Today’s retirees, and those who advise them, face a very different market environment from the one they faced even a few years ago. When 2019’s retirees began to draw down from their portfolios, they were doing so at the tail end of the longest bull market in history. More recent retirees have confronted something completely different over the past three years: a quick but severe bear market in early 2020, historic increases in inflation and interest rates, a historically poor bond market in the first half of 2022, and negative returns for both broad market equities and fixed income at the end of 2022. So far in 2023, market volatility continues.

That means these retirees are vulnerable to “sequence-of-returns risk”—when poor investment returns come early in their retirement, at the same time the clients are beginning their withdrawals, two phenomena that together can significantly diminish the value of portfolios. Meanwhile, people are also living longer—and thus increasing the possibility of outliving their savings. Both these risks can weaken investors’ chances for a successful retirement.

But advisors can help by developing prudent spending strategies for these clients, as well as implementing tax-efficient withdrawal strategies to help dampen the risks.

A Prudent Spending Strategy

It’s a complex process for U.S. retirees to develop and oversee their portfolio spending strategies. As their life expectancies increase and defined benefit plans become less available to them, they’ll need more complex approaches, and that’s because they are often reaching simultaneously toward two goals seemingly at odds: One is to maintain a relatively consistent level of their current spending while the other is to increase—or preserve—their portfolio’s value so they can support future spending, bequests and other items. What’s worse is that they’ll have to make decisions about these two different goals while also dealing with circumstances beyond their control—market forces, the rate of inflation and their life expectancy—all variables that affect their safe withdrawal rates.

Retirees dealing with these challenges can turn to the numerous spending strategies developed by academics and advisor thought leaders. One of these is called the “dollar plus inflation” strategy (one variation of which is the “4% spending rule” developed by advisor William P. Bengen). Here, an individual spends an initial percentage of their portfolio balance at retirement and increases this amount by inflation annually. This strategy provides stable, inflation-adjusted spending but is indifferent to the performance of the capital markets. As a result, the approach can run into problems given the sequence of returns: If there are several years in which the market performs poorly—especially at the onset of somebody’s retirement when they are also starting to take portfolio withdrawals—there is an increased risk that the portfolio will be depleted or that spending will need to be significantly reduced at some point in the future.

Another strategy calculates withdrawals based on a percentage of the portfolio. Under this approach, market performance is taken into account so that the annual spending amount is a function of the portfolio’s value. While it ensures that the portfolio won’t be depleted, unfortunately it doesn’t solve the problem of sequence-of-returns risk. If a person’s portfolio suffers negative returns at the same time they’re starting portfolio withdrawals, it can still meaningfully reduce their portfolio’s value and erode their future spending.

The Dynamic Approach

That leads us to consider instead a “dynamic” approach: essentially a hybrid of the two others. In this approach, annual spending will vary from year to year based on the markets, but it is not allowed to go beyond a set range (ceiling and floor) as long as assets remain, so it helps investors with their short-term planning. A “dynamic distribution” strategy such as this one offers an effective way to manage sequence-of-returns risk in that poor investment returns are at least partially offset by reductions in current spending, which helps to preserve the portfolio value and thereby sustain future spending.

The floor is the key: The more someone can reduce spending when the markets are not performing well, the more likely they are to meet their long-term spending goals.

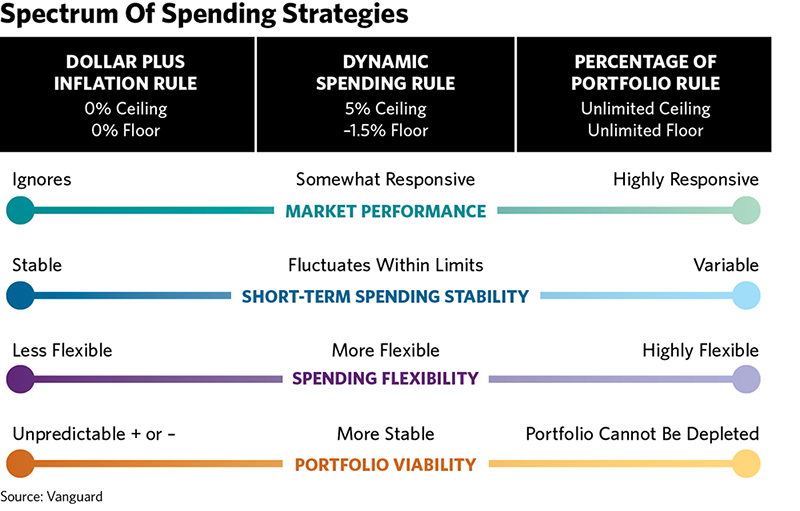

All these options lie on a spectrum, and the strategy advisors choose will likely depend on what their clients’ most important goals are (something illustrated in the chart). At one end of the spectrum is the dollar-plus-inflation strategy—essentially, a dynamic distribution with a 0% ceiling and floor. At the other end is the percentage-of-portfolio strategy—essentially, dynamic distribution with an unlimited ceiling and floor. Between those two poles is a dynamic strategy with different outcomes.

All these options lie on a spectrum, and the strategy advisors choose will likely depend on what their clients’ most important goals are (something illustrated in the chart). At one end of the spectrum is the dollar-plus-inflation strategy—essentially, a dynamic distribution with a 0% ceiling and floor. At the other end is the percentage-of-portfolio strategy—essentially, dynamic distribution with an unlimited ceiling and floor. Between those two poles is a dynamic strategy with different outcomes.

Advisors can help their retiree and near-retiree clients by recommending dynamic annual spending plans somewhere along this spectrum and devising ways for the clients to have spending flexibility—coming up with a proportion of total expenses that can be attributed to either discretionary or non-discretionary spending. That means asking how much a client needs to “keep the lights on” after accounting for ongoing income sources such as Social Security.

Generally, the greater the proportion of expenses that could be eliminated or minimized in any given year, the greater the level of spending flexibility. For example, if travel takes up a large portion of a client’s expenses each year, they may be better able to endure a reduction in their portfolio-based income than a client whose mortgage makes up the bulk of their monthly spending. By keeping their fixed expenses low, clients have more room to limit the withdrawals from their portfolios during periods of poor market performance, and they can at least partially offset poor returns by reducing their current spending. This can help them preserve their portfolio’s value and sustain their future spending, thus helping them deal with the risks of running out of money if they live longer than expected.

Implement A Tax-Efficient Withdrawal Strategy

Once advisors have determined what their clients’ annual spending strategy should be, they can also help to ease clients’ risk of outliving assets by making the withdrawal strategy more tax-efficient. Many retirees hold their assets in multiple accounts, including taxable accounts as well as tax-deferred accounts—including IRAs and 401(k)s—and tax-free accounts, such as Roth IRAs and Roth 401(k)s. By following an informed withdrawal-order strategy, clients can minimize the total taxes they’ll pay over the course of retirement and thus increase their annual spending amount, terminal wealth values or the longevity of their portfolios.

Research by Vanguard has shown that a tax-efficient withdrawal strategy can add up to 120 basis points of average annualized value without any additional risk, depending on the client’s breakdown of assets and marginal tax bracket. With this process alone, advisors can demonstrate their value to clients paying fees for advice.

Advice That Meets The Moment

Retirement can be an emotional subject for anybody, and people retiring today might be feeling overwhelmed by all the new financial challenges they’re facing. But the economic volatility gives advisors an opportunity to show their value by acting as behavioral coaches and helping clients manage sequence and longevity risk to improve their chances of success after they leave work. By turning to prudent spending strategies and tax-efficient withdrawal plans, advisors can share in the excitement as these clients enter retirement with confidence that their long-term financial plans will support them when they need it most.

Colleen Jaconetti, CPA, CFP, is a senior manager in Vanguard’s Investment Advisory Research Center.