order.

A Need For Context

This narrative is pretty standard for this stage of the economic cycle. The economy is growing, so the Fed, more worried about inflation than employment, starts to raise interest rates. Higher rates, mathematically, will mean slow growth and lower stock valuations. Cue the headlines.

What is missing, as usual, is context. As I focus on interest rates today, I want to talk about why the recent increase is not something to worry about. In subsequent days, we will get to the economy and the markets, but—spoiler alert!—the message will be the same.

What The Data Tells Us

The panic over the recent rise in interest rates is based on a couple of assumptions. First, we have the assumption that the increase reflects a problem with the financial markets. Second, there is the thinking that current rates—from which we see the increase—are, by definition, correct and the increase, therefore, represents a change from the correct rate levels. Both assumptions are wrong.

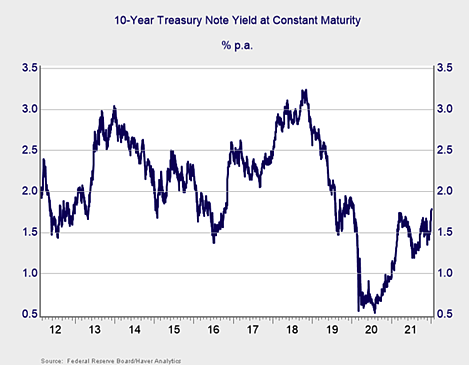

For context, let’s look at the past 10 years of interest rates for the 10-year Treasury notes. The current yield is around 1.8%, up in recent days from around 1.5%. That is a big—and sharp—increase, as you can see from the chart below.

But this rate increase is dwarfed by the ones we saw in 2020 and 2021. Neither of these increases derailed the recovery, despite the headlines at the time. And, looking back before the pandemic, the interest rates take us back only to the lower end of the range in the latter part of the last decade. In other words, the recent spike is simply reversing part of the drop during the pandemic—a drop caused by extreme fiscal and monetary policy actions. Or, put another way, rates right now are moving back to the lower end of the normal range for the last decade.

Rethinking The Assumptions

Given that, let’s take a look at those two assumptions again. The first one says the current spike is a problem in financial markets. Looking at the chart, however, the problem seems to have come from the pandemic. Now, from an economic perspective, this problem is starting to fade. In this sense, the recent increase is a recovery from a problem, not an indicator of one. The second assumption says recent rates are the correct and normal ones. Yet here again, due to the pandemic, this is definitely not the case. If both of these assumptions are wrong—and they are—the narrative we are seeing in the headlines must be wrong as well.